Trump Tariff Bombshell: Beijing Has Many Counter Aces Up Its Sleeve

Trump's tariff strategy has prompted China and EU to rethink their previously strained trade ties

Trump Tariff Bombshell: Beijing Has Many Counter Aces Up Its Sleeve

EU and Chinese officials are holding talks over existing trade barriers and considering a full-fledged summit in China in July. Finally, China sees in Trump's tariff policy a potential weakening of the international standing of the US dollar

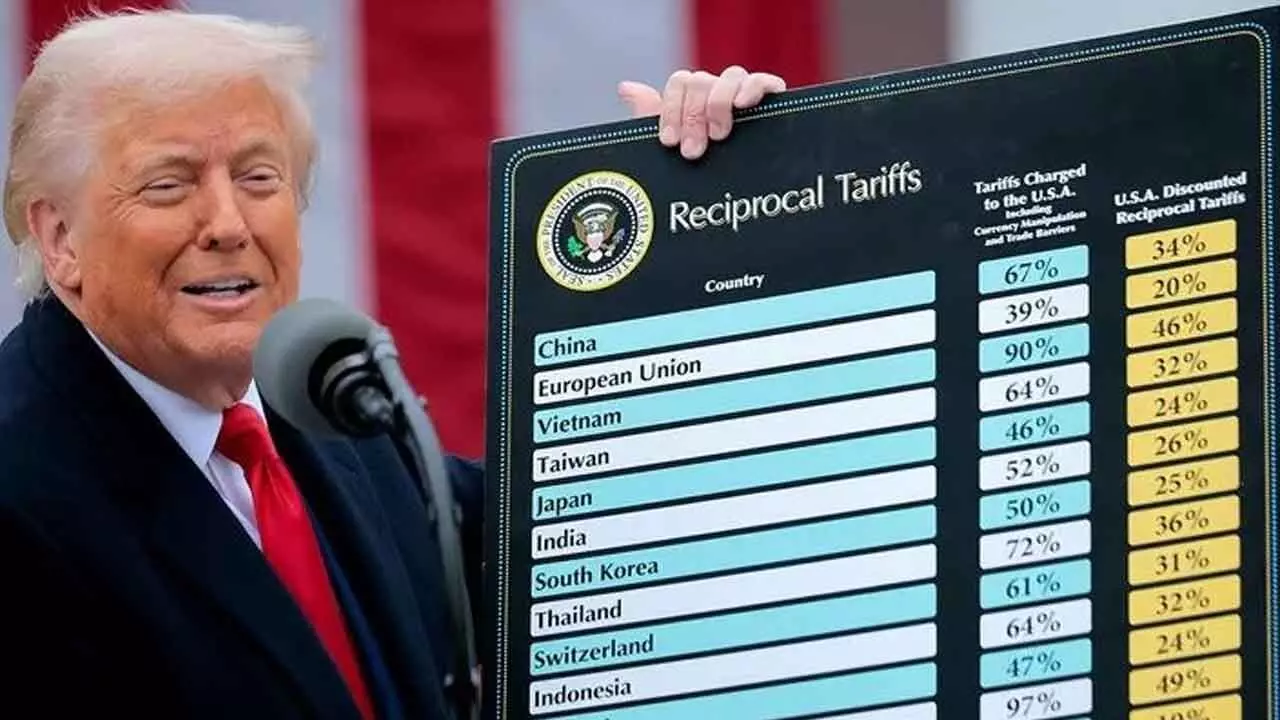

When Donald Trump pulled back on his plan to impose eye-watering tariffs on trading partners across the world, there was one key exception: China. The move, in Trump's telling, was prompted by Beijing's “lack of respect for global markets.” But the US president may well have been smarting from Beijing's apparent willingness to confront US tariffs head on. While many countries opted not to retaliate Beijing took a different tack. It responded with swift and firm countermeasures.

On April 11, China dismissed Trump's moves as a “joke” and raised its own tariff against the US to 125 per cent. The two economies are now locked in an all-out, high-intensity trade standoff. And China is showing no signs of backing down.

As an expert on US-China relations, I wouldn't expect China to. Indeed, Beijing believes it can inflict at least as much damage on the US as vice versa, while at the same time expanding its global position.

