Best SIP mutual funds to Invest in 2026

Best SIP mutual funds to Invest in 2026

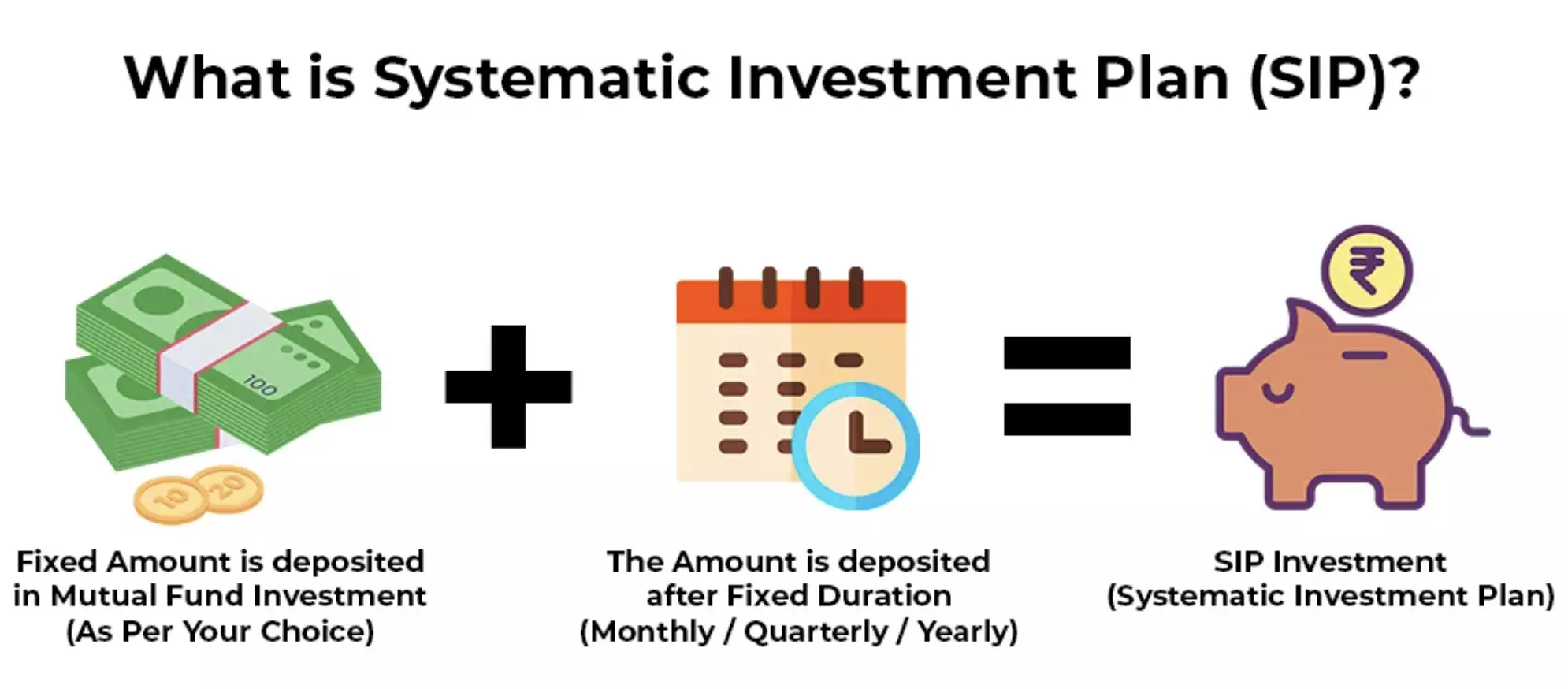

Mutual funds continue to be one of the most preferred investment avenues for both new and seasoned investors in India. They offer flexibility across asset classes such as equity, debt, and hybrid funds, while Systematic Investment Plans (SIPs) allow investors to build wealth gradually with disciplined contributions.

However, with hundreds of schemes available in the market, identifying the best SIP mutual funds can be challenging. To simplify the selection process, we have shortlisted some of the top-performing SIP mutual funds in India based on their 3-year annualised returns, along with 5-year returns for additional perspective.

