Nifty forms lower high lower low candle

Mixed global markets due to geopolitical tension and negative US futures foray equity market to trade volatile

image for illustrative purpose

The equity market continued to trade volatile as the clarity was missing on geopolitical tensions. The Nifty closed at 17304.60, with just a 17.6 points loss. It opened with a positive gap, but was not sustained at higher levels and declined 140 points from the day's high. The Bank Nifty fell 1.1 per cent is the worst performer. Energy index up by 1.5 per cent. FMCG, Infra indices ended flat to positive. The other sector indices closed with less than half a per cent decline. The broader market breadth is negative as 1334 declines and 709 advances. An equal number of stocks (29) hit a new 52 week low and high. About 96 stocks traded in the upper circuit and 94 in the lower circuit. Adani Power, Reliance and Tata Motors are the top traded counters on Thursday.

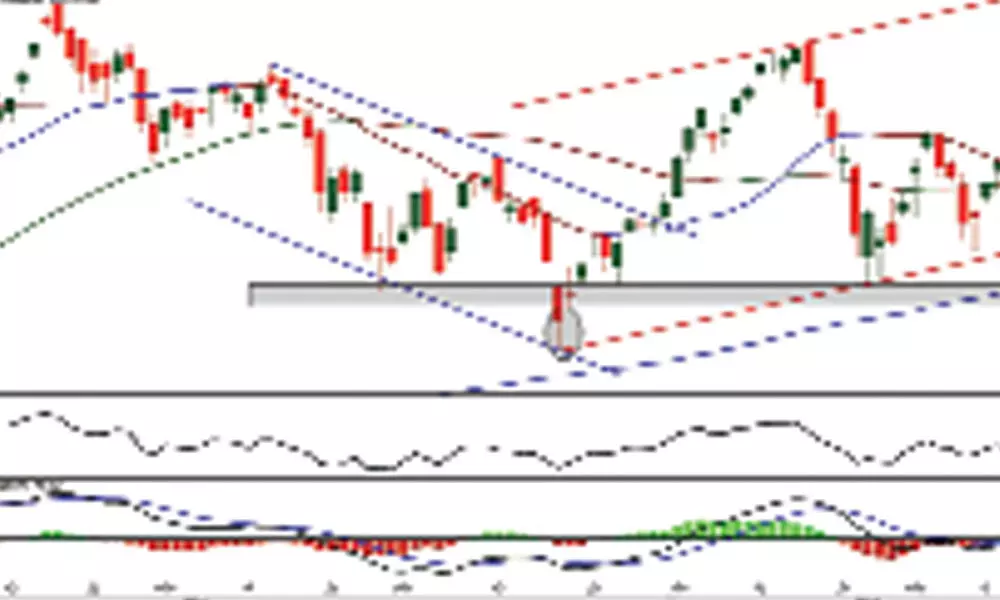

Another effort of pullback failed. The benchmark index formed a lower high lower low candle. For the second time, the Nifty opened above the 20DMA and closed below it. The 50DMA also began its downtrend after flattening for the last 14 days. The daily price range has been limited 207 points less than the previous day, which is surprising on a weekly expiry day. The 50DMA (17465) and 20DMA (17376) have become strong resistance points. The Nifty has formed a base at 16833-866 zone, which is strong support. The 500 point range is very crucial for the future trend. The index has formed three lower minor highs and a major lower high. This structure is generally a topping formation as per the classical technical analysis. Except 20th December low, the Nifty honored the base support.

Currently, the 200DMA (16837) is also placed at the base area. The momentum is dull and does not indicate any decisive trending signs. The RSI is flat, and the MACD line is below zero and the signal lines. As the 20DMA crossed below the 50DMA, the short-term trend is negative. The broader market benchmark index breadth worsened further today, which is not good. Mixed global markets and negative US futures dampened the sentiment today. In fact, the heavyweight stocks Reliance, HDFC and HUL rally saved the index for the day. As the Nifty is in a neutral zone, it is better to avoid aggressive positions.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)