Re flat in cautious trading

image for illustrative purpose

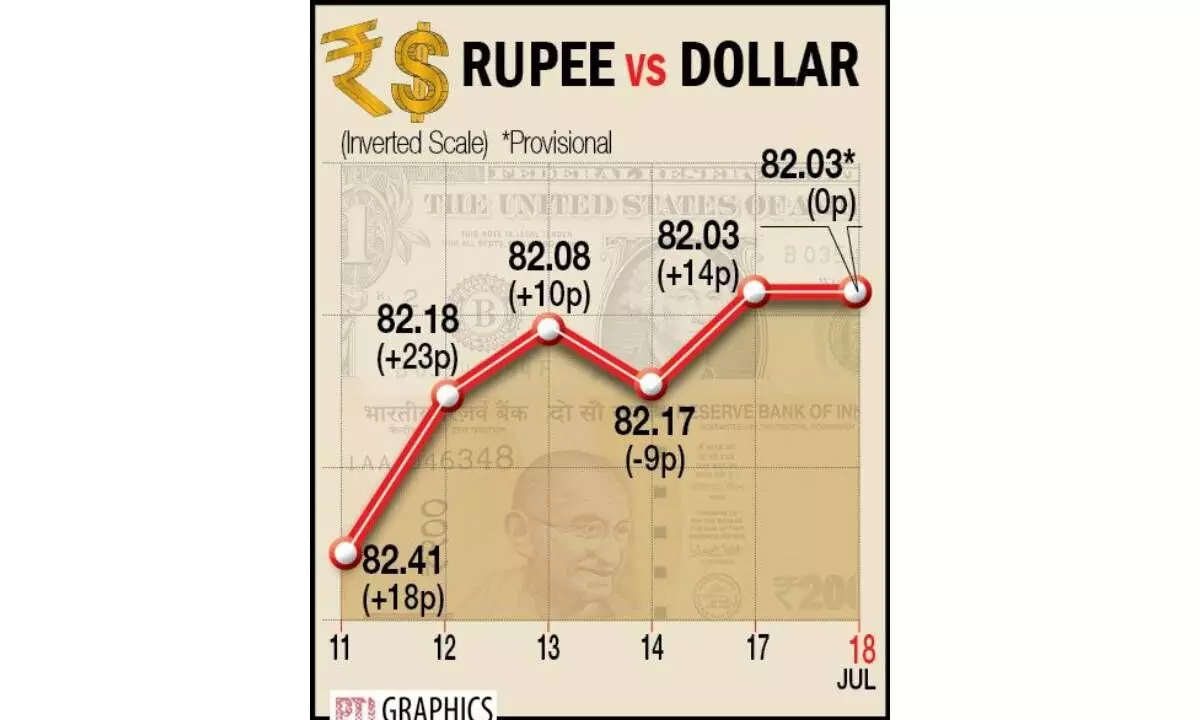

Mumbai: The rupee consolidated in a narrow range and settled flat at 82.03 (provisional) against the US dollar on Tuesday, as the support from positive domestic equities and weak American currency was negated by rising crude oil prices. Market participants remained cautious ahead of retail sales data from the US and the UK’s inflation data this week, forex traders said. At the interbank foreign exchange market, the rupee opened at 82.01 against the US dollar and finally settled at 82.03 (provisional), unchanged from its previous close. During the session, the domestic unit witnessed an intra-day high of 81.97 and a low of 82.07.

In the previous session on Monday, the rupee had closed at 82.03 against the dollar. The rupee traded with a slight positive bias on a soft dollar and bullish domestic markets. Domestic markets hit new record highs which boosted the local currency. The US dollar has declined to a 15-month low on rising expectations of just one more rate hike by the US Federal Reserve as inflation declined more than forecast.

“We expect the rupee to trade with a slight positive bias on account of strength in domestic markets and a weak greenback. Sustained foreign inflows may also support rupee,” said Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas.