Top Cross‑Border Payment Trends for 2026: Preparing Your SMB for What’s Next

image for illustrative purpose

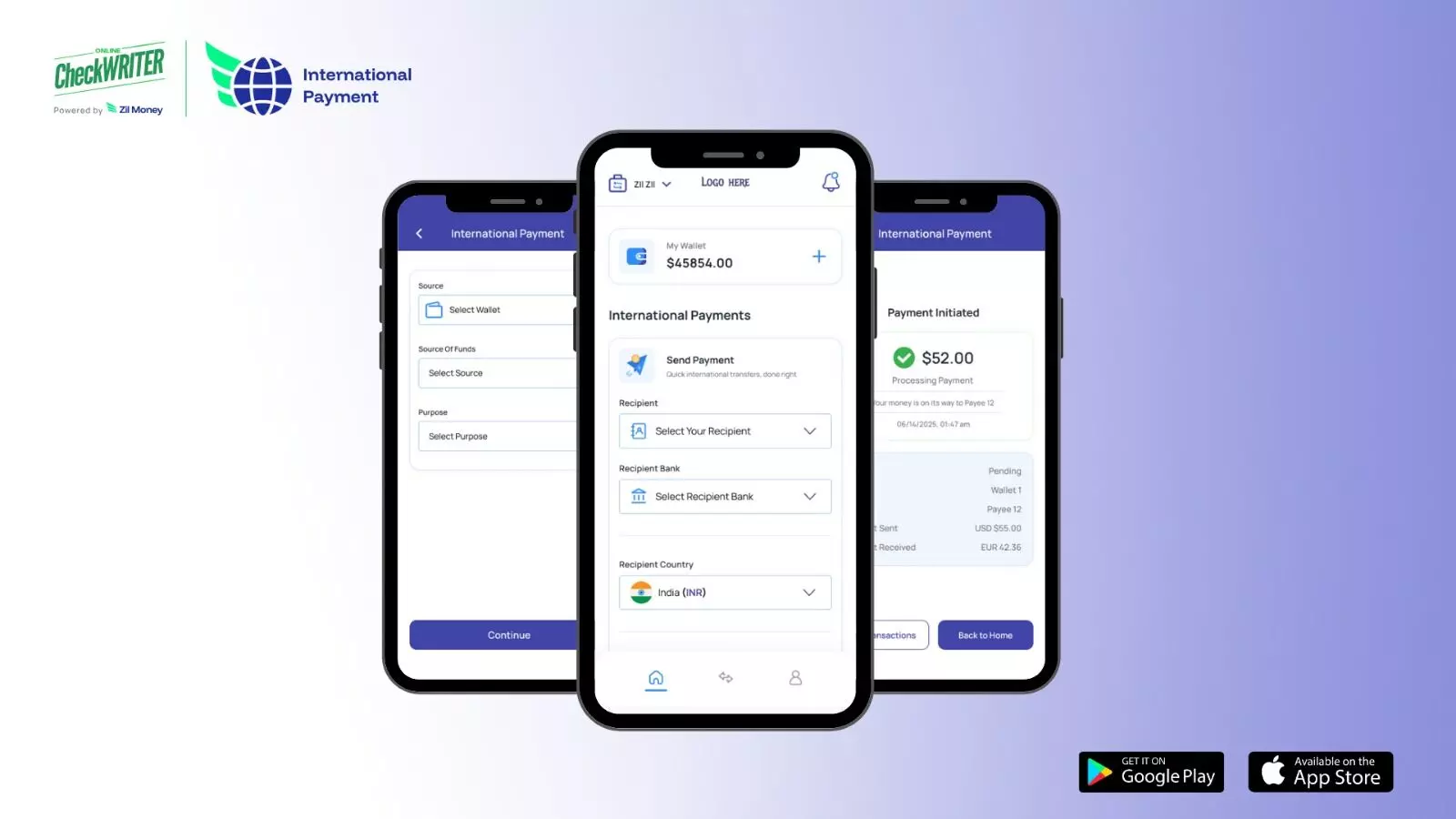

Leveraging OnlineCheckWriter.com – Powered by Zil Money to Stay Ahead

Global commerce isn’t just for multinationals anymore. Analysts predict B2B cross‑border payments could exceed US$42.7 trillion by 2026, while international transfers continue to grow roughly 5 % per year. For small‑ and medium‑sized businesses (SMBs), managing exchange rates, compliance and fees while satisfying customers’ expectations for fast international payments and affordability is critical. Apps like the International Payments App (iOS / Android) provide SMBs with tools to manage these complexities more easily.