A changed calculus for China:

There's no doubt that the consequences of tariffs are severe for China's export-oriented manufacturers – especially those producing furniture, clothing, toys and home appliances for American consumers. But since Trump first launched a tariff increase on China in 2018, a number of underlying economic factors have significantly shifted Beijing's calculus.

Trump's tariff policy may allow Beijing a useful external scapegoat, allowing it to rally public sentiment and shift blame for the economic slowdown onto US aggression. China also understands that the US cannot easily replace its dependency on Chinese goods, particularly through its supply chains. While direct US imports from China have decreased, many goods now imported from third countries still rely on Chinese-made components or raw materials. By 2022, the US relied on China for 532 key product categories. There's a related public opinion calculation: Rising tariffs are expected to drive up prices, something that could stir discontent among American consumers, particularly blue-collar voters. Indeed, Beijing believes Trump's tariffs risk pushing the previously strong US economy toward a recession.

Potent tools for retaliation:

Alongside the changed economic environments, China also holds a number of strategic tools for retaliation against the US.

It dominates the global rare earth supply chain – critical to military and high-tech industries – supplying roughly 72 per cent of US rare earth imports, by some estimates. On March 4, China placed 15 American entities on its export control list, followed by another 12 on April 9. Many were US defense contractors or high-tech firms reliant on rare earth elements for their products. China also retains the ability to target key US agricultural export sectors such as poultry and soybeans – industries heavily dependent on Chinese demand and concentrated in Republican-leaning states.

It accounts for about half of US soybean exports and nearly 10 per cent of American poultry exports. On March 4, Beijing revoked import approvals for three major US soybean exporters. And on the tech side, many US companies – such as Apple and Tesla – remain deeply tied to Chinese manufacturing.

Tariffs can shrink their profit margins, which, Beijing believes can be used as a source of leverage against the Trump administration. Already, Beijing is reportedly planning to strike back through regulatory pressure on US companies operating in China.

Meanwhile, the fact that Elon Musk, a senior Trump insider who has clashed with US trade adviser Peter Navarro against tariffs, has major business interests in China is a particularly strong wedge that Beijing could yet exploit in an attempt to divide the Trump administration.

A strategic opening for China:

While Beijing thinks it can weather Trump's sweeping tariffs on a bilateral basis, it also believes the US broadside against its own trading partners has created a generational strategic opportunity to displace American hegemony.

From Beijing's perspective, Trump's actions offer an opportunity to directly erode US sway in the Indo-Pacific. Chinese President Xi Jinping has strategically timed his state visits to Vietnam, Malaysia and Cambodia, the three Southeast Asian nations that were targeted with now-paused reciprocal tariffs by the Trump administration. Trump's tariff strategy has already prompted China and officials from the European Union to contemplate strengthening their own previously strained trade ties, something that could weaken the transatlantic alliance that had sought to decouple from China.

On April 8, the president of the European Commission held a call with China's premier, during which both sides jointly condemned US trade protectionism and advocated for free and open trade. Coincidentally, on April 9, the day China raised tariffs on US goods to 84 per cent, the EU also announced its first wave of retaliatory measures – imposing a 25 per cent tariff on select US imports worth over €20 billion – but delayed implementation following Trump's 90-day pause. Now, EU and Chinese officials are holding talks over existing trade barriers and considering a full-fledged summit in China in July. Finally, China sees in Trump's tariff policy a potential weakening of the international standing of the US dollar.

Widespread tariffs imposed on multiple countries have shaken investor confidence in the US economy, contributing to a decline in the dollar's value. Traditionally, the dollar and US Treasury bonds have been viewed as haven assets, but recent market turmoil has cast doubt on that status. At the same time, steep tariffs have raised concerns about the health of the US economy and the sustainability of its debt, undermining trust in both the dollar and the US Treasury.

While Trump's tariffs will inevitably hurt parts of the Chinese economy, Beijing appears to have far more cards to play this time around.

It has the tools to inflict meaningful damage on US interests – and perhaps more importantly, Trump's all-out tariff war is providing China with a rare and unprecedented strategic opportunity.

(The writer is associated with Auburn University)