Indian airports making losses remains an unanswerable paradox

Air travel remains out of the financial reach of a majority of Indians

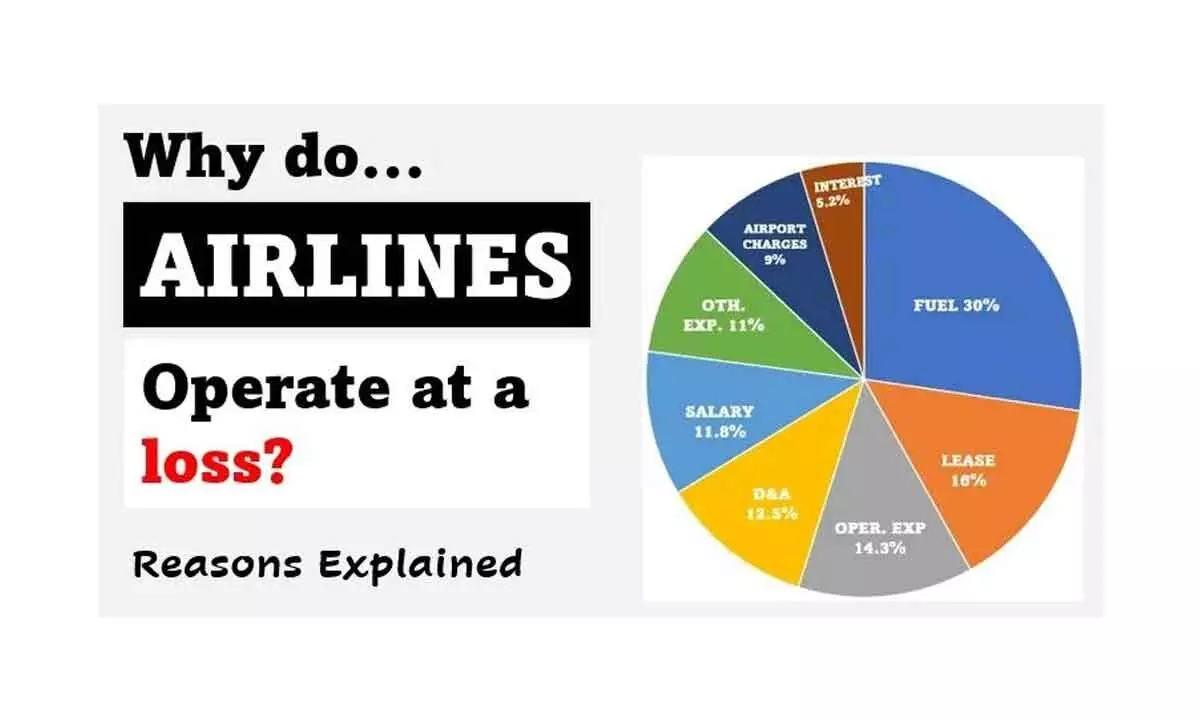

image for illustrative purpose

Foreign tourist arrivals are rebounding since the pandemic, but are still relatively scarce, barely topping 10 million in a good year (about the same as Romania). Experts feel that attracting foreign airlines and investments in new terminals and digital transformation can help reverse fortunes of domestic airports

There are 139 airports in the country that are run either by the Airports Authority of India (AAI) or under public-private partnership (PPP). Of these, only 21 were able to generate profits in the 2022-23 financial year, which implies that only 15 per cent of airports in India generated profits in the last financial year, according to data shared in the recent monsoon session of the Parliament.

According to the civil aviation ministry, as of July 27, of the 125 domestic airports run by AAI, only 18 registered profits in the past financial year, while 15 recorded neither profits nor losses. This was, however, an improvement over the previous financial year (2021-22), when only 11 airports run by AAI made profits. AAI continues with a steady stream of revenue from profit sharing and other services, while more airports can come online.

Operating an airport is a capital-intensive business that requires significant investment in strategic areas such as the development of new terminal buildings and digital transformation.

The pandemic affected airport revenues “drastically” since they are directly dependent on aircraft movement and passenger traffic. Passenger traffic is expected to return to the pre-Covid 2019 levels only next year, hence airports have definitely taken a hit when it comes to revenue, causing losses.

Air travel remains out of the financial reach of most Indians. An estimated three per cent of the country’s population flies on a regular basis. But in a nation of 1.4 billion people, that percentage represents 42 million — executives, students and engineers who yearn to get quickly from here to there inside India’s borders, and to gain easier access to destinations beyond, for both business and vacation.

A vast majority of Indians cannot afford such conveniences. The annual mean income is still less than a single economy-class fare from the United States, and, in this top-heavy economy, most Indians earn much less than that. Middle class, in Indian parlance, indicates somewhere close to the top of the pyramid. Foreign tourist arrivals are rebounding since the pandemic, but are still relatively scarce, barely topping 10 million in a good year (about the same as Romania). Experts feel that attracting foreign airlines and investments in new terminals and digital transformation can help reverse fortunes of domestic airports.

Bengaluru Airport, which operationalised its second terminal early this calendar year, was the most profitable airport in India in the last financial year. The airport recorded a profit of Rs. 528.31 crore in FY 2022-23 (Apr 2022 to March 2023).

The 21 profitable airports are a mix of private and public airports. Kolkata follows Bengaluru with a profit of Rs. 482.3 crore. Kochi occupies the third spot with Rs. 267.17 crore. The list includes those which are not utilised for scheduled commercial services like Juhu (Profit of Rs. 13.31 crore) and non-operational ones like Asansol (Profit of Rs. two crore).

The others in the list starting from the fourth position are Chennai, Calicut, Pune, Goa – Dabolim, Hyderabad, Tiruchirapalli, Deoghar, Srinagar, Juhu, Coimbatore, Bhubaneshwar, Chandigarh, Bagdogra, Vizag, Asansol, Leh, Kanpur and Darbhanga. Most airports, if not all, are undergoing rapid expansion and construction activity while Bengaluru and Kolkata have just concluded their major expansion activity. Either profits or loss, the numbers may not be indicative of a long-term pattern – unless studied.

The granular numbers for Delhi and Hyderabad airports are available, since they are owned by GMR Group under a separate company – GMR Airports Ltd, which is a listed entity.

Considering the rate at which RCS-UDAN scheme has expanded, these may also see scheduled commercial service in the next few years. The scheme has been a success in terms of operationalising new airports but when it comes to commercialising those new routes – it is far from being called a success. The most loss-making airport in the country in the last financial year was Ahmedabad, with a loss of Rs. 408.51 crore. This was followed by Delhi, the country’s largest airport, with Rs. 284.86 crore. The third in the loss-making category was Lucknow at Rs. 160.66 crore. Ahmedabad and Lucknow are part of Adani group’s airport foray with the group winning the rights just before Covid and having had to take over the airports in the middle of the pandemic, impacting their financial calculations.

There are only nine airports with a loss of over Rs. 100 crore, while 55 airports have a loss of less than Rs. 10 crore.