Markets Stay Cautious as Investors Await Key Jobs and Inflation Reports

Stocks finished mixed Monday as the S&P 500 advanced powered by gains in technology shares.

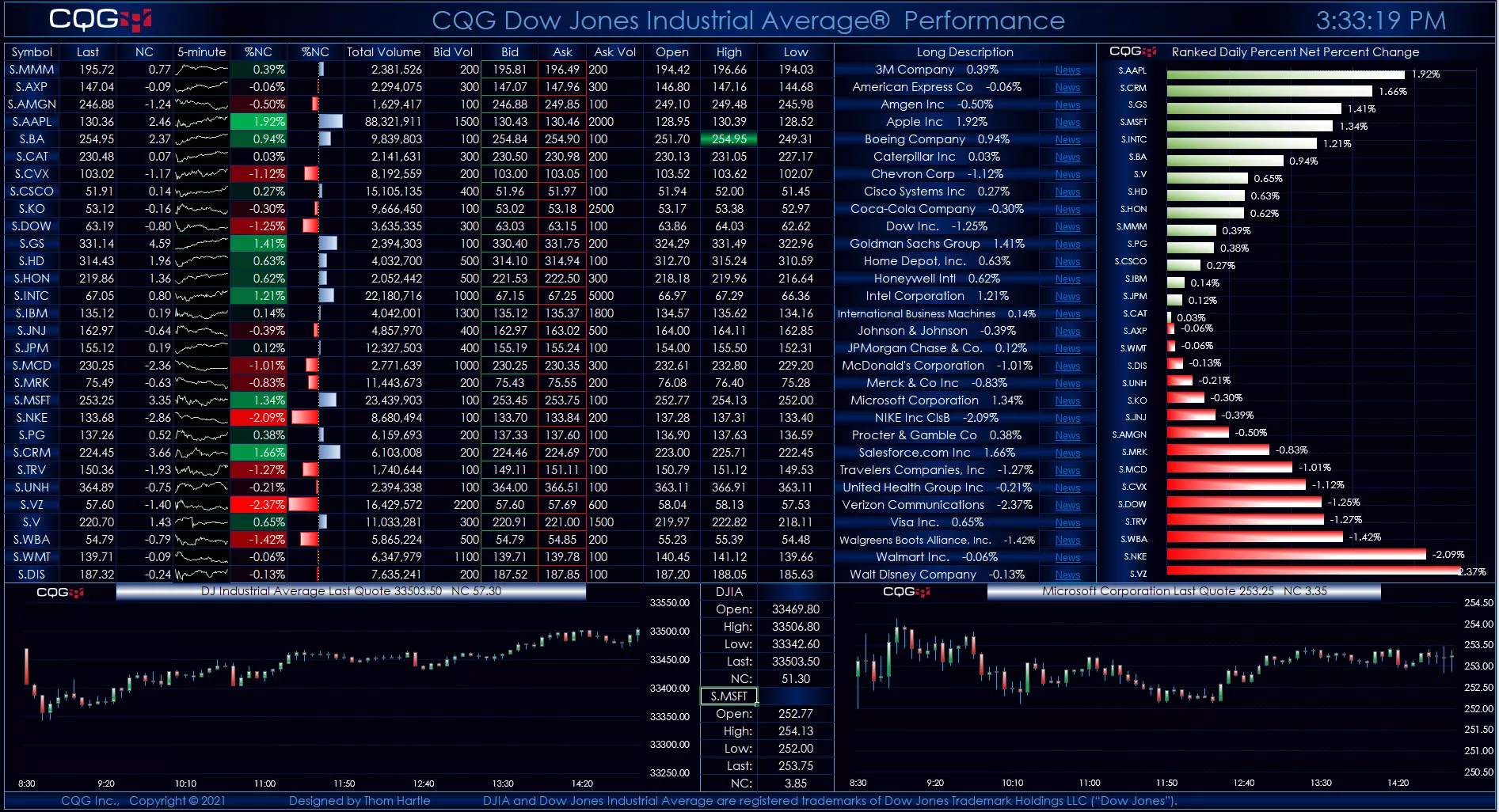

Wall Street trading session showing the Dow Jones reaching a record high as technology and AI-linked stocks drive market optimism.

The Dow Jones Industrial Average closed at an all-time high as investors look forward to key

economic data alongside another wave of corporate earnings after a choppy week for equities

that ended with the 30-stock average hitting a major benchmark.

The broad index gained for the second consecutive day, adding 0.47% to close at 6,964.82. The

blue-chip Dow added 20.20 points or 0.04% to close at 50,135.87. The Dow Industrials recorded

an intraday all-time high and closing high. S&P 500 and Nasdaq futures slip 0.9% to close at

23,238.67.

Nvidiaand Broadcom were big gainers once again Monday, building on Friday’s rally and

climbing 2.5% and 3.3%, respectively. Oracle also saw its stock climb 9.6% on an upgrade to

buy from neutral at D.A. Davidson as optimism around OpenAI and winners from the AI race

continue.

Shares recovers after last week’s losses. The Dow tops 50,000 milestone for the first time in

history Friday after tumbling at the start of the week. Inflation (CPI) report anticipation was led

by technology shares, particularly software. Bitcoin also took a nosedive Friday but trimmed its

losses during Monday’s session.

The chipmaker issued guidance for Q4 revenue and earnings that fell mostly in line with analyst

estimates. Demand for its chips that help manage power consumption at artificial intelligence

data centers has helped buoy the company’s sales, offsetting weak demand for electric vehicles

in North America and Europe that has impacted automotive chip spending on its silicon carbide

chips.