Will RINL be saved? Merger talks with SAIL offer a possible lifeline

Steelmaker facing cash crunch and lacks captive mines which are hindering its growth

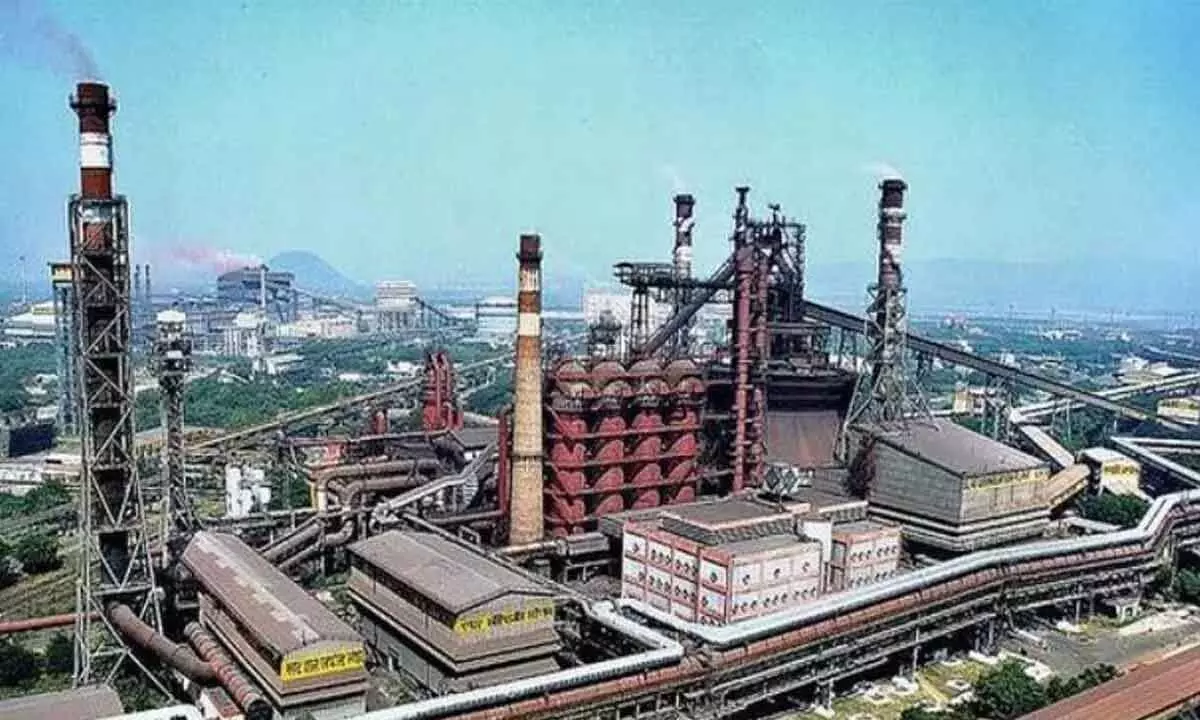

image for illustrative purpose

Visakhapatnam: The demand for merger of Rashtriya Ispat Nigam Limited (RINL), the corporate entity of Visakhapatnam Steel Plant and Steel Authority of India Limited (SAIL) has taken centre-stage as a section of ruling BJP leaders are batting for formation of a giant public sector entity to meet the demand for steel.

The National Steel Policy envisages achieving a production capacity of 300 million tonnes by 2030. SAIL has kicked off an ambitious project to ramp up its capacity 24 million tonnes and take up the next phase of expansion to infuse Rs 1 lakh crore to raise its capacity to raise its production to 43 to 35 million tonnes by 2030-31.

The hope of dispensing with the decision on strategic disinvestment of RINL by way of 100 per cent privatisation and revival of the talk of merger with SAIL has become the talking point in various circles following the spectacular victory of BJP in Chhattisgarh after the party’s leadership’s election-eve promise to withdraw the decision to sell off the NMDC Nagarnar Steel Plant. The three million tonnes integrated steel plant has been set up near Jagdalpur in Bastar district bordering Odisha.

RINL was formed after separating it from SAIL in 1982 with a corporate vision to raise its production to 20 million tonnes on a single campus to make it the largest steel producing single plant. However, the company is now battling for survival due to severe cash crunch and raw material insecurity. While working capital problem is caused due to heavy capital expenditure (capex) incurred on expanding capacity from three to 7.3 million tonnes a few years ago with a total investment of Rs 16,300 crore, the company is deprived of captive mines since its inception unlike major steel-makers like SAIL, TISCO and JSW.

In an important development, BJP Rajya Sabha GVL Narasimha Rao met Chairman and Managing Director of SAIL Amarendu Prakash and discussed possibility of a merger of RINL with SAIL or assistance from SAIL to operate a third blast furnace to increase production of the Visakhapatnam-headquartered company to improve its physical and financial performance.

It may be recalled that two weeks ago, RINL executive and employee unions met Narasimha Rao and requested his intervention to seek either RINL’s merger with SAIL or support from SAIL to operate the third blast furnace of RINL. The latest meeting of GVL with CMD of SAIL was held in this background on Wednesday.

“We want that RINL to be put back on the right track. Hence, we find merger with SAIL as most viable mutually beneficial option or else consider leasing out the third blast furnace of Visakhapatnam Steel Plant,” Visakha Ukku Parirakshana Porata Samiti co-chairman and AITUC national vice-president D Adinarayana told Bizz Buzz.

He said as SAIL is facing the requirement of huge investment to go ahead with its expansion plan and RINL is already faced with a severe working capital crisis and raw material insecurity, the merger will help both the companies. “While SAIL can make use of expertise of experienced workforce and surplus lands here, RINL can source its raw material requirement from the mines owned by SAIL,” he stated.

At the meeting with SAIL CMD, GVL informed him that he had been assisting RINL in the past two years by smoothening raw material supplies and working capital by taking up these issues with the Union ministers for Steel, Coal and Finance and senior officials of the Steel Ministry and PSUs like NDMC and Coal India Limited (CIL).

The merger of RINL with SAIL will be a win-win for both the PSUs which are under the same Ministry of Steel, stated Narasimha Rao. SAIL will benefit as it can make use of surplus lands of RINL, which has a land bank of 19,650 acres. Being a shore-based plant, it will have freight advantage towards shipment of consignments in its vicinity.

Currently, SAIL transports raw materials to its plants faraway from landing ports and in turn transports finished products from faraway plants to the markets in the Southern and Western States. This additional logistics cost can be avoided by a merger of RINL with SAIL. Merger will help RINL immensely by getting raw materials from SAIL’s captive iron ore and coal mines and further provide it access to the much needed working capital and at a lower interest rates.

The MP said he will discuss with the government the potential merger of RINL at the highest level and sought the views of SAIL top brass on the merger issue. The Government of India’s approved 100 per cent disinvestment of RINL, its joint ventures and subsidiaries in January, 2021. Since then, the expression of interest for receiving bids has not been issued due to several reasons.