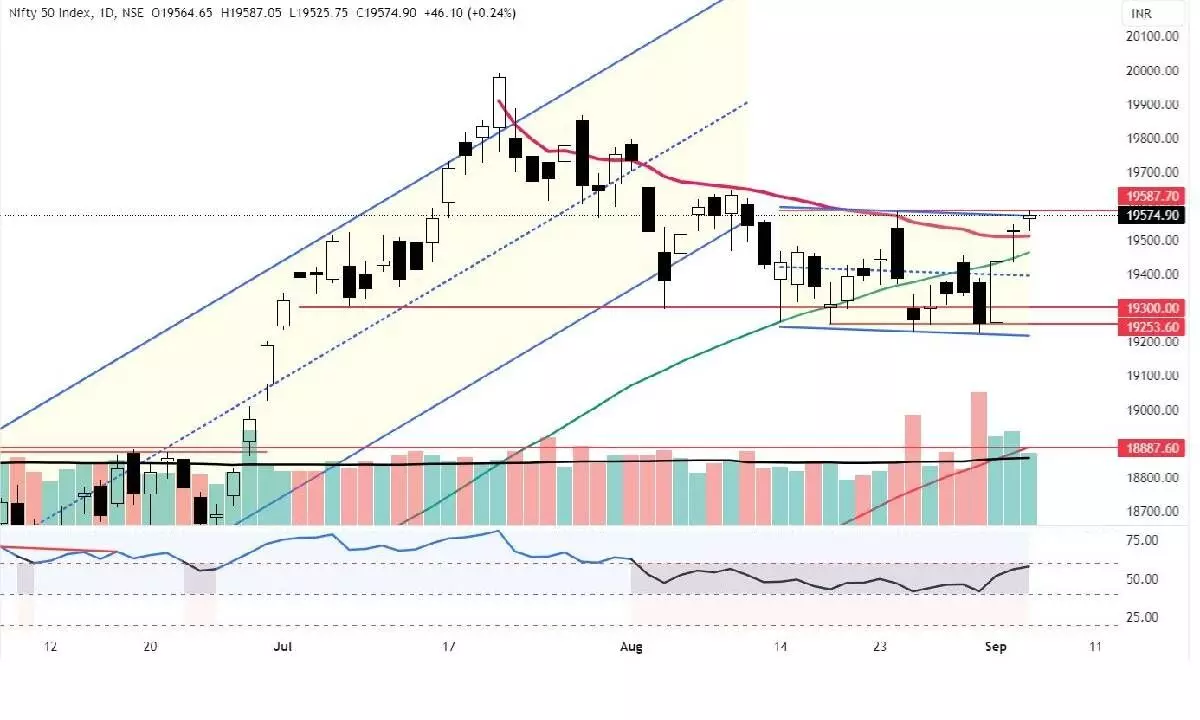

Nifty forms another Hanging Man candle

Volume is lower than the previous day; For second day, benchmark index closed above Anchored VWAP resistance; MACD has given a fresh buy signal and RSI is just at the doorstep of a bullish zone

image for illustrative purpose

The benchmark indices registered a third straight winning session on Tuesday as NSE Nifty gained by 46.10 points or 0.24 per cent closed at 19,574.90 points. Barring banking and financials, all the sectors closed with decent gains. The Bank Nifty declined 0.10 per cent, and FinNifty is down by 0.17 per cent. The Media index is the top gainer with 3.19 per cent, followed by Pharma with 1.10 per cent. The Realty index is also up by 1.06 per cent. The Nifty IT and FMCG indices gained by 0.63 per cent and 0.74 per cent. The Midcap and Small-cap indices advanced by 1.06 per cent and 0.84 per cent. The India VIX is further down by 1.35 per cent to 10.81. The market breadth is positive. About 219 stocks hit a new 52-week high, and 105 stocks traded in the upper circuit. IRFC, HDFC Bank, and Adani Enterprises were the top trading counters today in terms of value.

The Nifty has formed another Hanging Man candle. The index closed at the prior minor high or the 24th August high. The volume is lower than the previous day. For the second day, it closed above the Anchored VWAP resistance. The MACD has given a fresh buy signal, and the RSI is just at the doorstep of a bullish zone. It formed the second consecutive Hanging Man candle. The previous day’s Dragonfly Doji candle failed to get the confirmation for bearish implication. The index rallied over 331 points in the last three days. The outperformance from the Midcap and Smallcap indices continued. Both the indices are overstretched and extremely in overbought conditions on a weekly and daily chart.

Any correction of high magnitude may hurt the broader market sentiment, too. At the same time, the India VIX is back to the historically lowest range of 10.81, which is not good for a trending market. The banks and financials look tired after two days of rallies. Now, the Nifty has to close above the 19,587 points for a confirmed trend reversal. If the index closes below today’s low of 19,525 points, it is negative for the market. Stay neutral if it trades the 19,525-19,583 zone.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)