Evaluate topline growth of a company before putting your money into it

Each investor has different values for different variables that are required for calculation

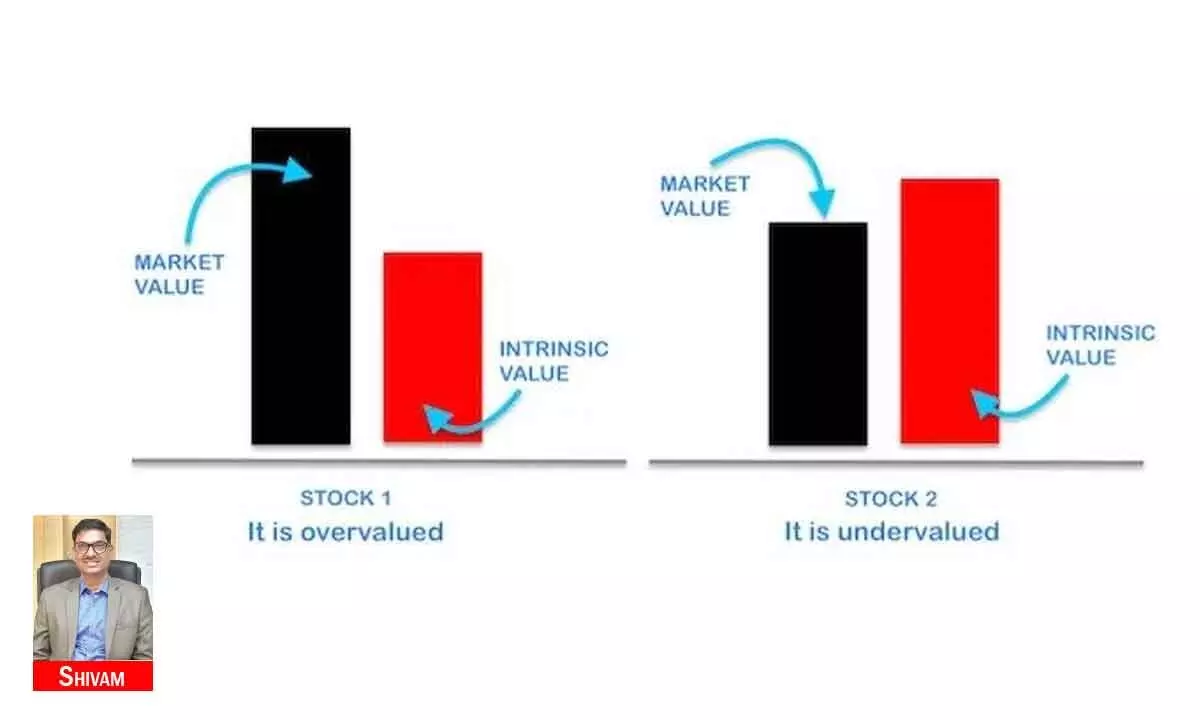

image for illustrative purpose

The difference between intrinsic and market value of a stock has important implications for investors. It can help them identify opportunities to buy or sell stocks. It can also indicate the level of risk and uncertainty involved in investing in a stock. This implies that the investors need to adopt different strategies to cope with the uncertainty and risk

”Aantarik Mulya Aur Pratyashit Aay, Ye Do Kaarak Jaan Lo;

Equity Nivesh In Par Nirbhar Hai, Nivesh Ke Pahle Ch

Translation: ‘Intrinsic value’ & ‘Expected income’, are the two factors you must analyse;

Equity investments depend on them; do analyse them before you finalise

When we invest in any share the whole idea is to earn income in the form of dividends and more importantly through price appreciation. For this we need to select the stocks that we buy very judiciously. When we compare the different shares for taking a decision as to which one to buy we look for two important parameters: Intrinsic Value and Expected Income.

Intrinsic value is the anticipated or calculated value of a company, stock, currency or product determined through fundamental analysis. It includes tangible and intangible factors. It is also called the real value and may or may not be the same as the current market value. Though it may appear as simple as putting the definite numbers in an Excel Spreadsheet and get the right price of a share, it is not as simple as it sounds.

Each investor has different values for different variables that are required for calculation. This is the reason someone buys a share (attractive) at a certain price and someone sells (not so attractive) at that very price (stress sales and promoters deal excluded).

To find the intrinsic value of a stock, calculate the company's future cash flow, and then calculate the present value of the estimated future cash flows by discounting with a suitable discounting rate for a certain period. Add up all these present values, which will be the intrinsic value. All three highlighted variables will be different for different investors. These variations, primarily, are responsible for equity market volatility.

Intrinsic value is the theoretical value of a stock based on its fundamental factors, such earnings, dividends, growth, and risk. It represents the true worth of the company, regardless of the current market price or sentiment.

The difference between intrinsic and market value of a stock has important implications for investors. It can help them identify opportunities to buy or sell stocks. It can also indicate the level of risk and uncertainty involved in investing in a stock. This implies that the investors need to adopt different strategies to cope with the uncertainty and risk.

One of the common strategies is to use a margin of safety, which is the difference between the intrinsic value and the market price as a percentage of the intrinsic value. A higher margin of safety implies a lower risk and a higher potential return.

Earnings per share (EPS) is another important parameter to understand the profitability of a company. It is calculated as a company's profit divided by the outstanding shares of its common stock. The higher it is the more profitable is a company. EPS indicates how much money a company makes for each share individually and obviously an investor will choose to buy the share which earns more. Part of this is given back as dividends also in many cases. A good dividend paying company is always preferable to the one that doesn’t pay generously. Like other financial metrics, earnings per share are most valuable when compared against competitor metrics, companies of the same industry, or across a period of time.

Several factors can distort earnings per share, either intentionally or unintentionally. Consider a company with two factories manufacturing cellphone screens. Over the past few years, new developments have surrounded the space where one of the factories sits, increasing its value. The company's management team decides to sell the factory and build a new one on a less valuable land. Firms gain windfalls from such a transaction. Although the company and its shareholders have made real profits from this land sale, it is considered an "extraordinary item" since the company cannot necessarily repeat that transaction in the future. The windfall may mislead shareholders, so it is excluded from the EPS equation numerator. For the same reason, if a company suffered an unusual loss - perhaps there was a strike, which temporarily reduced EPS, the loss must be excluded from EPS. Therefore, extraordinary items must be viewed with extraordinary care while evaluating a company.

Apart from the bottom-line growth, we must also check the topline growth of a company which is very difficult to manipulate. A consistent growth means that the company will keep doing well in the foreseeable future.

All what have been discussed above may appear quite simple on paper but, in practice, it calls for Herculean efforts and exceptional skills. Unless one is professionally qualified and thoroughly skilled, one should leave these to experts.

At the same time, engaging an expert may be beyond the reach of the common man. For them, Mutual Fund is the better route as experts are on the job for investments as low as `500.

(The writer is senior Vice-President, SBI Funds Management Ltd; Translation and text by Abhijeet Bhushan, Group Head (Treasury), HK Group of Companies)