Rollovers drop, premiums surge: Volatility heats up in derivatives play

Options traders recalibrate as OI concentrations and high IV suggest tactical shifts, and Bank Nifty outshines broader indices amid sector rotation

Rollovers drop, premiums surge: Volatility heats up in derivatives play

The support level remained at 25,500PE for the third consecutive week, while the resistance level hovering at 26,000CE for two weeks in a row, as per the latest options data on NSE after the last Friday session. Considering this, the market appears range-bound in the 25,500-26,000 zone.

The 26,000CE has highest Call OI followed by 25,900/26,100/26,500/26,700/ 25,800/ 25,950/26,150/ 26,600/ 26,700 strikes, while 25,800/25,900/26,000/26,100/ 26,500/26,700 strikes recorded heavy build-up of Call OI. Call Out-of-the-Money (OTM) strikes 26,850/26,900/27,250/ 27,450/ 27,650 strikes had marginal OI fall. OTM Calls indicating traders are unwinding or taking profits due to lower probability of being breached, hinting at limited strong upside momentum above these levels.

Call In-the-Money (ITM) strikes from 25,400 inwards witnessed minute OI fall, which could imply some unwinding, but not a strong bullish action, since ITM calls are usually exercised when strong upside is expected. The small fall shows lack of aggressive bullish bets ITM.

Coming to the Put side, maximum Put OI is visible at 25,500PE followed by 25,700/ 25,800/ 25,400/ 25,100/ 25,900/ 24,800/ 25,000 strikes. Further, 25,000/ 25,700/25,750/ 25,800 strikes witnessed reasonable addition of Put OI. Put ITM strikes in 25,850 inwards recorded modest OI fall.

Few Put OTM strikes too hold minute drop in OI. Dhirender Singh Bisht, Associate Vice-President (Technical Research – Equity), SMC Global Securities Ltd, said: |In the derivatives segment, the highest Call Open Interest for Nifty was observed at the 26,000 and 25,900 strike levels, whereas notable Put Open Interest was concentrated at the 25,800 and 25,700 strikes.

For Bank Nifty, significant Call open interest was seen at the 58,000 strike, with substantial Put open interest at the 58,000 strike.”

