Things don’t seem as bright for Indian E2W leaders

Sales of both startups and legacy automakers dipped significantly

image for illustrative purpose

Ather’s total expenses more than tripled to Rs 2,670.6 crore from Rs 757.9 crore in FY22, despite strong sales. The surge in losses was reported even after the firm’s revenue from operations grew 4.3 times to reach Rs 1,784 crore during the fiscal year ending March 2023

Despite gaining significant market shares, Indian electric two-wheeler (E2W) market leaders like Ola Electric and Ather Energy are evoking a lukewarm response from investors amid heavy losses and regulatory uncertainties, the media reported.

According to Nikkei Asia, industry executives view this phenomenon “as a warning sign despite the startups' rapid growth” while green mobility is considered a sunshine sector.

Ather Energy "resorted to a rights issue after potential investors balked at its plea for more than $200 million’ at a valuation of at least $1 billion,” the report mentioned, citing people aware of the company's plans.

Hero MotoCorp-backed EV company Ather Energy’s losses surged more than 2.5 times in the financial year 2022-23. It reported a loss of Rs 864.5 crore in FY23, against a loss of Rs 344.1 crore in FY22, according to its annual financial statements filed with the Registrar of Companies (RoC).

Ather’s total expenses more than tripled to Rs 2,670.6 crore from Rs 757.9 crore in FY22, despite strong sales. The surge in losses was reported even after the firm’s revenue from operations grew 4.3 times to reach Rs 1,784 crore during the fiscal year ending March 2023.

Meanwhile, SoftBank-backed Ola Electric's valuation rose just 10 per cent to $5.5 billion after a $140 million funding round led by existing backer Temasek in September, the report mentioned.

IPO-bound Ola Electric posted a net loss of Rs 784.1 crore in the financial year FY22, a four times jump from Rs 199.2 crore in FY21.

As per its FY22 results, the total expenditure stood at Rs 1,240.4 crore in the reported fiscal year.

However, FY22 figures are not comparable with FY21 as the company started delivering electric scooters from December 2021 only.

According to investors, “while smaller fundraises will keep them going for now, growth could be impacted if they don't manage to raise bigger rounds," said the Nikkei Asia report.

While both startups and legacy automakers saw sales dip, the pressure is far higher on startups, which need to increase sales as well as reduce losses to attract investors.

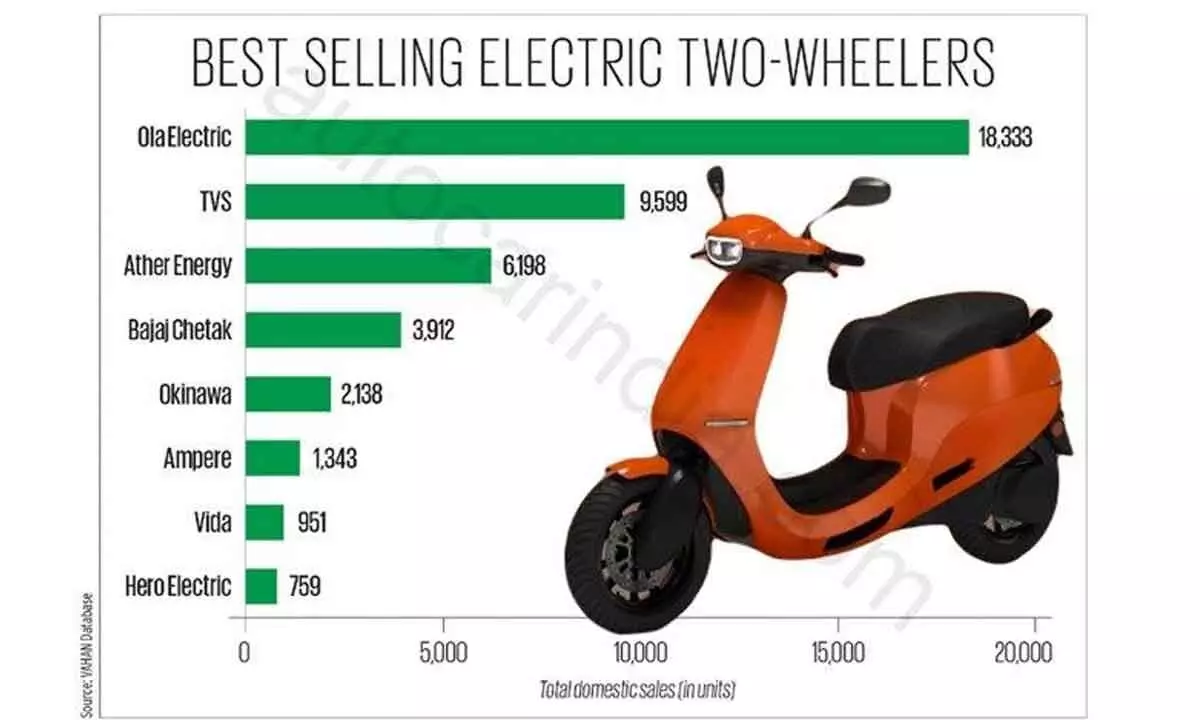

According to the latest BNP Paribas India EV report, Ola Electric (Ola) continued to lose market share (month-on-month), dropping to 29 per cent (-66 bps) in September Bajaj Auto (11.1 per cent, +57 bp) gained the most market share, while Ola lost the most, followed by Okinawa.

Among the top five original equipment manufacturers (OEMs), the monthly sales volume of Bajaj Auto increased most, while that of Okinawa declined the most.