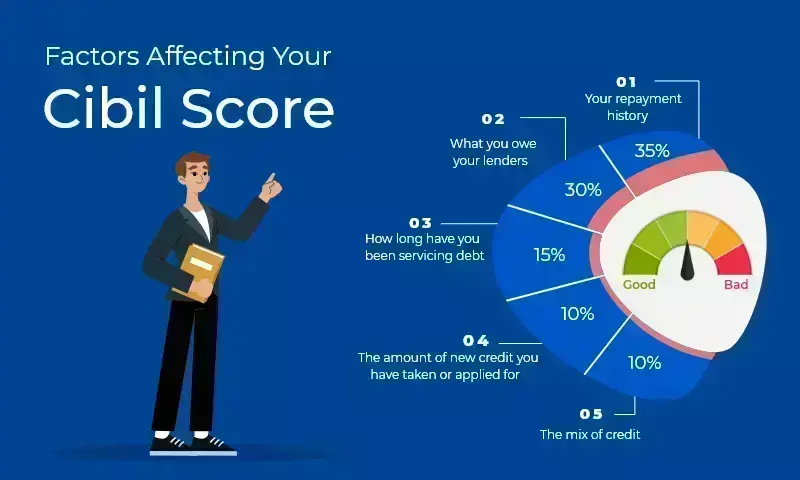

Factors that affect your CIBIL score

image for illustrative purpose

Have you ever wondered why your CIBIL credit score varies and what factors impact it? Understanding your CIBIL score is crucial for good financial health, especially if you plan on applying for loans or credit cards. This score measures your creditworthiness and can be impacted by a variety of factors. Let's go into the specifics and look at the key factors that impact your CIBIL score, so you can maintain a healthy score and enhance it as needed.

Factors that affect your CIBIL score

∙ Payment history

Your track record of payments is one of the most critical aspects that determine your CIBIL credit score. Repaying loans and credit card dues on time also positively impacts the score. Conversely, late payments, defaults, or settlements can significantly lower it. Each on-time payment adds positive information to your credit report, demonstrating your reliability to other lenders. Maintaining a good CIBIL score requires making regular payments on time. To avoid missing any due dates, setting reminders, or automating the payment process is advisable.

∙ Credit Utilisation ratio

The credit utilisation ratio reveals the extent to which one uses his or her available credit facility. A high ratio means that you are close to using most of your credit limit, a situation that lenders consider as risky. Ideally, the credit utilisation should not exceed 30 percent of the total credit limit. For example, if your credit card limit is ₹1 lakh then it is advisable to use no more than ₹30,000 at a time. Reducing the credit utilisation ratio is another way of enhancing the CIBIL score and proving creditworthiness.

∙ Credit mix

Another factor that has an impact on your CIBIL score is the number of credit accounts that you have. Both, home loans or auto loans which are secured loans, as well as personal loans and credit cards, which are unsecured, can help in improving the score by providing timely credit utilization across different types of credit facilities. It is perceived that reliance on one form of credit can be dangerous. Thus, a proper blend of credits, if maintained efficiently, improves the CIBIL score and reflects the efficiency in the management of credits.

∙ Number of hard inquiries

A hard inquiry is when you apply for credit and the credit reporting agency is requested by the credit provider. Every hard inquiry is reported and can marginally affect the CIBIL score. One should also mention that if a customer makes several requests within a short time, it is likely that he or she is a credit seeker, which means that the client has financial problems. To keep a good standing, do not apply for credit often and only apply when there is a need to do so. Loan offers that come with pre approval and use soft inquiries that are not reflected in your credit report do not impact your score.

∙ Outstanding debt

Your total amount of debt also plays a significant role in determining your CIBIL score. Overdue debts can lower your score, indicating potential over-indebtedness. Consistently paying off debts and using credit responsibly helps maintain a good CIBIL score. By managing debt levels effectively, you demonstrate to lenders that you are a reliable credit risk. Using an investment calculator can assist in planning repayments and investments to meet all financial obligations on time.

∙ Credit card balance

Even if you pay your dues on time, high credit card utilisation can affect your CIBIL score. This is the ratio of balances on your credit cards to their credit limits to determine your credit usage rate. To sustain a good credit standing, it is advisable to either clear the amount in full or keep the balance below 30% of the credit line. Using credit cards wisely and paying your bills on time and in full to ensure that your credit card balance is low has a good effect on the CIBIL score.

∙ Number of credit accounts

A crucial factor influencing your CIBIL score is the total number of open credit accounts. Many open accounts can also be a problem for lenders since it may signal overextension. On the other hand, a few accounts may not give adequate information for credit assessment. One should avoid opening too many credit accounts and ensure that the existing ones are well managed. This is true because it is wise to close accounts that are no longer in use or needed to create a good credit standing.

∙ Public records and defaults

Any legal information like bankruptcies, foreclosures, or defaults is a blow to your CIBIL score. These records show a lot of problems in the financial aspect and are kept for several years. One must abstain from actions that may lead to the creation of public records and resolve any financial matters immediately. Improving your credit rating requires the clearance of balance and embracing good credit habits. A good credit history entails being open and managing affairs concerning credit and finances.

∙ Credit behaviour trends

Credit grantors also look at credit trends in your history over time. On the same note, responsible behaviours including early payments and low credit usage can increase your CIBIL score. On the other hand, late payments, frequent applications for credit or high credit limits can lower your score. It is also important to review your credit report often and to practice good credit management consistently. This is because the management of credit balances through an investment calculator can lead to positive credit trends.

Ending note

Understanding and managing payment history, credit utilisation, and credit mix are all necessary for maintaining a strong CIBIL credit score. You may improve your credit score by maintaining a low credit usage ratio, a balanced credit mix, and a long credit history. Avoiding frequent hard inquiries, controlling ongoing debt, and keeping credit card balances low are all important. A healthy CIBIL score also requires limiting the number of credit accounts, avoiding public records, and demonstrating consistent positive credit behaviour. By remaining aware and proactive, you may guarantee that your CIBIL score accurately represents your creditworthiness, making it simpler to get loans and other financial products when necessary.

So, ensure to check your CIBIL score periodically and have a good score by maintaining good credit practices. Doing so would make you financially strong and stable during financial exigencies or fund mismatches.