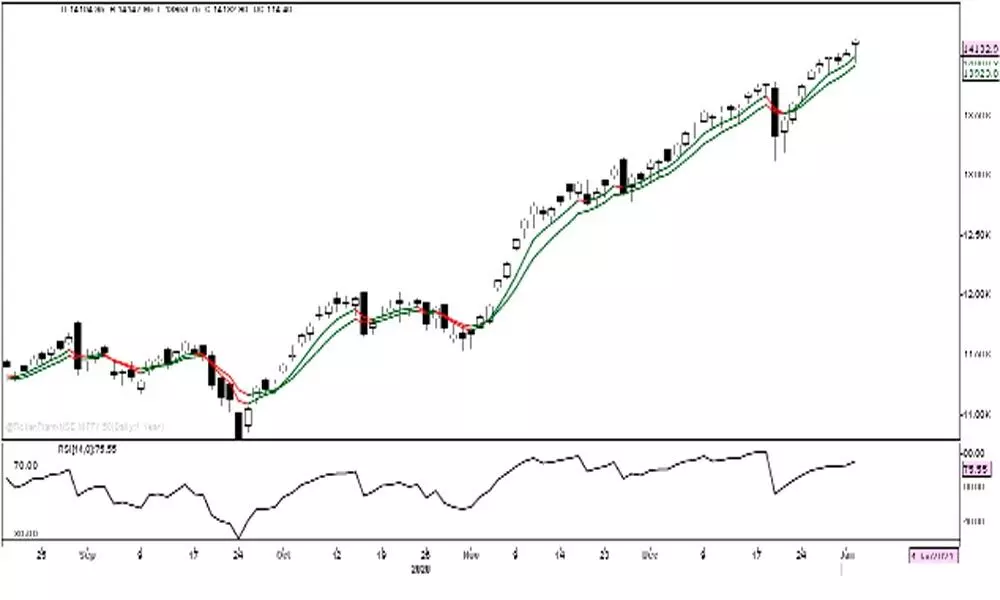

Nifty shows volatility in momentum

The benchmark indices further closed at a new lifetime high with another over 100 point gain.

image for illustrative purpose

The benchmark indices further closed at a new lifetime high with another over 100 point gain. The nine-day swing has six gap up openings and dips used for a buying opportunity. The volatility has increased further. After a 200 points volatility, the Nifty finally closed at 14,132.90 with 114.4 point gain. Barring Banknifty, all the sectoral indices closed with decent gains. India VIX rose by 2.4 per cent. The Metal index was the top gainer with 5.09 per cent.

IT, Auto and Commodities indices also advanced by over one per cent. The overall market breadth is extremely positive as 1,361 stocks closed in green. The mid and small-cap indices also rose by 1.4 per cent on an average. As many as 244 stocks hit a new 52-week high, and only three stocks were at 52-week low.

The Nifty made another high on a volatile day. It opened with over 85 points gap up and fell sharply in the first two hours of trading. The fall of 150 points from the opening created some havoc in the market. The sharp rise in volatility did make an impact on day traders. It recovered about 195 points after it made a low at 13,953. After a series of indecisive small range candles, today's largest bar is indicating the rising volatility. It formed another long lower shadow candle, looks like a hanging man. Initially, the Nifty moved below the previous day's low and 5EMA. As it closed above Friday's high, no weakness is visible. As we mentioned yesterday, it met our first target of 14,135.

The next level resistance or target is placed at 14,375. The concern from now will be the volatility. In any case, the Nifty closes below the previous bar low, exit the long positions. The support zone further inched up to 14,000 – 13,923 zone. Only a close below this zone market may turn weak. As long as it trades above 14,000 be with the trend.

(Financial journalist, technical analyst, trainer, family fund manager)