India’s growth momentum acceleration signals a confident march towards Viksit Bharat

Q2 GDP beats all estimates, consumption rises, and reforms strengthen India’s path to $5 trillion economy by 2029

India’s growth momentum acceleration signals a confident march towards Viksit Bharat

On November 28, 2025, National Statistical Office (NSO) released GDP figures for the quarter ended September 2025. It was a pleasant surprise for all economists and market that India’s real GDP grew by a higher than all of their estimation at 8.2 per cent in the second quarter this year as against the first quarter real GDP growth of 7.6 per cent.

Quarter to Quarter as well on year to year the real GDP has been much higher. Real GDP in the second quarter of the previous year was at 5.6 per cent. Market Expectations (Reuters 7.3% and RBI projection 7% the real GDP at 8.2% y-0-y) surpassed all these forecasts.

Nominal GDP growth, however, eased to a four quarter low of eight per cent, thereby narrowing the real income gap to a six year low. The government in Budget 2025-26 had estimated a nominal GDP growth rate of 10.1 per cent (real growth plus inflation). Due to CPI inflation and WPI inflation has been coming down substantially as well there is muted tax receipts , the real GDP growth is much lesser which may upset some of the budget estimates.

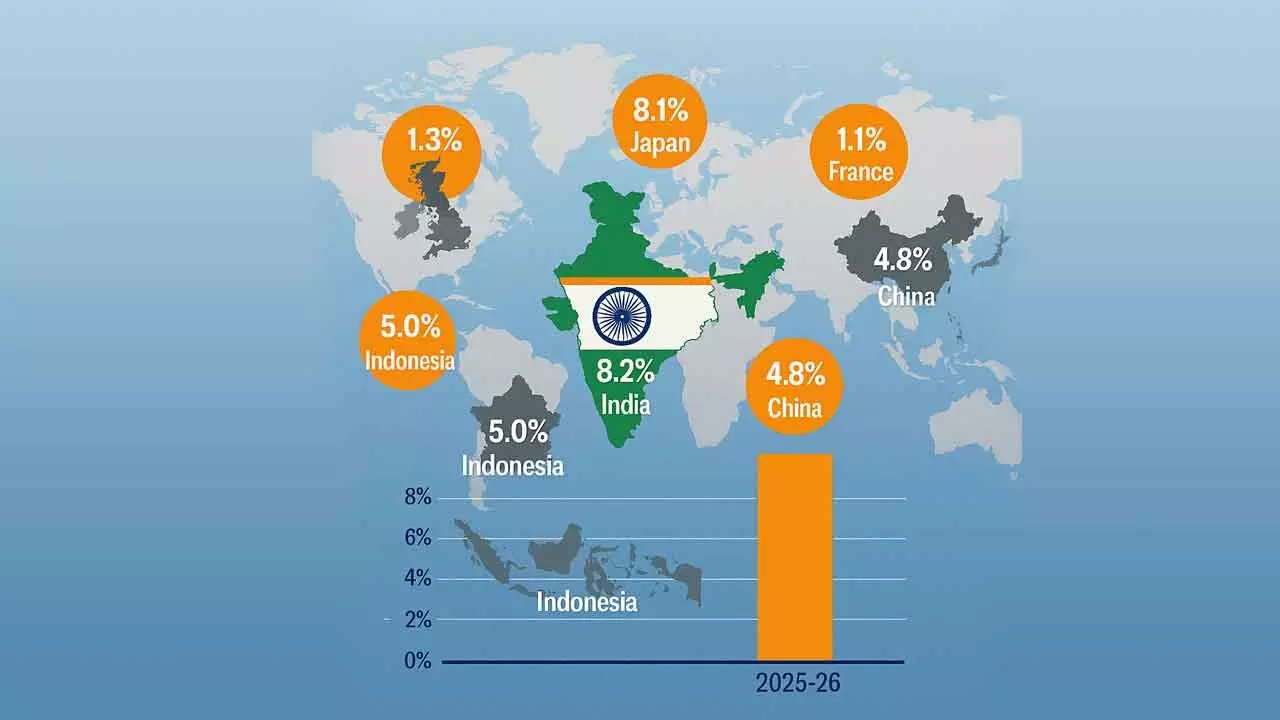

Inspite of the global uncertainties and pressure on Indian Exports due to USA Trump tariffs on India at 50 per cent, still the strong Fundamentals of Indian Economy and it’s resilience led to Indian economy growing much stronger and at a rate much higher than all other countries.

India real GDP growth in Q2/2025-26 at 8.2 per cent is much higher than five per cent in Indonesia, China at 4.8 per cent, UK at 1.3 per cent, Japan at 1.1 per cent and France at 0.9 per cent.

PM Shree Narendra Modi, calling the second quarter number ‘encouraging’ Modi said “It reflects the impact of our pro growth policies and reforms. It also reflects the hard work and enterprise of our people. Our Government will continue to advance reforms and strength the ease of business for every citizen.”

Here we can recall the GST Reforms GST 2.0 was implemented in India starting 22, September 2025, substantially reducing the rates on all major items primarily on many daily essentials, health and consumer durable goods to two slab system (5% and 18%) thereby abolishing 12 per cent and 28 per cent slabs, most of these old slabs were moved to the new 5% or 18% rates.

This reform just before Diwali has given boost to private consumption, Real Private Final Consumption Expenditure (PFCR) increased by 7.9% in Q2, indicating healthy domestic demand. It is likely that the private consumption expenditure is likely to accelerate further in the next half year which will be positive for the GDP growth.

