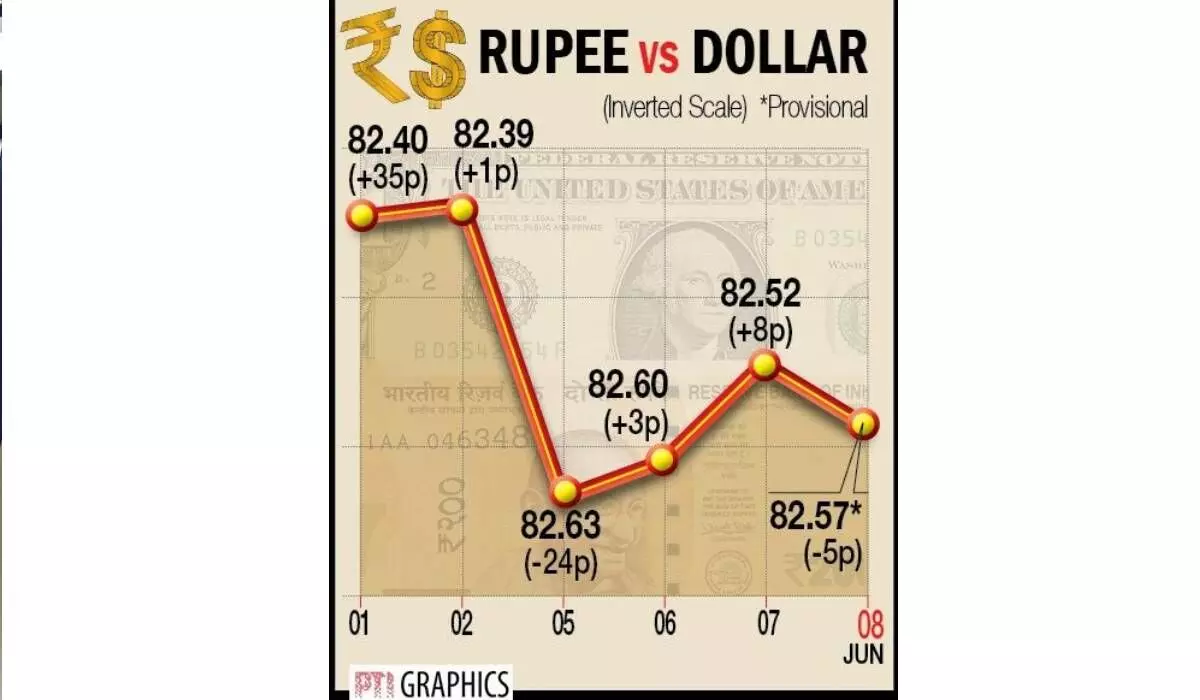

Re falls 5 paise on negative domestic trends

Closes at 82.57/USD after RBI opts a pause on rate hike

image for illustrative purpose

Mumbai The rupee fell 5 paise to close at 82.57 against the US dollar on Thursday, after the Reserve Bank kept the key interest rate unchanged.

At the interbank foreign exchange, the domestic unit opened at 82.59 against the dollar, and finally settled at 82.57, down 5 paise from its previous close amid a negative trend in domestic equities. During the day, the rupee touched a high of 82.53 and a low of 82.61 against the greenback as a weak dollar and softening of crude oil prices cushioned the downside. On Wednesday, the rupee had settled at 82.52 against the dollar. The Reserve Bank of India on Thursday opted for a pause second time in a row, maintaining key benchmark policy rate at 6.5 per cent citing moderate inflation. The central bank kept its GDP growth projections for the current fiscal (April 2023 to March 2024) unchanged at 6.5 per cent while marginally lowering the retail inflation expectation to 5.1 per cent from the previous 5.2 per cent. On rupee, RBI Governor Shaktikanta Das said the domestic unit has remained stable since January this year.

“We expect rupee to trade with a slight positive bias as the RBI governor's statement did not raise any major red flags for the Indian economy except some worries over El Nino and its impact on monsoon,” said Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas. “GDP and inflation projections along with a good rabi harvest augur well for the economy. However, any recovery in US dollar and weak global market sentiments may put downside pressure on rupee at higher levels,” Choudhary added. Traders may also remain cautious ahead of weekly unemployment claims from US. “We expect USDINR spot to trade in between 82.20 to 82.80 in the near-term,” Choudhary said.