Nifty’s Open Interest maps path for upside move

Call and Put OI positions spotlight support and resistance; FIIs’ futures play and volatility trends may fuel bullish momentum

Nifty’s Open Interest maps path for upside move

The latest options data on NSE after last Friday’s session points to a 500-point rise in the resistance level to 26,500CE, while the support level remained at 25,500PE for the second consecutive week.

The 26,500CE has the highest Call open interest, followed by 27,000/ 26,000 / 26,100 / 25,900/ 25,800/ 26,300/ 26,400/ 26,800/ and 26,900 strikes. Meanwhile, the 26,000/ 26,500/ 25,900/ 25,850/ 25,950, and 26,100 strikes recorded a reasonable to heavy addition of Call open interest. Marginal Call open interest decline is visible from ITM strikes, starting at 25,600CE.

On the Put side, maximum open interest is seen at 25,500PE, followed by 25,000/ 25,700/ 25,400/ 24,800/ 24,700/ 25,200/ 25,750/ 25,800/ 25,900/ 24,600 strikes. Further, 25,700/ 25,750/ 25,500 and 25,550 witnessed moderate build-up of Put open interest. Deep OTM Put strikes from 25,350 and select others showed marginal to reasonable drop in open interest, while ITM Put strikes from 25,850PE onwards also posted a modest decline in open interest.

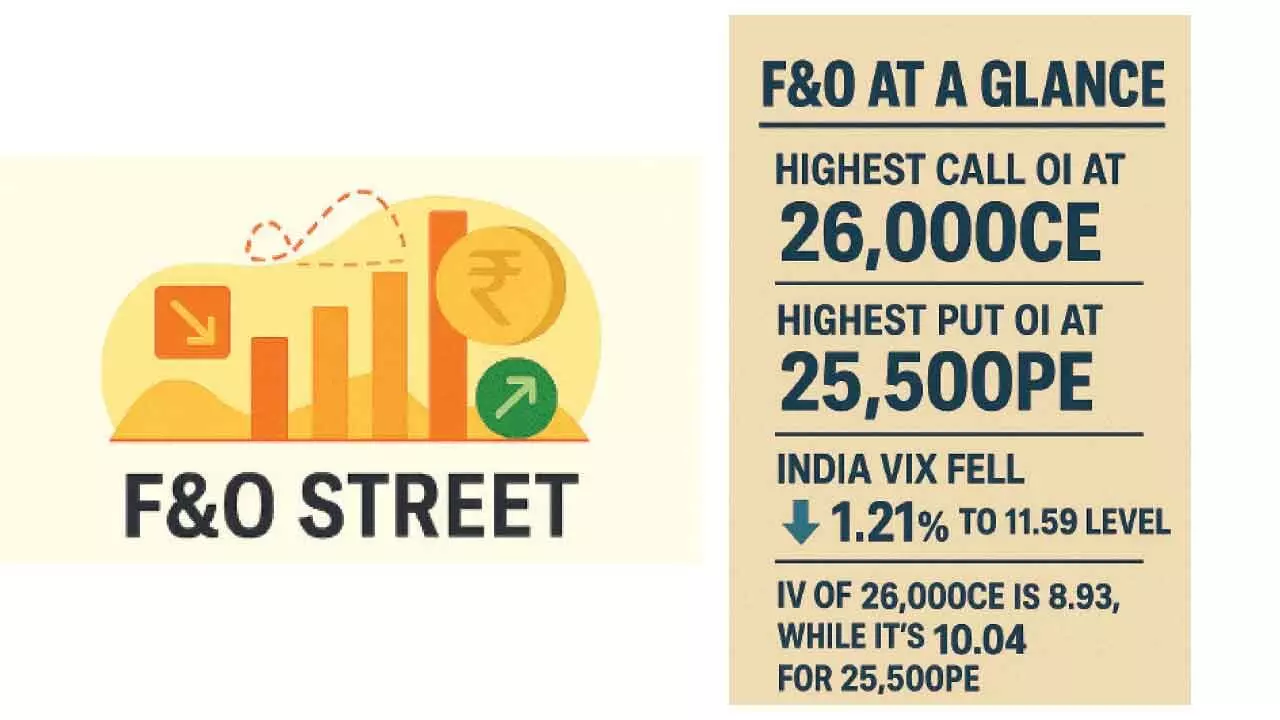

Dhirender Singh Bisht, Associate Vice-President (Technical Research – Equity), SMC Global Securities Ltd, said: “In the derivatives segment, the highest Call Open Interest for Nifty was observed at the 26,000 and 25,900 strike levels, whereas notable Put Open Interest was concentrated at the 25,500 and 25,700 strikes.”

Call ATM and OTM strikes witnessed aggressive call writing, with the highest Call base at 26,500CE, which may act as an immediate resistance zone. The highest Put OI base at 25,500PE is likely to serve as the immediate support level.

“Last week, NSE Nifty ended with a modest gain of 0.33 per cent, witnessing profit booking in the latter half of the week, while Bank Nifty closed flat.

Market sentiment remained positive, supported by expectations of strong quarterly earnings due to relaxation in lending norms and ongoing India-US trade deal negotiations. Sector-wise, IT, PSU Banks, and Metals led the gains, whereas chemicals, financial services, and consumer durables ended the week in the red,” added Bisht.

For the week ended October 19, 2025, BSE Sensex closed at 83,952.19 points, a net recovery of 1,451.37 points or 1.75 per cent, from the previous week’s (October 10) closing of 82,500.82 points. NSE Nifty rebounded by 424.50 points or 1.67 per cent to 25,709.85 points from 25,285.35 points a week ago.

Bisht forecasts: “On the daily chart, Nifty witnessed a minor correction after testing the psychological mark of 26,000. The index continues to trade above its long-term moving averages and an upward channel, indicating that the broader bullish trend remains intact.

Traders are advised to adopt a buy-on-dips strategy, while closely watching open interest positions, which could guide market direction in the coming sessions. Key support for Nifty is placed at 25,500–25,400, while resistance levels are seen near 26,000 and 26,200.”

From the FIIs’ perspective, heavy short covering occurred last week. FIIs reduced their net shorts in Index futures from 1.37 lakh contracts to 1.13 lakh contracts. As a result, FIIs’ net long percentage jumped to approximately 25 per cent. The current leg of short covering may continue, and it is expected to lead to further upside in the index in the near term.

India VIX fell 1.21 per cent to the 11.59 level. “Implied volatility for Nifty’s Call options settled at 10.82 per cent, while Put options concluded at 11.57 per cent. The India VIX, a key indicator of market volatility, ended the week at 11.73 per cent. The Put-Call Ratio of Open Interest stood at 0.83 for the week,” remarked Bisht.

Bank Nifty

Bank Nifty, NSE’s banking index, closed the week at 57,713.35 points, up 1,103.60 points or 1.94 per cent from the previous week’s closing of 56,609.75 points. “For Bank Nifty, significant Call Open Interest was seen at the 58,000 strike, with substantial Put Open Interest at the 57,000 strike,” said Bisht.