Best Mutual Funds for SIP in 2026

Below are some of the leading SIP mutual fund options, ranked by their 3-year annualised performance:

Mutual Fund 3-Year Returns 5-Year Returns

Bandhan Small Cap Fund Direct – Growth 32.24% 27.33%

Invesco India Mid Cap Fund Direct – Growth 29.03% 25.28%

Edelweiss Mid Cap Fund Direct – Growth 27.98% 26.17%

Motilal Oswal Mid Cap Fund Direct – Growth 26.88% 28.54%

HDFC Mid Cap Fund Direct – Growth 26.55% 25.68%

Nippon India Growth Mid Cap Fund Direct – Growth 26.54% 25.28%

Motilal Oswal Large & Mid Cap Fund Direct – Growth 26.44% 23.95%

Kotak Multicap Fund Direct – Growth 25.54% –

Bandhan Large & Mid Cap Fund Direct – Growth 25.34% 23.02%

Data last updated on January 07, 2026

Overview of Top SIP Mutual Funds for 2026

Bandhan Small Cap Fund Direct – Growth

Launched in February 2020, this open-ended small-cap fund allows SIP investments starting at ₹100. With an AUM of ₹18,173.90 crore and an expense ratio of 0.42%, the fund has delivered strong long-term performance despite muted short-term returns. A 1% exit load applies if redeemed within one year.

Invesco India Mid Cap Fund Direct – Growth

Established in 2013, this mid-cap fund has an AUM of ₹10,006.30 crore and a minimum SIP requirement of ₹500. The fund tracks the BSE Midcap 150 TRI and carries an expense ratio of 0.54%, with a 1% exit load on excess redemptions within one year.

Edelweiss Mid Cap Fund Direct – Growth

This mid-cap fund, launched in 2013, offers SIP investments starting at ₹100. It manages assets worth ₹13,195.70 crore and has an expense ratio of 0.40%. The fund levies a 1% exit load for redemptions made within 90 days.

Motilal Oswal Mid Cap Fund Direct – Growth

With assets under management of ₹38,002.70 crore, this fund has been operational since 2014. Although it reported negative absolute returns over the past year, its long-term performance remains competitive. The fund has an expense ratio of 0.72% and a one-year exit load of 1%.

HDFC Mid Cap Fund Direct – Growth

One of the largest mid-cap funds in India, this scheme manages ₹92,168.90 crore in assets. Launched in 2013, it has delivered stable long-term returns with an expense ratio of 0.71% and a 1% exit load within one year.

Nippon India Growth Mid Cap Fund Direct – Growth

This fund manages ₹42,041.60 crore and has been in existence since 2013. With a minimum SIP of ₹100 and an expense ratio of 0.73%, the fund applies a 1% exit load for redemptions within one month.

Motilal Oswal Large & Mid Cap Fund Direct – Growth

Launched in 2019, this fund invests across large and mid-cap stocks and tracks the Nifty Large Midcap 250 TRI. It has an expense ratio of 0.69% and charges a 1% exit load for redemptions within 365 days.

Kotak Multicap Fund Direct – Growth

Introduced in 2021, this multicap fund follows the NIFTY500 Multicap 50:25:25 TRI. It offers SIP investments starting at ₹100, manages assets worth ₹22,281.30 crore, and carries an expense ratio of 0.45%.

Bandhan Large & Mid Cap Fund Direct – Growth

Operational since 2013, this fund manages ₹12,783.70 crore in assets. With an expense ratio of 0.56%, it tracks the Nifty LargeMidcap 250 TRI and applies a 1% exit load for redemptions within one year beyond 10% of the investment.

Key Factors to Consider Before Choosing an SIP

Financial Goals: Clearly define your investment objectives and time horizon before selecting a fund.

Risk Profile: Equity-oriented funds carry higher risk compared to debt funds; choose schemes aligned with your risk tolerance.

Consistency: Staying invested through regular SIP contributions helps manage market volatility and benefit from compounding.

Periodic Review: Reviewing your portfolio periodically helps identify underperforming funds and rebalance investments.

Costs: Expense ratios and exit loads can impact overall returns and should be factored into fund selection.

Conclusion

SIP investments in equity, hybrid, and debt mutual funds remain an effective way to build long-term wealth. While 3-year annualised returns can serve as a useful shortlisting criterion, investors should also consider factors such as fund management, cost structure, and market conditions before making investment decisions.

Mutual Fund Selection Criteria

The mutual funds listed above are ranked solely based on their 3-year annualised returns. Past performance does not guarantee future results. Investors should conduct thorough research or consult a financial advisor before investing.

Disclaimer: This article is for educational purposes only and does not constitute investment advice or recommendations. Mutual fund investments are subject to market risks.