Nominal GDP growth has witnessed a growth rate of 8.7 per cent in Q2 of FY 2025-26. There has been substantial growth of 8.1 per cent in 25-26 in Secondary sector against four per cent in 2024-25. However in 23-24 Secondary sector growth was at 15.8 per cent.

Similarly territory sector from 7.2 per cent in 24-25 moved up substantially to 9.2 per cent in 25-26. These two sectors better performance boosted the real GDP growth rate in Q2 of FY 2025-26 to rise above 8%. Manufacturing sector real GVA at 8.4 per cent in 2025-26 as against 4.8 per cent in 24-25, Trade, Hotels, Transport, Communication & Services related to Broadcasting rose to eight per cent in 25-26 as against 5.8 per cent in 24-25, Similarly Financial, Real Estate & Professional services registered a growth of 9.9 per cent in 25-26 as against 6.9 per cent in 24-25.

Public Administration, Defence and other services showed a growth of 9.7 per cent in 25-26 as against 8.9 per cent in 2024-25.

The Private Final Consumption Expenditure (PFCR) at current prices as a components of GDP for H1/2025-26 stood at 61.4 per cent as against 61.1 in 24-25. Government Final Consumption Expenditure (GFCE) which were at 10 per cent at 2024-25 has come down to 9.6 per cent in 2025-26.

Another important factor of Gross Fixed Capital Formation (GFCF) again shown marginal reduction from 30.6 per cent in 24-25 to 30.5 per cent in 2025-26. It is heartening to note that Exports at 21.2 for 2025-26 as against 21.1 per cent in 2024-25. India could do substantial exports to USA before cut of date for Tariffs to come and India has been able to tap the potential in other countries by combination of diversifying the exports, using the already done Free Trade Agreements as well tapping new potential.

However, there will be threat to keep this momentum in Exports. Hence, finalising the USA trade deal at the earliest which is likely before December will further help in exports.

However, the government has brought in lot of fiscal and regulatory relief recently for export sector which will help the exporters to cover up the shortfall in exports in other countries. “Aiming to conclude First Track of US Trade Talks by December” by Rajesh Agrawal, Commerce Secretary.

“We are engaged in discussions over a protracted trade deal framework to address reciprocal tariff issues with the US-We are in the last leg of this deal now.” Market and Exporters are eagerly waiting for this trade deal to happen early which will help our exports and economy substantially if the trade deal in our favour. It may be noted that Exports stood at$491 billion in the first nine months of this fiscal year compared to $461 billion last year.

India is in talks with 50 nations for Trade Pacts said Shree Piyush Goel, Commerce and Industry Minister. In the light of recent trade uncertainties, India has taken up trade agreement with Canada, in Gulf namely Oman, Bahrain, Qutar and the Gulf Cooperation Council also talking that whole six Nations group would like to engage in trade discussion. India has concluded trade agreements with Australia, the UAE, Mauritius, the UK and European free Trade Association.

Exports growth this quarter at 5.6 per cent as against 6.3 per cent in the last quarter whereas Imports this quarter is at 12.8 per cent higher than 10.9 per cent in the last quarter. India’s trade deficit for the latest available months is widening reaching an estimated $41.68 billion in October 25, a record high, driven by a surge in imports (especially gold) and a decline in exports partly due to US Tariffs.

The trade deficit for the fiscal year, FY 2024-25 was $78.1 billion, down from $121.6 billion in 2023-24. There must be substantial increase in exports manufactured and strong performance in service exports to be further enhanced as the same will keep our trade deficit at manageable level and exports will have a greater contribution to GDP.

India's exports of goods and services accounted for approximately 21.4 per cent to 22.4 per cent of its GDP in recent years which has shown significant upward trend from previous years. This shows the growing importance of external trade to the Indian economy with the ratio rising from under nine per cent in 2001-02 to 22.4 per cent in 2022-23.

India needs to accelerate the real GDP growth rate to an average of eight per cent plus in its vision to become a Viksit Bharat. With the current trend of acceleration in GDP growth, the earlier estimation of real GDP growth of 6.5 per cent for India is likely to much above and it will be above seven per cent, SBI Research has revised FY2026 GDP growth to 7.6 per cent. BOB has revised their estimate of real GDP growth to be 7.4%-7.6% for the full year.

This revised estimates are encouraging in the current global headwinds. SBI research suggests “With 7.6 per cent real GDP growth for FY 26, our GDP growth will likely to cross $4 trillion by March 2026 and FY27 GDP is estimated to be around $4.4 trillion.

Thus India is on the right track to reach $5 trillion by March 29. Already India is the world’s fourth largest economy, the nation is charting a confident course towards becoming the third largest by 2030 with the GDP projected at $7.3 trillion. This needs to be enabled with further structural reforms. In this regard the Government labour reforms were an important reform. Both at the government and regulator level there has been steps to reduce the compliance burden and work towards further ease of business.

With the Public Digital Infrastructure as well Government actively pursuing AI related initiatives, it is expected that digital Indian economy can contribute $more than one trillion to our GDP in future.

With growth showing better trend and lowest CPI inflation, it is now watched Is RBI in its forthcoming RBI Monetary policy, likely to further cut Repo rate by 25 basis points as well continuing with the neutral stance.

All the stakeholders will have to utilise the current momentum in India growth story and provide further opportunities and enablers to not only sustain but also accelerate our economic drivers in our path towards Viksit Bharat by 2047.

(The author is former Chairman & Managing Director of Indian Overseas Bank)