Time To Avoid Large Trading Positions

However, selective buying opportunities now emerging in sectors like infra, hospitality, pharma, materials, retail and telecom

Time To Avoid Large Trading Positions

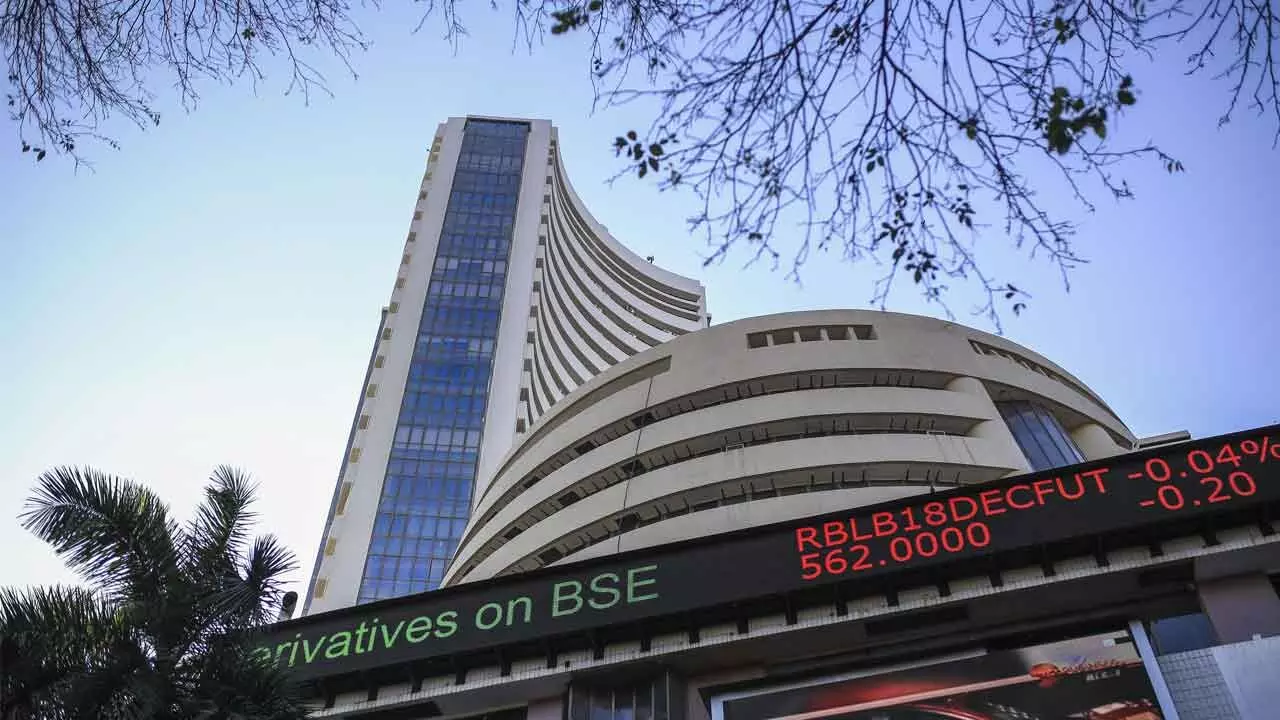

Despite persistent geopolitical tensions between India and Pakistan that continue to pressure market sentiment, positive earnings reports and optimism over a potential India-US trade deal have contributed to FIIs making net inflows last week, supporting a positive sentiment. For the week, BSE Sensex index jumped 1,289.46 points or 1.62 per cent to finish at 80,501.99 points, and NSE Nifty gained 307.35 points or 1.2 per cent to end at 24,346.70 points. Nervousness was visible in the broader market with the Mid-cap and Small-cap indices logging losses. Among sectors, the Nifty Oil & Gas index added 4.3 per cent, the Nifty Realty index rose 2.5 per cent, Nifty Auto, IT, and Healthcare indices rose one per cent each. However, the Nifty Media index shed 1.7 per cent and the Nifty Metal index shed 0.6 per cent. For the record, in the month of April, both the benchmark indices added 3.5 per cent each. It is pertinent to observe that in April, the advance-decline ratio for BSE-all listed stocks averaged 1.26—the highest level since June 2024—signalling a broad-based recovery across segments. This rebound follows a prolonged correction that began in late September 2024, during which the Sensex and Nifty fell over 14.7 per cent and 15.6 per cent respectively, while Mid and Small-cap indices saw steeper declines of 21.8 per cent and 24.48 per cent. FIIs and DIIs remained net buyers during the week, with net purchases of Rs10,071 crore and Rs9,270 crore, respectively. The Indian Rupee appreciated 1.06 per cent during the week, breaching the 84-per-dollar mark for the first time since October 2024. Near-term direction of the market will be dictated by geopolitical developments on Indo-Pak border, US Fed meet on May 7, macroeconomic data and remaining set of Q4 earnings. The trading range is expected to be much wider than usual; avoid large trading positions. Market observers see a picture of global financial systems approaching an inflexion point, stirred not just by economic forces, but political ones, especially in the US. Bitcoin, often dismissed as a speculative play, is gaining favour among risk-tolerant investors in light of geopolitical uncertainty. Selective buying opportunities are now emerging in sectors like infrastructure, hospitality, pharmaceuticals, materials, retail, and telecom.

