In search of anti-fragile portfolio in the AI world

The pertinent questions-will AI create entirely new markets? Which industries will be next to face obsolescence? Which companies will emerge as architects of this new reality?

In search of anti-fragile portfolio in the AI world

The market presents a curious paradox. On the surface, it is directionless, lacking a clear trend or a decisive narrative. Yet beneath this placid surface, a powerful undercurrent of volatility has been unleashed.

The source of this turbulence is not the usual suspects of interest rates or geopolitical strife, but something more fundamental and unsettling - the relentless march of technological disruption, specifically the rise of Artificial Intelligence (AI).

The equity markets are grappling with a phenomenon that is, as of now, poorly defined. While the "first order" effects of AI are becoming painfully clear, viz., the direct challenge it poses to the established business models of the IT services industry - the subsequent ripples, the "next order" effects, remain shrouded in fog.

Will AI create entirely new markets? Which industries will be the next to face obsolescence? Which companies will emerge as the architects of this new reality? For now, the answers are frustratingly opaque.

And as any seasoned investor knows, markets abhor uncertainty above all else. This ambiguity is a poison pill for investor sentiment. In the absence of clarity, the human mind, prone to cognitive biases, begins to extrapolate the worst-case scenario.

A vague threat to a specific sector, morphs into a systemic risk for the entire ecosystem. This fear is not confined to speculative growth stocks but has leached into the very bedrock of the market.

The most striking symptom of this fragile investment environment is the pressure being exerted on the market's traditional stalwarts: the cash-rich, stable, blue-chip companies. For decades, these corporations have been the port in any storm, the "safe haven" for risk-averse capital.

Investors parked their money there, comforted by the predictability of their earnings and the resilience of their business models.

But AI has rendered their prospects indistinct, the ‘save heaven’ is being unraveled. The fear is no longer about a bad quarter or a missed earnings estimate. It is a deeper, existential worry: is this business model relevant in a world of artificial general intelligence (AGI)? Will their decades of accumulated data and industry expertise become a defensible moat or a stranded asset?

Consequently, even these bluest of chips are bleeding investments. The capital that once sought refuge in their stability is now questioning whether that stability is an illusion.

The ground has shifted, and the pillars that were once considered immovable are now showing cracks. This has sent a shockwave through the investment community, forcing a fundamental rethink of portfolio construction.

As the environment turns increasingly fragile, investors are desperately seeking a new paradigm. They are pondering the creation of portfolios that are not just robust, not just able to withstand a shock, but are, in the words of author Nassim Nicholas Taleb, "anti-fragile."

The concept is seductive. An anti-fragile system is one that gains from volatility, shocks, and disorder. It doesn't just survive the fire; it emerges from it stronger. In the context of an AI-disrupted world, an anti-fragile portfolio wouldn't just protect capital; it would thrive on the very chaos that is toppling others. It would be structured to benefit from the "next order" effects, whatever they may be.

This quest for the unbreakable leads to the critical, and perhaps unanswerable, question that hangs over every investment committee and individual portfolio manager today: Is there anything truly anti-fragile?

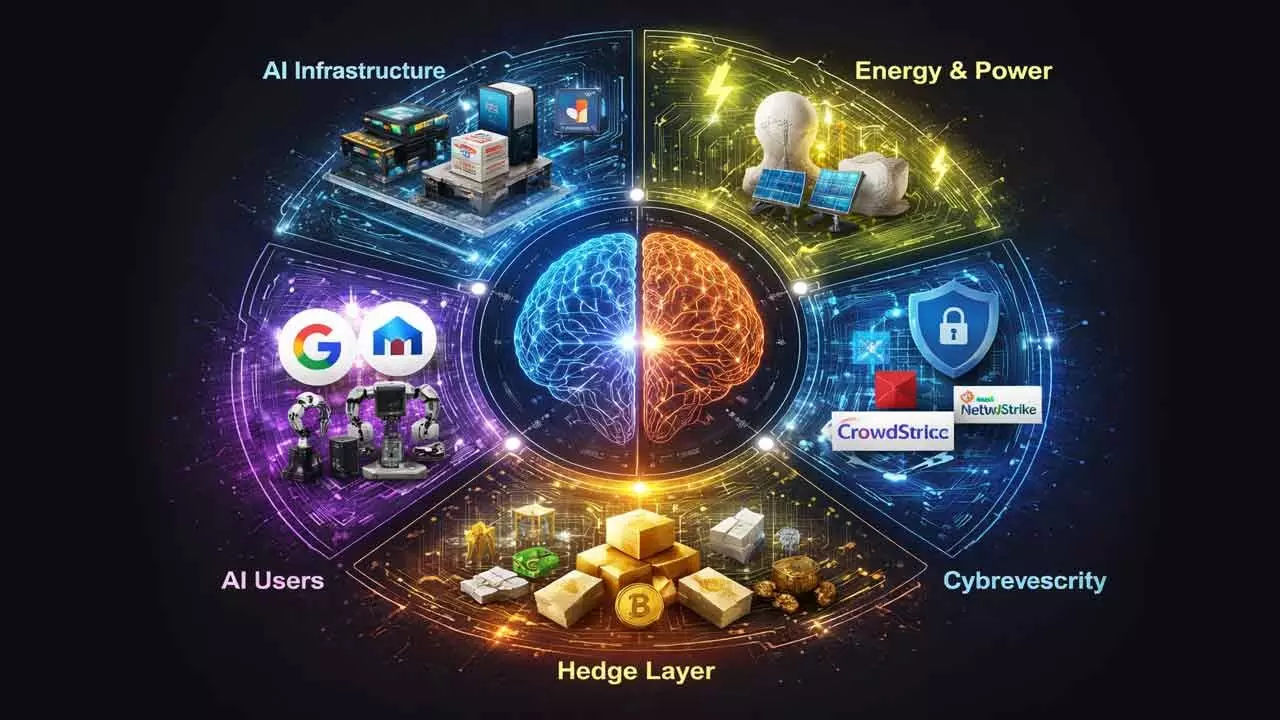

Perhaps the answer lies not in finding a single, mythical asset class that is immune to disruption, but in a different approach to structure. True anti-fragility might be found in a barbell strategy i.e., on one end, hyper-conservative assets (cash, short-term government bonds, even gold) that provide a floor, and on the other, a calculated portfolio of high-conviction, speculative bets on the very technologies causing the disruption. The middle, the traditional blue-chip growth stock, is precisely where the fragility is most acute.

Or perhaps anti-fragility is a mindset, not a portfolio. It is the acceptance that the future is inherently unknowable. It is the discipline of avoiding the fatal error of extrapolating the worst, while simultaneously preparing for a multitude of outcomes.

It is the understanding that in a world being rewritten by AI, the only true hedge is the adaptability to recognize the "next order" effects not as they are forecast, but as they unfold.

The market's current turmoil is a stark reminder that in times of profound technological shift, there are no permanent safe havens. The search for the anti-fragile portfolio may ultimately be a search for a mirage. But the pursuit itself—the rigorous questioning of established truths and the humble acknowledgment of uncertainty—is the only practice that can prevent investors from being broken by the waves of change they cannot control. Investors should also realize that their health is the most fragile and ensure that they take good care of it during these tumultuous times.

(The author is a partner with “Wealocity Analytics”, a SEBI registered Research Analyst firm and could be reached at [email protected])