Robinhood traders in US get a Chinese lesson

Covid-19 has awoken an army of retail investors

image for illustrative purpose

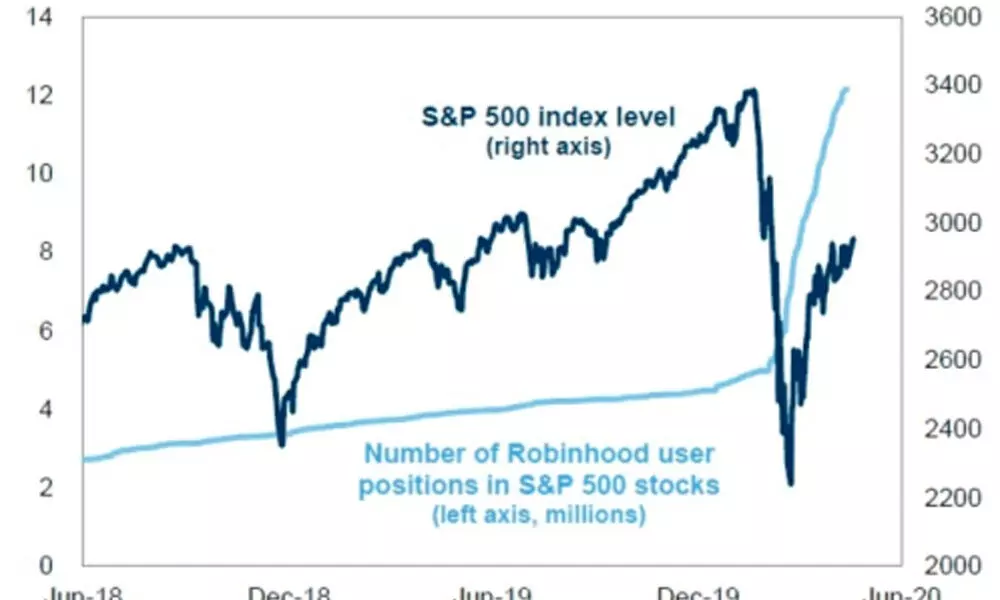

Covid-19 has awoken an army of retail investors. They now account for a fifth of the United States stock market's volume, doubling their presence from a decade earlier. Day traders are even dabbling in exotic products, from thematic exchange-traded funds to short-dated call options on Big Tech stocks.

This is a remarkable shift in market composition. Judging by turnover, leverage deployed and new account openings at online brokerages such as Robinhood Markets Inc., the United States is starting to resemble China, where retail investors can account for as much as 80 per cent of total trading.

Money managers may not like this frenzy, because they're no longer in the driver's seat and don't always understand the market's dynamics. But higher retail participation is a good thing overall, especially since passive funds have already surpassed active ones in total assets under management. Day traders sifting through online chat rooms make pricing more efficient.

Take China, for example. Despite its reputation for exuberant turnover, the mainland market can be surprisingly rational. What drove stock returns most over the past three years has been earnings revisions, followed by profitability and momentum, Bloomberg's factor analysis shows. Chinese investors also pay attention to what equity analysts have to say. If you constructed an equally weighted portfolio, buying the top 20th percentile of stocks that had the most positive changes in target prices, while shorting the bottom 20th percentile, you would earn more than a 60 per cent cumulative return over three years.

The same can't be said in the United States, where money managers overwhelmingly chased growth stocks, tossing aside important financial signals that China's day traders valued, such as earnings revisions or the health of a company's balance sheet. This might explain why the mainland stock market was more resilient during the global selloff in March. Back then, cash was king.

One concern is that retail fervor could overheat things. Back in 2015, China's mom-and-pop investors generated a gravity-defying bubble, doubling the blue-chip CSI 300 Index in just eight months, before an equally furious tumble.

In 2020, their American peers have made a good run for it too, with the S&P 500 up over 60 per cent from its March low.

But fear not, there isn't enough evidence to suggest this will all end in tears. Every week since 1987, the American Investor Sentiment Survey has been asking retail traders the same simple question: How they feel the stock market will be over the next six months - bullish, neutral or bearish.

There have been 115 times when the bull-bear spread exceeded 25 per cent - that is, when respondents have been overwhelmingly bullish - with the latest in November, according to CLSA Ltd. Looking at the S&P's performance 10 to 90 days after these episodes, such enthusiasm hasn't been an indicator of the market topping, the brokerage finds. In fact, on average, stocks were up 1.6 per cent three months later. Only a third of these occurrences ended up with negative returns. (Bloomberg)