Five Warren Buffett quips and anecdotes from Warren Buffett’s 2025 Berkshire Annual Meeting:

1. Buffett’s Longevity Secret: Coke, not crunches

Holding two cans of Coca-Cola on stage, Buffett poked fun at his famously unconventional diet and exercise habits. “At 94 years of age, I’ve been able to drink whatever I like and do what I want—and I’ve defied all the predictions of what should’ve happened to me.”

He added that he and his late partner Charlie Munger preserved themselves by skipping the gym rather than hitting it.

2. Charlie’s hypothetical sex change for longevity

Buffett didn’t miss a chance to joke about mortality—and Charlie Munger. “Once you get to 115, it’s almost a cinch you’re going to die. Especially, if you’re male. All the records are held by females. I even tried to get Charlie to have a sex change so he could touch the top. And he did pretty well for being a male.”

3. No exercise mantra!

“If you look at the career span of athletes, you might decide it’s better not to be on a baseball or basketball team. Charlie and I never exercised much—we just focused on preserving ourselves.”

4. On grooming his successor (or not)

Whether if he was holding off on investing so his successor, Greg Abel, could shine later, Buffett deadpanned: “I wouldn’t do anything nearly so noble as to withhold investing myself just so that Greg could look good later on.”

5. Buffett’s quip for being born lucky

“The luckiest day in my life was the day I was born in the US If I were being born today, I’d just keep negotiating in the womb until they said I could be in the US.”

You are an investor, not someone who can predict the future. Base your decisions on real facts and analysis rather than risky, speculative forecasts.

F&O/ SECTOR WATCH

Tracking the cash markets, derivatives segment continued to witness strong stock-specific moves. It is pertinent to observe that RIL was primarily responsible for the resilience of the market in the last week. In the derivatives market, prominent Call Open Interest for Nifty seen at the 24,500 and 25,000 strikes, while the notable Put OI was at the 24,000 strike. For Bank Nifty, the prominent Call OI was seen at the 55,500 strike, whereas notable Put OI is at the 55,000 strike. Implied Volatility (IV) for Nifty’s Call options settled at 16.19 per cent, while Put options conclude at 17.12 per cent. The India VIX, a key market volatility indicator, closed the week at 18.22 per cent. The Put-Call Ratio of Open Interest (PCR OI) for the week was 1.56. The geopolitical tensions between India and Pakistan remain ingrained in the market behaviour; the rise in VIX shows increased hedging activity by the market participants. Technical indicators suggest that the market is showing signs of tiredness, foretelling potential consolidation at higher levels. Traders are advised to closely monitor position build-up during the week, as it could further drive market movement. Cautious approach is recommended. The next significant resistance for the Nifty lies at 24,540. A volume breakout above 24,500 could push it toward 24,800, followed by 25,200 in the short term. On the downside, immediate support is seen at 24,200. A break below this level could lead to a slide toward the next support at 23,850.

Stocks looking good are Godrej Consumer, HDFC Life, ITC, IGL, PNB Hsg, SBI Life and PI Inds. Stocks looking weakare ACC, Bajaj Finance, Exide Inds, IOC, Glenmark, Tata Tech and PFC.

(The author is a senior maket analyst and former vice- chairman, Andhra Pradesh State Planning Board)

STOCK PICKS

Lumax Auto Technologies Ltd

Lumax Auto Technologies Ltd is a manufacturer and supplier of automotive moulded and fabricated parts, emission and transmission systems for the automotive industry. The company specializes in designing, testing and manufacturing of gear shifters and interior solutions. The company has a diversified product portfolio, which comprises integrated plastic modules, two-wheeler chassis, two- and three-wheeler lighting, gear shifters, transmission products, emission systems, seat structures, telematics products and services, oxygen sensors, and on-board antennas, electric devices and components, and aftermarket solutions. This portfolio further encompasses vehicle interior systems and components. The Company has approximately 23 manufacturing plants across India. The company along with its subsidiaries has evolved from a lighting focussed business to a diversified auto component supplier with a wide customer base and product mix. Its steady expansion into high value components, EV-ready products, and electronics through joint ventures and partnerships shows company’s alignment with long term industry trends. The volatility due to tariffs would not have much impact on the business of the company. Buy on declines for medium-term price target of Rs750.