Nifty course hinges on Monday’s close

19223-778 zone crucial for Nifty which is expected to consolidate within this zone for some time

image for illustrative purpose

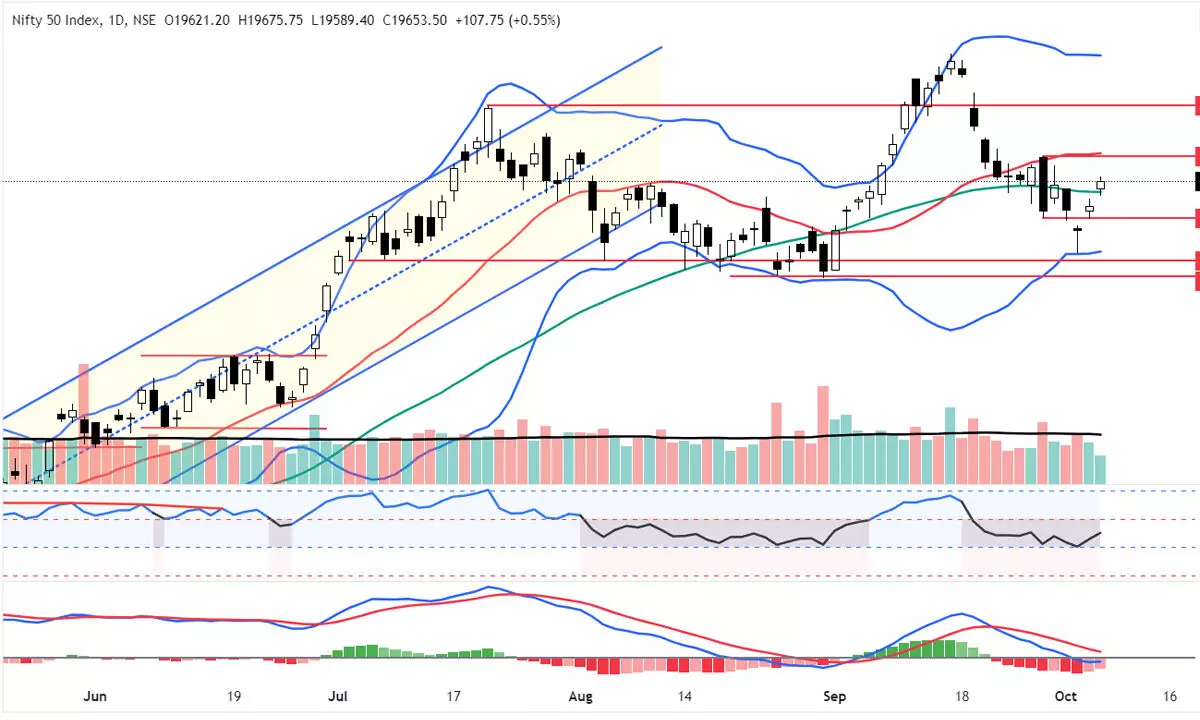

The equities continued to recover from the oversold zone. The benchmark index, Nifty, was up by 107.75 points or 0.55 per cent and closed at 19653.50. Only Nifty Media index closed with a flat to negative note. All other sectoral indices were advanced by 0.50 per cent to less than a percentage point. The Realty index is the top gainer with 3.08 per cent. The India VIX is down by 5.85 per cent. The broader market breadth is positive. About 122 stocks hit a new 52-week high, and 112 stocks traded in the upper circuit. Bajaj Fin Twins, HDFC Bank, and Liquid Bees were the top trading counter in terms of value on Friday. With a broader market recovery, the Nifty decisively opened and closed above the 50DMA. However, the volume was lower in recent times. Even the daily range also shrunk to just 86.35 points. On Friday, it tested the 38.2 per cent retracement level of the prior fall. This price action is in line with our expectations for the past two days. The hourly RSI reached the bullish zone, which met the positive divergence target. The Bollinger bands have been moving horizontally for the last two days. The daily RSI is just at 50. Now, the question is how long the pullback will continue. Generally, the pullbacks end at a 38.2 per cent retracement level. At the most, at a 50 per cent retracement level. The first level of pullback is done. The 50 per cent retracement level and the 20DMA are at the same level, at 19766, which is just another 113 points away. Monday’s close will give a clue on the continuation of pullback or the continuation of reversal.

If Nifty closes below the 50DMA again, it means we are heading for a major low below 19223. On the upside, we can’t forecast more than the 19778-882 zone. In other words, the 19223-778 zone is crucial for the market. Mostly, the Nifty will consolidate within this zone for some period. Stay with a neutral bias.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)