Trade Setup for April 11: Will Trump’s tariff pause propel bullish sentiments?

Trade Setup for April 11: Will Trump’s tariff pause propel bullish sentiments?

After a brief breather, markets turned cautious again. On April 10, the Nifty 50 dipped 137 points to end at 22,399, continuing its downward streak on the weekly expiry day. Despite closing in the red, the index stayed above the 22,400 mark, trading in a narrow 100-point range throughout the day.

What’s Fueling Market Sentiment?

The spotlight remains on two major triggers:

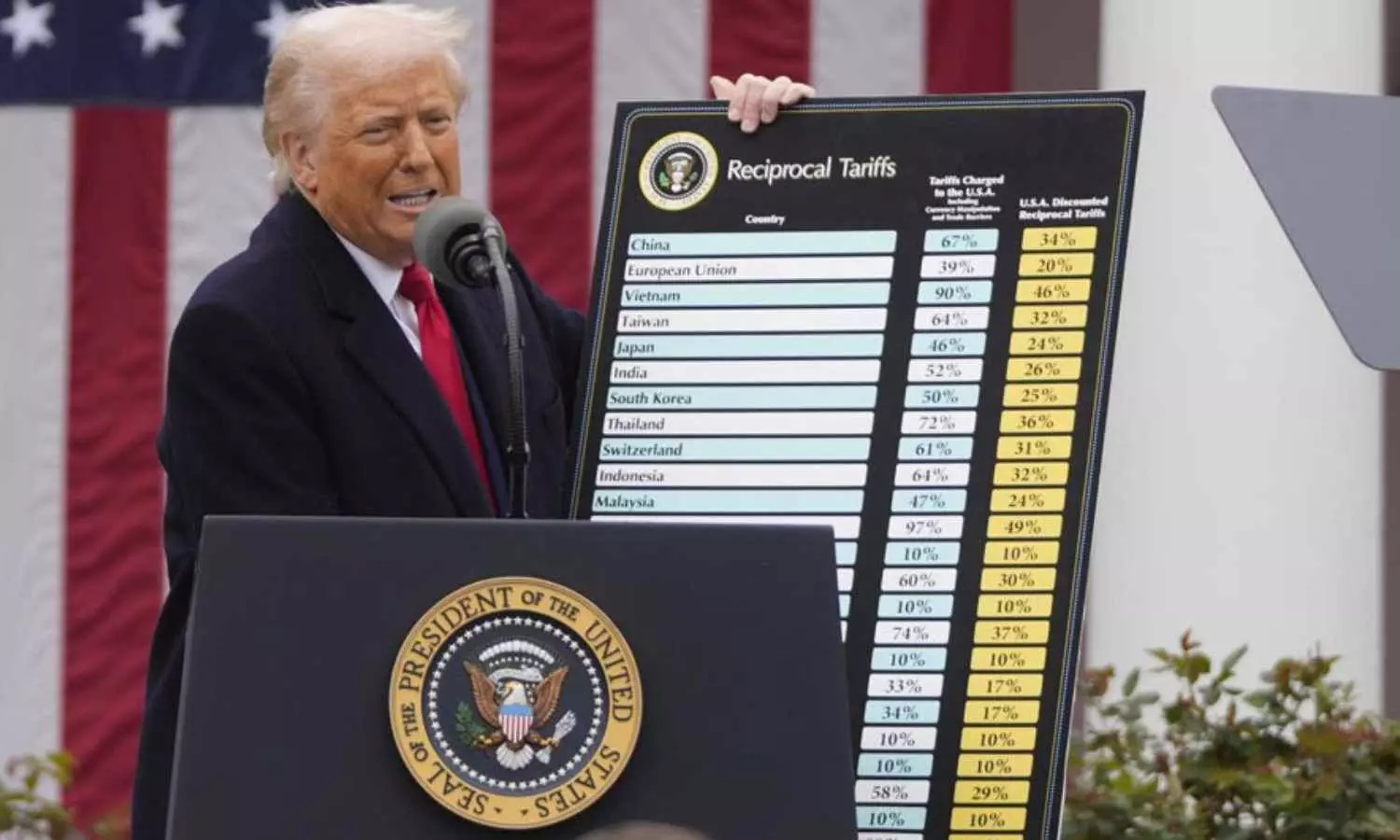

A temporary pause in Trump’s proposed tariffs, which could potentially boost market sentiment.

Q4 earnings from TCS, India’s largest IT company. With five other IT giants included in the Nifty 50, TCS’s performance could ripple across the sector.

That said, TCS disappointed the Street, reporting March quarter revenue of ₹64,479 crore — just a 0.8% growth over the previous quarter. In dollar terms, the $7.465 billion revenue came in below estimates. Constant currency growth for FY25 was 4.2%.

Market Overview

IT stocks were the top laggards, dragging the index down. Heavyweights like Infosys, HDFC Bank, and SBI joined TCS in posting losses.

Midcap and Smallcap indices also saw selling pressure, falling 0.51% and 0.86%, respectively.

Gold loan firms Muthoot Finance and IIFL Finance recovered partially after sharp early losses, following clarification from RBI Governor Sanjay Malhotra on upcoming draft gold loan rules.

Foreign investors remained net sellers on Wednesday, while domestic institutional investors stepped in as buyers.

What Do the Charts Say?

Technical signals suggest short-term weakness:

Nifty is trading below key moving averages — both the 9-day and 20-day EMAs.

The 22,500 level is acting as stiff resistance.

If it breaks above this, a rise to 22,750–22,800 is possible.

If it fails, the index could fall toward 22,000.

Support levels to watch:

Immediate: 22,270

Broader range: 22,150 to 22,000

Resistance: 22,700 to 22,800

Nifty Bank Outlook

Nifty Bank closed at 50,240.25, down 0.54%. It’s trading below the 38.2% Fibonacci retracement level (50,400) but above the 50% retracement (49,900), offering some temporary support.

To establish a clear trend:

It must break above 50,800 for a bullish signal

Or fall below 49,160 for a bearish turn

Stocks to Watch on April 11

Sun Pharma: Wins US court ruling allowing immediate launch of Leqselvi.

Biocon Biologics: Gets US FDA approval for cancer drug Jobevne.

Bank of Baroda: Keeps lending rates unchanged from April 12.

Bajaj Healthcare: Appoints Rohan Parekh as CFO, effective April 16.

Bharti Hexacom: Halts sale of its infra business to Indus Towers; will restart process with TCIL's input.

SRF: Commissions new ₹239 crore agrochemical facility in Dahej, Gujarat.

In Summary

Market volatility continues, driven by global trade tensions and domestic earnings. Whether Nifty hits 23,000 or drops further will depend on how investors digest TCS's results and upcoming macro signals.