Uptrend continuation likely

If Nifty breaks below the recent base low with increased distribution days, we may get weaker signals; Till then, be with the confirmed uptrend with caution; If RSI closes above 69 on Monday, Nifty will test 18,604 level

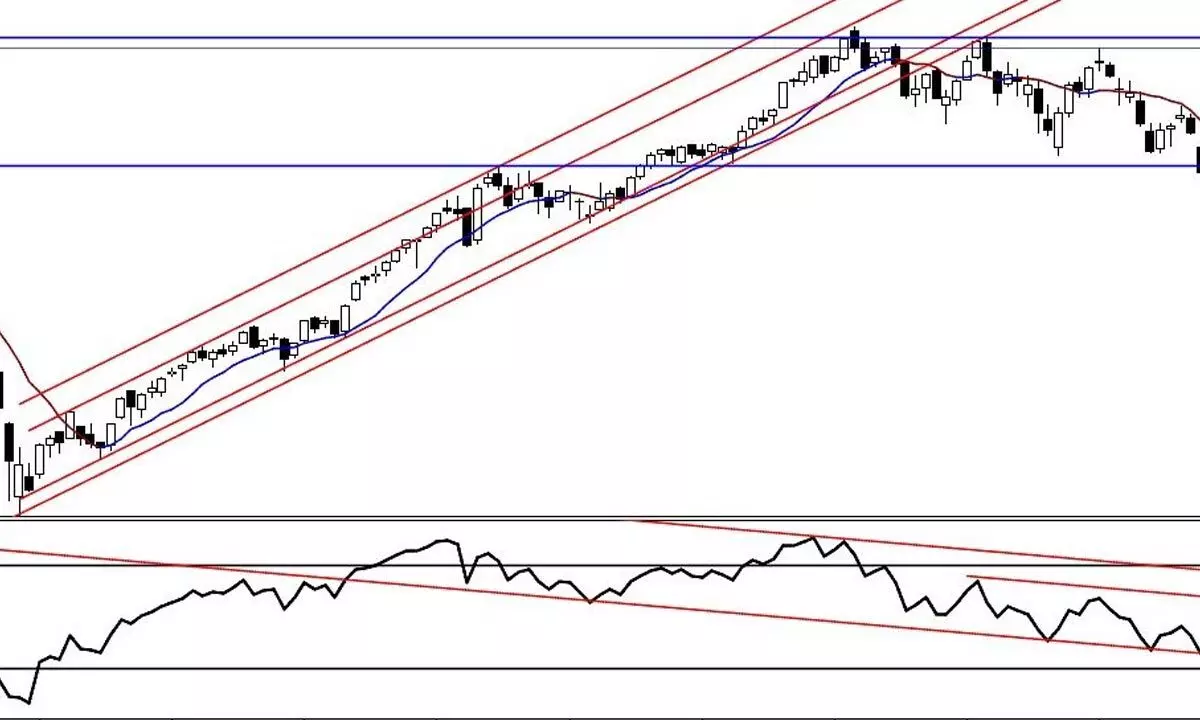

image for illustrative purpose

The domestic equity markets ended indecisiveness and broke out of the consolidation. The Benchmark Index Nifty gained by 205.1 points or 1.1 per cent, after an oscillation of 402 points. The BSE Sensex also gained by percentage points. The broader market indices-- The Nifty Midcap-100 and Smallcap-100 indices, gained by 2.2 per cent and 2.5 per cent, respectively. The Nifty Media and PSU Bank indices were the top gainers with 5.4 per cent and 5.2 per cent. The Nifty Energy is down by 1.5 per cent and Realty is down by 0.9 per cent. The India VIX was down by 7.35 per cent last week, and at the year low of 13.33, and it also tested 11.87 during the last week. FIIs turned into buyers for the last two days. In all, they bought Rs11,358.48 crores this month, and the DIIs sold Rs1,588.43 crore worth of equities.

The Nifty is at a new lifetime high close. After six days of tight-range consolidation, the breakout registered a strong volume on Thursday. On a weekly chart, it formed a bullish engulfing candle. In continuation of the trend, this engulfing pattern provides a clue for further upside. Though it formed a Hanging Man candle on Friday, it may not be a worry point for now. The Nifty is still above the breakout level, and there is no confirmed weakness in any time frame. All the short, medium, and long moving averages are in the uptrend.

Last Monday, the index registered a distribution day, and the bears failed to violate the key support. From Tuesday onwards, the index made the higher high candles and cleared the wavering moves with a strong breakout. It almost tested the 20DMA and 21EMA and bounced. Now, the support has raised to the 18,220 level. The previous bar low is at 18294, which is short-term support. Currently, the Nifty is trading 4.48 per cent above the 50DMA. As we expected last week, the index almost tested the 61.8 per cent extension of the prior swing. Next, if it closes above 18548, there is a possibility of Nifty closing above 18604. The next level of targets and resistances are 19034 and 19421. The recent pattern target is at 19660. For the short-term, these levels we can achieve in the most bull case scenario. On the downside, if the index closes below 19219 (20DMA), we may get the first signs of weakness. The recent base low of 18114 is strong support. Only below this level, we may expect a reversal sign.

The leading RSI indicator broke out of a flag pattern and was given strong uptrend possibilities. If the RSI closes above 69 on Monday, the Nifty will test the 18604. In the current structure, the RSI can test the 83-84 level, and the index may test the 19421, with the majority of probabilities. The MACD line is about move above the signal line for a fresh bullish signal. The ADX is also near a strong bullish zone.

The Bank Nifty and the PSU Bank indices are also stronger, as the Bank Nifty is at a new high, led by the rally in the PSU banks. The PSU bank index formed a bearish Shooting Star candle on Friday, which may lead to consolidation from now. The Bank Nifty is losing momentum and is near the weakening quadrant in the RRG charts. If this happens, the Nifty may face resistance around 18604 after hitting an all-time high. Friday's Hanging Man is the first caution for this. On the other side, the volumes have been declining since this began in September. The Advance-Decline ratio is not so great in this rally period. The RRG momentum is still oscillating around the 100 zone. The Nifty is in a confirmed uptrend with just one distribution day. Only if the Nifty breaks below the recent base low with increased distribution days we may get weaker signals. Till then, be with the confirmed uptrend with caution.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)