Markets eke out slim gains amid Covid-19 resurgence

Sensex zooms 84 pts, Nifty inches 55 pts; metal, IT stocks sparkle

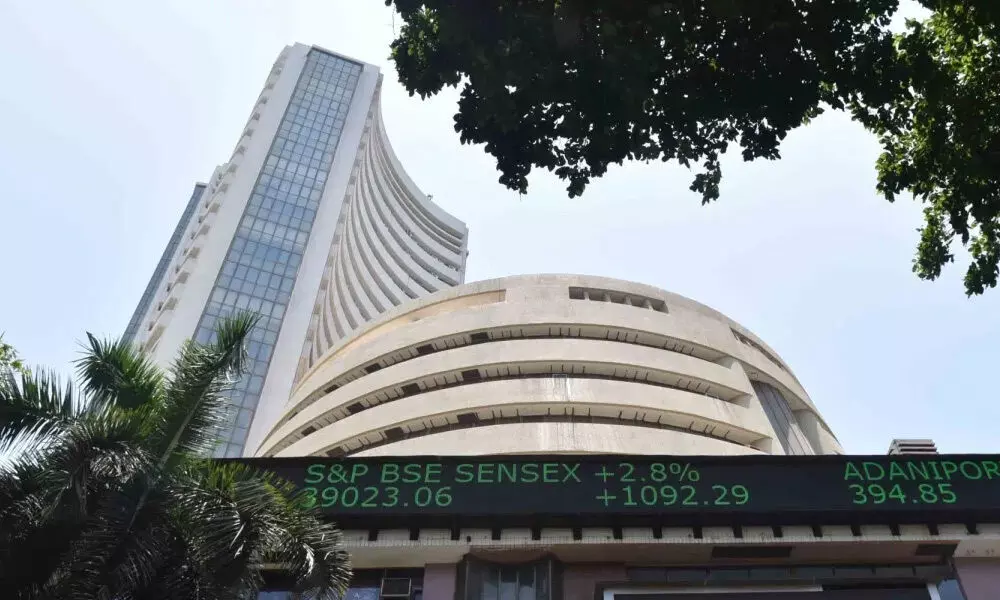

image for illustrative purpose

Mumbai: The BSE Sensex gave up early gains but managed to close in the green on Thursday as concerns over rising coronavirus infections and resultant restrictions across the country kept investors on the edge.

A depreciating trend in the rupee also weighed on risk sentiment, traders said. Rising for the third session on the trot, the 30-share BSE benchmark settled 84.45 points or 0.17 per cent higher at 49,746.21.

The broader NSE Nifty advanced 54.75 points or 0.37 per cent to 14,873.80. UltraTech Cement was the top performer among the Sensex constituents, rallying 4.24 per cent, followed by Titan, Tech Mahindra, Nestle India, TCS, Bajaj Finserv and L&T. On the other hand, IndusInd Bank, ONGC, Sun Pharma, Bajaj Auto, HDFC Bank and Axis Bank were among the laggards, slipping up to 1.07 per cent. Domestic market continued its optimistic rally supported by dovish monetary policy, though it witnessed consolidation during the second half due to selling in banking stocks.

"Metal stocks led the sectorial rally on a strong outlook supported by rising steel prices and production. Q4 earnings season has started and the market is expected to have a stock-centric rally in the coming days which has a very broad positive view," said Vinod Nair, Head of Research at Geojit Financial Services.

Sectorally, BSE metal, basic materials, consumer durables, industrials, IT and teck rallied as much as 4.44 per cent, while power, utilities, bankex and finance indices fell up to 1.04 per cent. Broader BSE midcap and smallcap indices climbed up to 0.73 per cent. Domestic equities, despite trading positively for most of the session, gave up a large portion of gains towards the end of the day as concerns of rising Covid-19 cases continued to weigh on investor sentiment, said Binod Modi, Head-Strategy at Reliance Securities. "Expectations of steady 4Q FY21 earnings and weakening INR continued to attract investors' interest towards IT stocks," he added. Global markets remained buoyant after minutes of the US Federal Reserve's last policy meeting reiterated the central bank's dovish outlook. Elsewhere in Asia, bourses in Shanghai, Hong Kong and Seoul ended on a positive note, while Tokyo was in the red. Stock exchanges in Europe were largely trading with gains in mid-session deals. Meanwhile, the global oil benchmark Brent crude was trading 0.44 per cent lower at $62.88 per barrel.