Resale mkt expected to reach $77 bn by 2025

Retailers struggling before Covid-19 will likely see their declines accelerate. Income disparities will drive continuing business toward off-brand and discount retailers

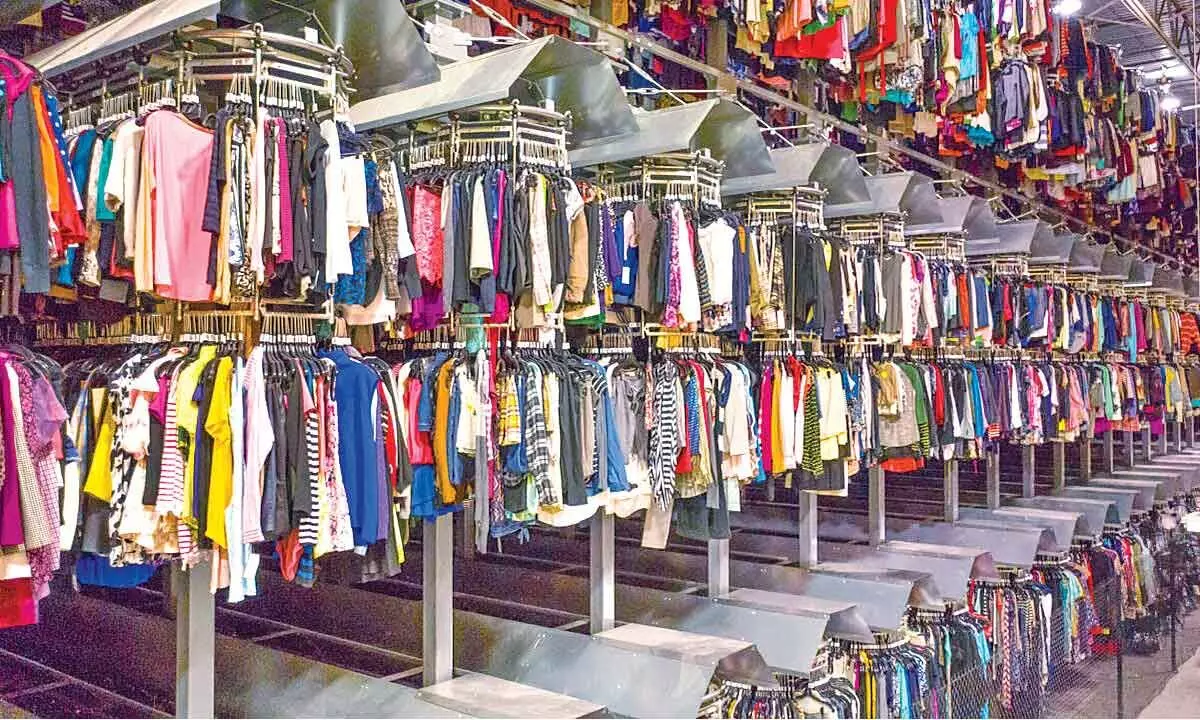

image for illustrative purpose

A bad economy can be a boom time for resale shops, which typically offer steep discounts on previously owned goods. Many households are short on cash and eager to pay as little as possible for essentials like clothing, said Jared Ristoff, an analyst for the market research firm IBISWorld.

A recent report from retail analytics firm GlobalData and the online thrift store ThredUp projected the second-hand market would reach $77 billion by 2025, up from its 2021 level of $30 billion as Jefferies estimated last April. About a quarter of the second-hand market is resale clothing, which Jefferies estimates will grow by 39 per cent per year in the same time frame, coming to eventually account for over half of the market.

Socially and environmentally conscious, it makes sense that Gen Z would lean toward more ethical, eco-friendly shopping. But sustainability isn't the only factor pulling Gen Z toward the second-hand market. The pandemic has sent Gen Z down a nostalgic path, turning towards trends reminiscent of the millennium such as indie sleaze and Y2K fashion as comfort during moments of economic instability. Deemed vintage by Gen Z, clothes for these trends can best be found at thrift stores.

Previous recessions expose existing weaknesses, accelerate emerging trends, and force organizations to make structural changes faster than they had planned. This is particularly true in retail. During the great recession of 2008–2009, e-commerce grew, and brick-and-mortar retail declined. As the economic recovery took hold, that trend continued, while off-price, discount, and emerging players, succeeded by appealing to new consumer demands.

Now with new trends shaped by a pandemic-driven global recession, certain truths remain: Retailers struggling before Covid-19 will likely see their declines accelerate. Income disparities will drive continuing business toward off-brand and discount retailers, and online shopping will continue to accelerate.

The 'typical' business cycle has involved the over expansion of credit, under pricing of risk, and eventual bursting of financial market bubbles.

By contrast, the Covid-19 recession was triggered by a sudden shutdown of consumer activity. People simply stopped eating out, travelling, and leaving the home. Billions of workers were furloughed or laid off as demand shut off and factories and offices were idled to prevent the spread of the virus. Some sectors, such as health care which had proven virtually immune to recessions in the past have shrunk as people have cancelled doctor's appointments and suspended plans for elective medical care.

Even consumers with jobs have stopped spending. Retail sales plunged 20 per cent from February to April, with very large declines in categories like clothing and accessory stores (down 89 per cent) and department stores (down 45 per cent). The personal saving rate jumped to 33 per cent in March from 8 per cent in February. That's likely the result of households with employed members cutting back on spending because there wasn't anything to spend money on and because many households had good reason to wish to increase their savings in an uncertain time - rising saving rates are typical at the beginning of recessions.

Even before the Covid-19 crisis began, the next consumer recession found that retail was facing several financial issues that could make it difficult to weather a recession. Many retailers faced challenges already: increasing debt burdens, moderating revenue growth, compressing margins, increasing SG&A, and slowing asset turnover. Not surprisingly, we are starting to see these issues force several retailers to file for bankruptcy in recent weeks. But across retail, significant weaknesses in the foundation: the technology and process architecture of retailers, often vulnerable to sudden shocks, are now completely exposed. Even, many retailers that had been making incremental moves toward transformation have not been able to cope with the halt in store traffic, demand on digital, and shocks to the supply chain.

No matter the retailer, one cannot overstate the damage done when stores are closed for months at a time. Each regular customer represents a relationship that took years to develop and nurture and losing that continuity is a risk to any retailer's position in the marketplace. The same is true with other stakeholders. Long-time employees, for example, have mastered what it takes to represent the brand over several years. Retailers are now having to create workforce flexibility, tools for secure collaboration, and positioning around furloughs, all while sustaining morale and keeping employees healthy. Even retailers who are faring well in the pandemic should take account of the damage done up and down their value chain and begin to develop strategies to restore what has been lost. What took years and even decades to build was severely damaged, if not destroyed, in a matter of weeks.