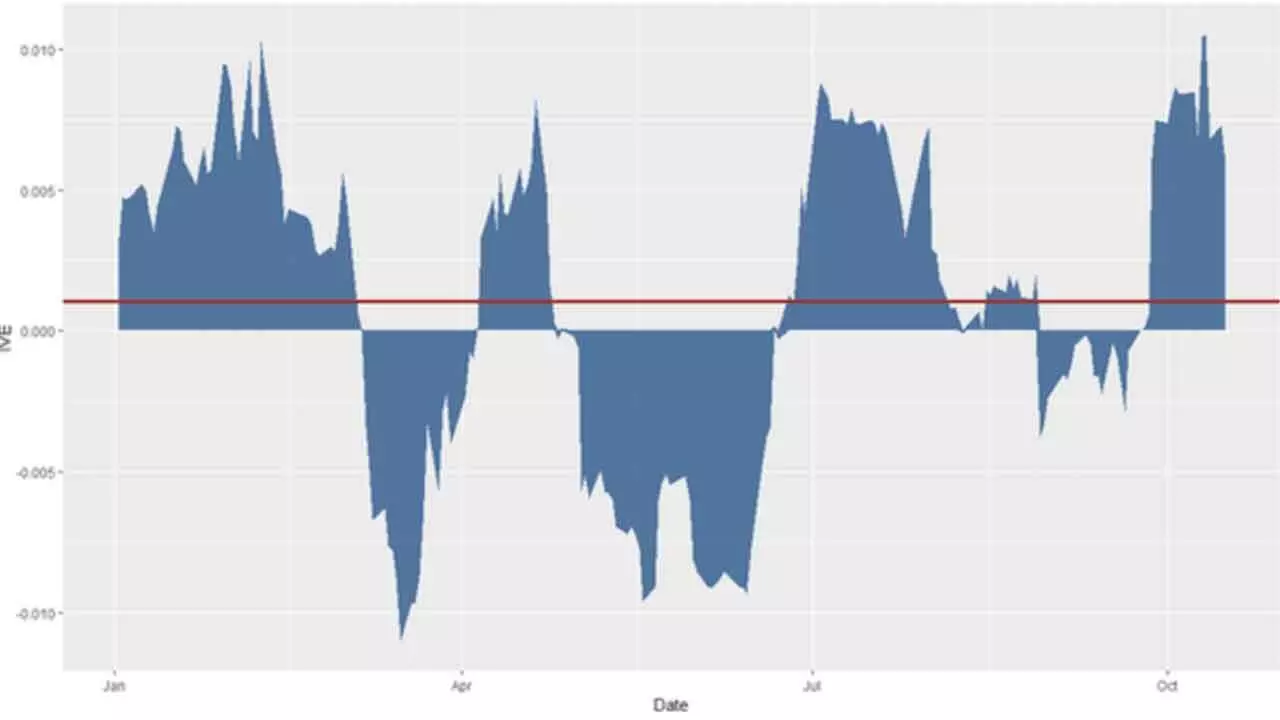

The Implied Volatility (IV) at Call higher OI base rose about 50 per cent and 25 per cent at higher Put OI concentration. Such an increase in IV often leads to elevated option premiums and may prompt traders to recalibrate their hedging positions in anticipation of larger market swings.

“Nifty rollovers declined to 75.79 per cent, compared to 82.60 per cent in the previous month and below the three-month average of 80.64 per cent, indicating a loss of momentum heading into the November series.

Bank Nifty rollovers stood slightly higher at 79.57 per cent, versus 78.45 per cent last month, and were broadly in line with the three-month average of 79.11 per cent, reflecting an adequate carryover of positions.

For Nifty, the majority of rollovers were observed in the 26,000–26,050 futures range, while Bank Nifty rollovers were concentrated between 58,100–58,200,” said Bisht.

“Bank Nifty outperformed the broader indices, closing the week in positive territory, while the Nifty declined by around a quarter of a percent on the weekly chart. However, on a monthly basis, the Nifty recorded its second-highest gain of the year.

The recent market rally was primarily driven by the US Federal Reserve’s rate cut and expectations of an easing in US-China trade tariffs. Toward the end of the week, markets witnessed some correction after Fed Chair Jerome Powell indicated that no further rate cuts are likely this year due to insufficient supporting data.

Sector-wise, PSU Banks, Metals and Oil & Gas stocks led the gains while Auto, Healthcare and Capital Market sectors ended the week in negative territory, added Bisht.

For the week ended October 31, 2025, BSE Sensex closed at 83,938.71 points, a marginal loss of 273.17 points or 0.32 per cent, from the previous week’s (October 24) closing of 84,211.88 points. NSE Nifty too edged down by 73.05 points or 0.28 per cent to 25,722.10 points from 25,795.15points a week ago.

Bisht forecasts: “Currently, Nifty is trading below its rollover zone and sustained weakness at these levels could lead to further downside pressure. Nifty’s immediate support is placed in the range of 25,500–25,400 range, while resistance is seen around 26,000–26,200.”

India VIX rose 0.70 per cent to 12.15 level. “Implied Volatility for Nifty’s Call options settled at 10.84 per cent, while Put options concluded at 11.89 per cent. The India VIX, a key indicator of market volatility, concluded the week at 12.06 per cent.

The Put-Call Ratio of Open Interest stood at 1.14 for the week,” remarked Bisht. Thought FIIs were sellers in the F&O September series, their selling pressure eased in October. FIIs sold nearly 19,000 crore in the September. In October, foreign funds turned net buyer with the tune of 21,000 crore so far. Domestic institutions deployed significant sum as they poured over 45,000 crore each in September and October.

Bank Nifty

Bank Nifty, NSE’s banking index, closed the week at 57,776.35 points, up 76.75 points or 0.13 per cent from the previous week’s closing of 57,699.60 points. “For Bank Nifty, significant Call Open Interest was seen at the 58,000 strike, with substantial Put Open Interest at the 57,000 strike,” said Bisht.