Rupee climbs 3ps to 91.96/$

In the near-term currency direction will continue to be guided by global cues

Rupee climbs 3ps to 91.96/$

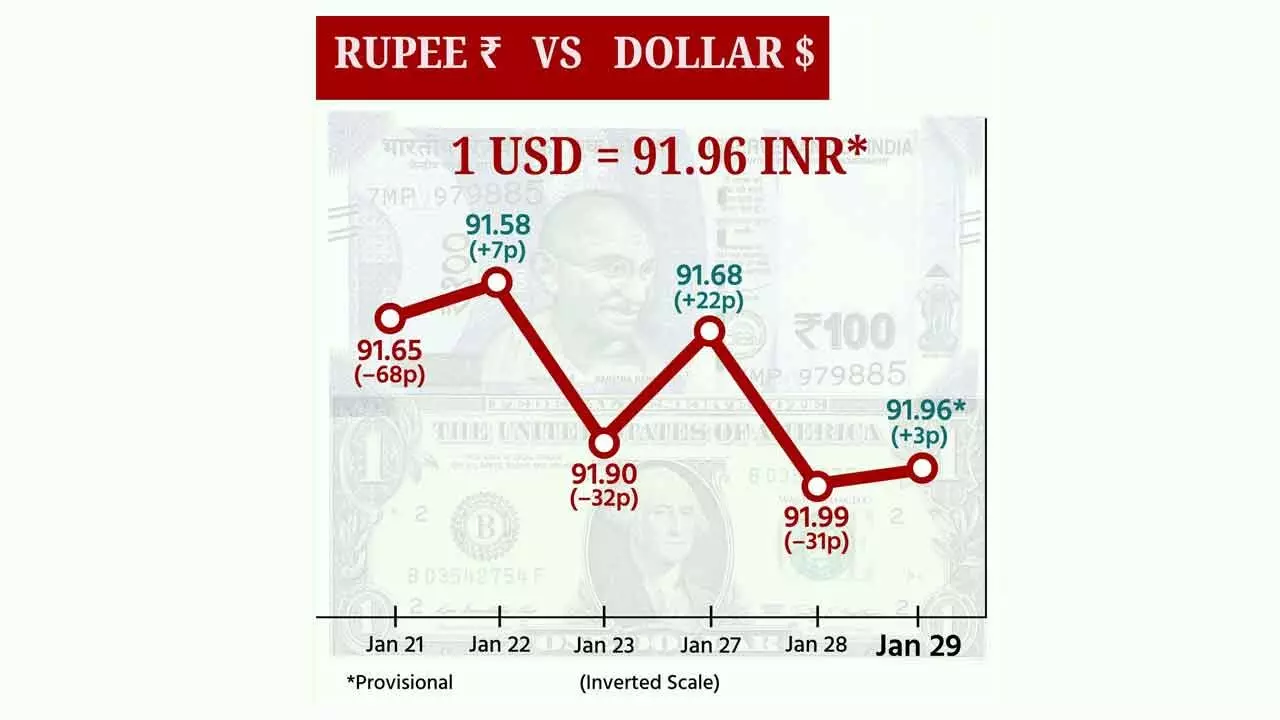

The rupee settled near its all-time closing low at 91.96 (provisional) against the US dollar, amid selling pressure from foreign funds and risk-off sentiment in global markets. Forex traders said the rupee hit its all-time intra-day low of 92 against the US dollar amid geopolitical uncertainty and foreign outflows.

Moreover, a surge in crude oil prices weighed on the rupee. At the interbank foreign exchange, the rupee opened at 91.95 and touched an early high of 91.82, but pared gains to touch an intra-day low of 92 against the greenback. The domestic unit settled at 91.96 (provisional), up 3 paise from its previous close.

On Wednesday, the rupee settled 31 paise down, revisiting its lowest-ever closing level of 91.99 against the greenback. On January 23, the rupee hit an all-time intra-day low of 92 against the US dollar. Finance Minister Nirmala Sitharaman tabled the economic survey, flagging concerns over risks from the external sector and foreign outflows.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.07 per cent lower at 96.37.

“Persistent dollar strength, elevated US bond yields, and continued foreign portfolio outflows have collectively kept emerging market currencies under stress, with the rupee being no exception,” Akshat Garg, Head, Research & Product of Choice Wealth, said.

Garg further noted that month-end importer demand and precautionary hedging has further accentuated the move. While the RBI has the ammunition to smooth excessive volatility, it is unlikely to defend any specific level aggressively in the absence of disorderly market conditions.

“From a medium-term perspective, India’s fundamentals remain relatively resilient, supported by stable growth and manageable inflation. However, near-term currency direction will continue to be guided by global cues -- particularly the US rate trajectory, capital flow trends and geopolitical developments.