Re declines for 2nd consecutive day

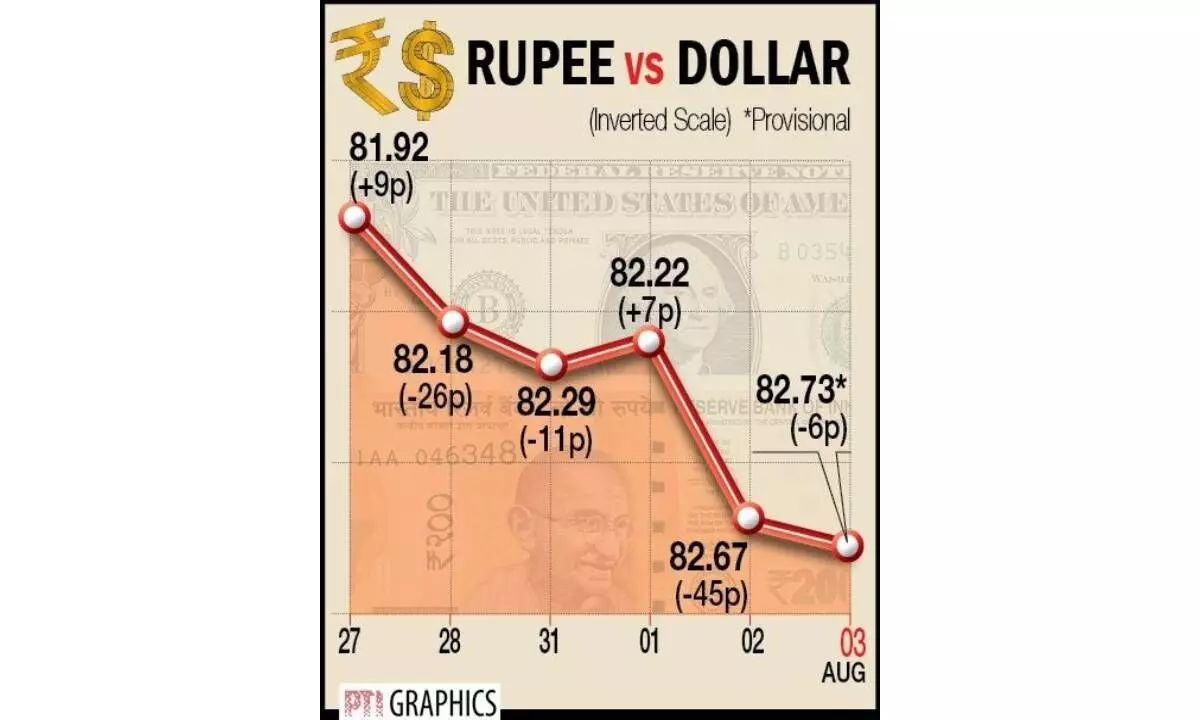

The rupee fell by 6 paise to settle at 82.73 against the US dollar on Thursday on weak domestic equities and a stronger greenback in the overseas market.

image for illustrative purpose

Mumbai The rupee fell by 6 paise to settle at 82.73 against the US dollar on Thursday on weak domestic equities and a stronger greenback in the overseas market.

Sustained foreign fund outflows and firm crude oil prices further dented sentiments, forex traders said. At the interbank foreign exchange, the domestic unit opened at 82.71 against the dollar and finally ended the day at 82.73, registering a fall of 6 paise from its previous close. During the session, the local unit touched a peak of 82.66 and hit the lowest level of 82.81. On Wednesday, the rupee had settled at 82.67 against the dollar. “US Dollar gained on safe-haven buying and upbeat jobs data. US ADP data released Wednesday was better-than-expected at 324,00 vs the forecast of 190,000, showing a strong jobs market,” Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas. However, upbeat domestic macroeconomic data from India cushioned the downside. India’s services sector growth touched a 13-year high in July. The seasonally adjusted S&P Global India Services PMI Business Activity Index rose from 58.5 in June to 62.3 in July, signaling the sharpest increase in output since June 2010. “We expect the rupee to trade with a negative bias as the strong dollar and risk aversion in global markets may continue to mount downside pressure on the rupee,” Choudhary said.