Niftys' evening star candle signals further bearishness

The index forms higher high, higher low candles on charts

image for illustrative purpose

On a low-volume day, the benchmark indices closed flat to a negative note. The NSE Nifty closed at 17314.65 with just 17.15 points decline. All the sectoral indices registered less than a half per cent gains or declines. The CPSE index gained by 0.60 per cent, and the FMCG index declined by 0.64 per cent, which are top gainers and losers. All other indices not registered any significant changes. The market breadth is positive as 1015 advances and 875 declines. About 60 stocks hit a new 52-week high, and 88 stocks traded in the upper circuit. Titan, Zomato, and HDFC Bank were the top trading counters on Friday in terms of value.

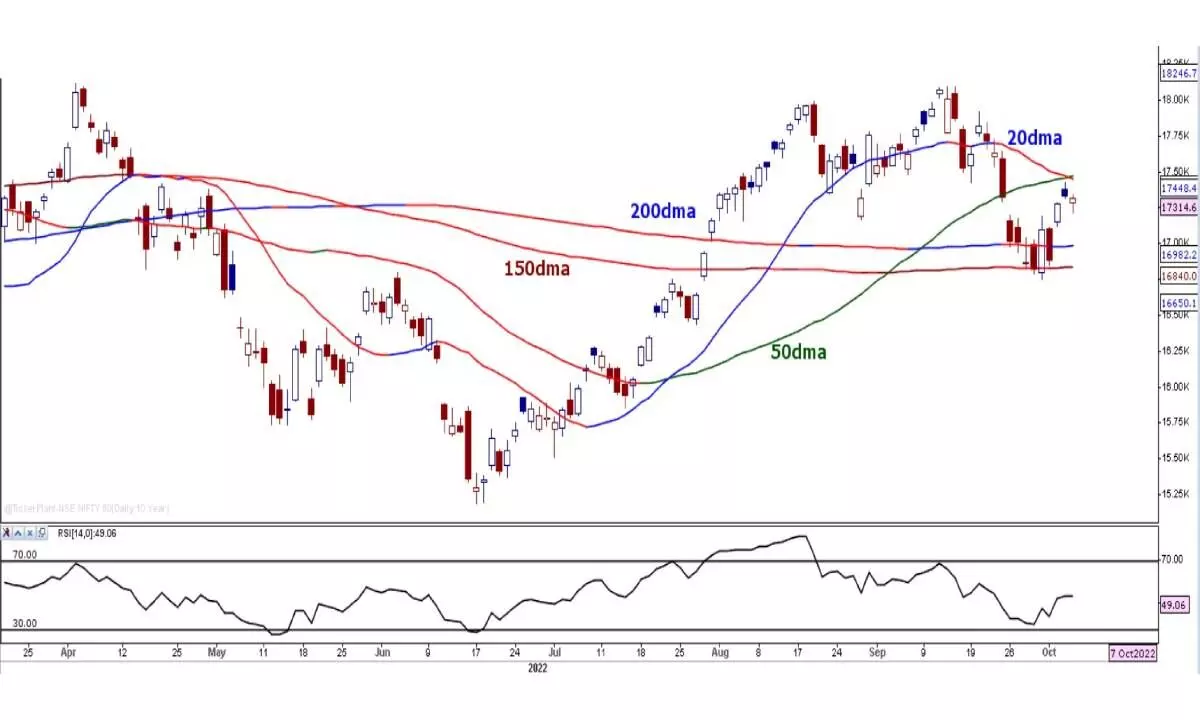

The Nifty closed flat on the weekend in an increasingly volatile session. It ended above the previous week's high, which is a positive development. It also formed higher high and higher low candles. It just closed above the 23.6 per cent retracement level of the prior downtrend. The index recovered by 100 points from the day's low. The Nifty is still below the 10-week average (17505). Another important technical development on Friday is that Thursday's evening star candle got the bearish confirmations by closing below it.

Overall, the volume declining for the last four sessions. Interestingly, the index closed flat on a negative breadth, as 29 stocks of Nifty 50 declined. The 20DMA cross under the 50DMA is a negative for the short-term. The 150 and 200 DMAs were flattened. The RSI is below the 50 zone, and the MACD histogram is neutral. The Nifty has moved above the 50 and 20 DMA or a decisive close above the 17500 level for a bullish direction. In any case, the Nifty closes negatively on Monday, and it can test the 200 DMA of 16982. For next week this 16982-17500 zone will be crucial for direction. For now, the index is in a neutral zone. As the earnings season kicks off next week, focus on high-growth stocks.