Let’s dive into what the future holds for cross-border payments in 2026.

1. Real‑Time Payments Expand.

Domestic real‑time payment networks have matured, and cross‑border links are forming. SWIFT gpi routes most payments to destination banks within an hour, proving that instant settlement is feasible. Projects like Singapore’s PayNow linking to Thailand’s PromptPay and India’s UPI illustrate how regional corridors can make transfers fast and low‑cost.

Analysts estimate that connecting real‑time systems across countries could unlock tens of billions in economic output by improving cash‑flow visibility and reducing working‑capital needs. More such corridors may appear by 2026, putting instant settlement within reach for SMBs.

2. Digital Currencies and Blockchain Mature.

Central‑bank digital currencies (CBDCs) offer 24/7 settlements and lower fees. Only a few CBDCs have been launched, but pilots are proliferating. Permissioned blockchains let banks and businesses settle securely on a shared ledger without multiple intermediaries. As regulation and interoperability improve, digital currencies will complement traditional payment rails rather than replace them.

3. AI and Automation Streamline Operations.

Verifying payees, screening sanctions and reconciling invoices slow cross‑border payments. AI can automate these tasks, cutting processing times by up to 90 % and costs by 30–50 %. Machine‑learning models improve fraud detection by spotting unusual patterns in real time and support smarter FX hedging. As these tools mature, finance teams will spend less time on manual checks and more on strategy.

4. Costs Decline as Digital Remittances Soar.

The average cost of sending USD 200 fell to about 6.3 % and continues to decline. Consumers now prefer online transfers and prioritise security and low fees, driving demand for mobile apps that provide real‑time exchange rates and transparent pricing. Multi‑currency digital wallets will let SMBs pay suppliers and contractors abroad without correspondent banks.

5. Regulations Remain a Challenge.

Multiple payment systems and diverse regulatory regimes make compliance complex. International bodies like the G20 and FATF are pushing for streamlined frameworks, but harmonization takes time. Businesses need adaptable tools to automate screening and reporting across jurisdictions and stay current with changing sanctions lists and data‑localisation requirements.

6. Partnerships and Embedded Finance Lead Innovation.

Banks increasingly partner with fintechs to modernise cross‑border payments—surveys show about 62 % of banks collaborate with fintech providers. Embedded finance lets businesses build payment flows directly into their platforms, such as marketplaces paying sellers overseas without redirecting them to a third‑party site. Collaborations leveraging open‑banking data can simplify account verification and enable real‑time payouts, giving SMBs a seamless experience from invoicing to settlement.

How the International Payments App Helps SMBs Stay Ahead

OnlineCheckWriter.com – Powered by Zil Money’s International Payments App is designed to simplify international payments. From one app, users can send international payments instantly, with no pre-funding required. Multi‑currency accounts display live exchange rates and fees upfront, ensuring full transparency.

Live Status allows users to monitor the status of their payment from initiation to settlement. With this mobile-first concept, businesses can choose the most cost-effective method for each transaction. Bank-grade security and fraud detection further enhance the experience, ensuring payments are secure, compliant, and well-managed. The app offers the lowest transaction fee in the industry with no hidden charges.

Conclusion

Cross‑border payments are becoming routine for SMBs. With transaction volumes projected to soar and technology enabling near‑instant settlement, choosing the right partner is vital. The International Payments App combines speed, transparency, and compliance to simplify global transactions. Prepare for 2026—sign up today and streamline your international payments.

FAQs

How do instant cross‑border payments work?

Traditional transfers rely on chains of correspondent banks. International Payments App connects banks directly with block chain powered rails, so funds arrive within minutes.

How can I reduce international payment costs?

International Payments App shows exchange rates and fees before you send, avoiding hidden mark‑ups with the lowest transaction fee.

How can I ensure the security of international payments?

OnlineCheckWriter.com - Powered by Zil Money ensures payment security for this app with bank-grade encryption, multi-factor authentication and fraud detection. The platform is SOC 1, SOC 2, PCI DSS, and ISO certified, meeting global security standards.