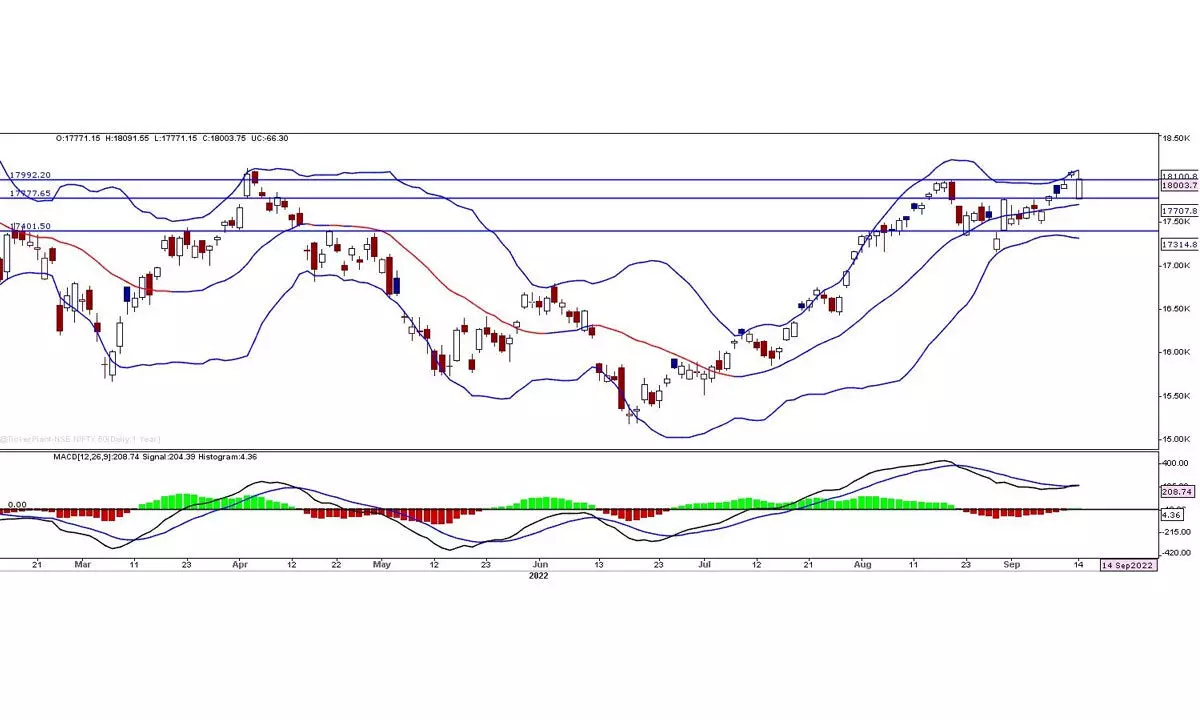

Nifty forms higher high, higher low candles

The global market meltdown did not influence the domestic market. Except euphoric lower opening and the sharp decline in the IT sector index, there is nothing change in the market.

image for illustrative purpose

The global market meltdown did not influence the domestic market. Except euphoric lower opening and the sharp decline in the IT sector index, there is nothing change in the market. The Nifty recovered 300 points from the day's low. It closed with just 66.30 points or 0.37 per cent negative and ended at 18004.75. As the psychological 18000 level is protected for the day. The Nifty IT is the top loser with 3.36 per cent. And the Bank Nifty is up by 1.30 per cent.

The Metal and FinNifty are up by 1.58 per cent and 0.75 per cent. The other sector indices limited their gains and losses to less than one per cent. The market breadth is negative as 1133 declines and 764 advances. About 104 stocks hit a new 52-week high, and 104 stocks traded in the upper circuit. Ambuja Cement, Infosys, and Vedanta were the top trading counters today in terms of value.

The domestic benchmark indices dramatically recovered from the opening lows. It opened exactly at the prior breakout level of 17,770 and formed a low open candle. During the day, the Nifty moved above the prior day's high and closed marginally lower. Except for the last hour bar, it formed higher high and higher low candles. It declined by 100 points in the last hour, forming a negative divergence. The Bank Nifty led the recovery rally today. It gained almost 1400 points from the day low. The PSU Bank index rose by 1.74 per cent. With the sharp decline in the IT index, our market ended in the red.

The only concern now is that the index closed below the previous day's low. With this, the MACD histogram flattened. The RSI is still in the strong bullish zone. The Nifty closed above the breakout level means there are weak signs available. Other than weak and gap-down openings, technically, there is no change in directional bias. As the weekly expiry is on the cards, some covering trades may influence the trading, and volatility may increase. In any case, after the first hour, trading below 18,000 is negative, and it can test 17,900 points. The current weekly close will determine the near-term direction.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)