Global chip shortage not yet over

There are lots of reasons for the scarcity: storms, cold snaps and a worldwide recovery that’s increased demand more stuff with microprocessors in them

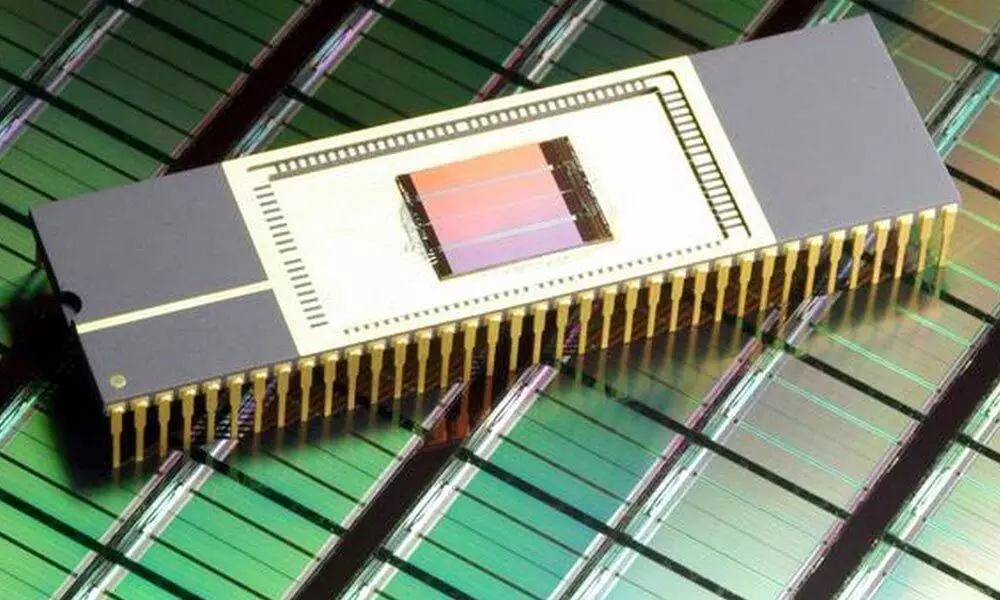

image for illustrative purpose

When Samsung Electronics Co. says there is a "serious imbalance in supply and demand" for chips, there can be little doubt that we are dealing with a severe semiconductor shortage. The warning from the world's largest smartphone maker - and a major producer of chips - was the loudest in the recent litany of complaints from carmakers, auto parts and electronics manufacturers as well as other microprocessor companies.

The underlying data from some of the biggest chipmakers continue to show lead times at factories getting longer for products across the board. On average, it's gone from 10 weeks to about 17 weeks for certain types of microprocessors over the last year, according to data from Bain & Company and LevaData, a procurement and sourcing platform. In addition, around 75 per cent of all semiconductor parts had an overall jump in lead times, with most of the increases coming over the earlier part of this year, according to IHS Markit. Capacity utilization numbers remain elevated, meaning factories are running at full steam. And there are a variety of chips that have lead times of as long as 52 weeks. If you need a different types of chips in your car or phone or flat screen panel, then the problems just multiply.

Demand is likely to stay strong as global consumption, a push toward advanced 5G technology and hi-tech generation cars continue to grow. But the chip supply isn't showing up yet. Makers of semiconductor components like multi-layer ceramic capacitors, substrates, microcontroller units and silicon wafers are all facing orders they aren't able to satisfy, based on the firms outlooks for demand.

The one-off factors hitting multiple levels of the global supply chain, from geopolitics to weather, have exacerbated the underlying imbalance. Take Qualcomm inc. in San Diego. It doesn't run any microchip making factories itself. In fact, some of its chips are made by Samsung, some of whose phones happen to rely on application processors designed by Qualcomm.

A spell of bad weather and port blockages also are crimping supplies in North America. That has led Toyota Motor Corp. and Honda Motor Co. to warn of disruption to their supply chains in the region. The former said a "shortage of petrochemicals" at some plants would affect production, while the latter said several factors including bursting pipes at facilities would cause temporary shutdowns. And surprise: a shortage of chips were also a factor.

Still, supply chains in all sorts of industries have dealt with shortages resulting from catastrophes before. For example, in Thailand, where floods affected the hard-disk drive industry; or Japan, when automakers and their parts suppliers ceased operating in the aftermath of the Fukushima earthquake, tsunami and nuclear plant meltdowns, according to Peter Hanbury of Bain. This time, however, there's some level of a shortfall for most types of semiconductor and sub-components. And with factories everywhere churning away, there's no clear path to satisfying demand. It's not like cleaning up after a storm. These shortages are here for a while. (Bloomberg)