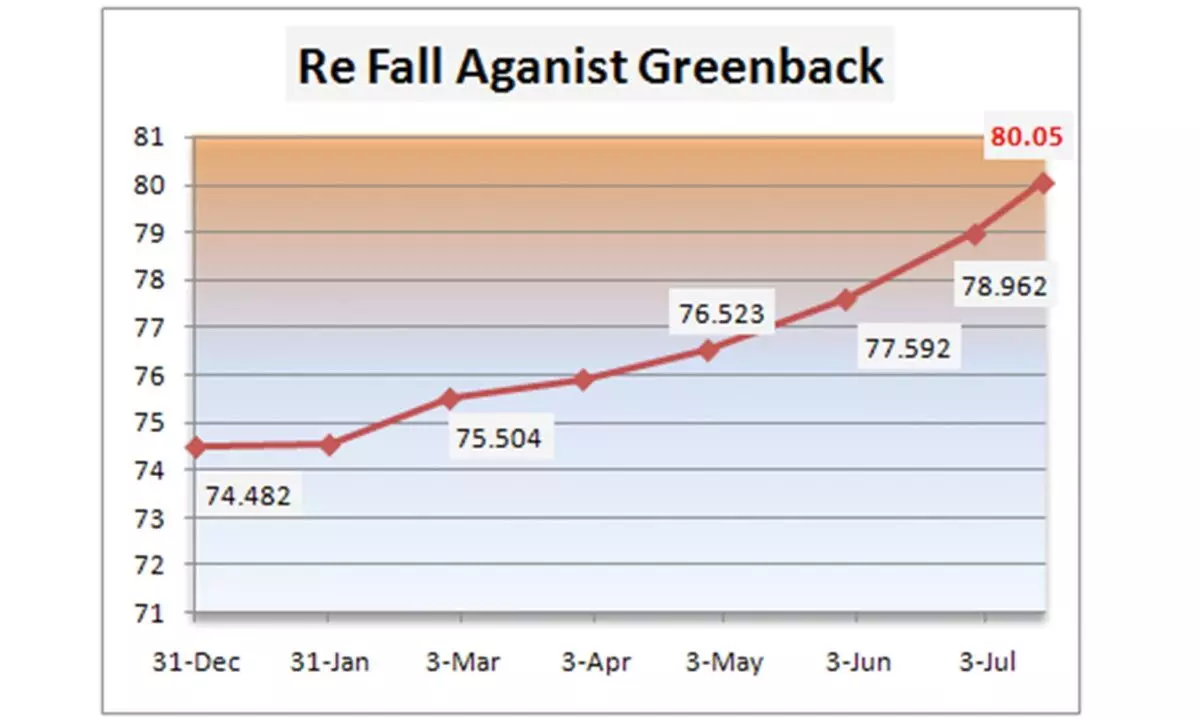

Rupee breaches 80 mark

Hits intra-day low of 80.05 before recovering to 79.92 against $; Near-term consolidation likely along with the dollar index ahead of ECB and Bank of Japan policy meetings on Thursday

image for illustrative purpose

Rupee breaches 80 mark

- Russia-Ukraine war has also impacted

- RBI's intervention saves the day

Mumbai: The Indian rupee finally breached Rs 80 mark against US dollar and slipped to its all-time low of 80.05 to close six paise higher at 79.92 on Tuesday, tracking its regional peers and a positive trend in domestic equities. The fall in rupee's value is owing to multiple factors like Russia-Ukraine war, outflow of foreign institutional investors, tightening of global liquidity, higher crude oil prices and others. Experts also said though the rupee has depreciated against the dollar, it has appreciated against other currencies like Euro, GBP and Yen.

At the interbank forex market, the local unit opened lower at 80.00 against the greenback and fell further to an intra-day low of 80.05. The local unit recouped losses later and settled at 79.92, registering a rise of 6 paise over its previous close. On Monday, the rupee for the first time declined close to the level of 80 against the US dollar in intra-day spot trading before ending the session 16 paise lower at 79.98 amid a surge in crude oil prices and unrelenting foreign fund outflows.

"The Indian rupee broke the level of 80 after many days' failed efforts by the dollar bulls amid higher crude oil prices. However, the central bank's intervention and stronger regional currencies and equities supported the rupee to erase early morning losses," said Dilip Parmar, research analyst, HDFC Securities.

The Indian rupee broke the level of 80 after many days' failed efforts by the dollar bulls amid higher crude oil prices. However, the central bank's intervention and stronger regional currencies and equities supported the rupee to erase early morning losses

-Dilip Parmar, Research Analyst, HDFC Securities