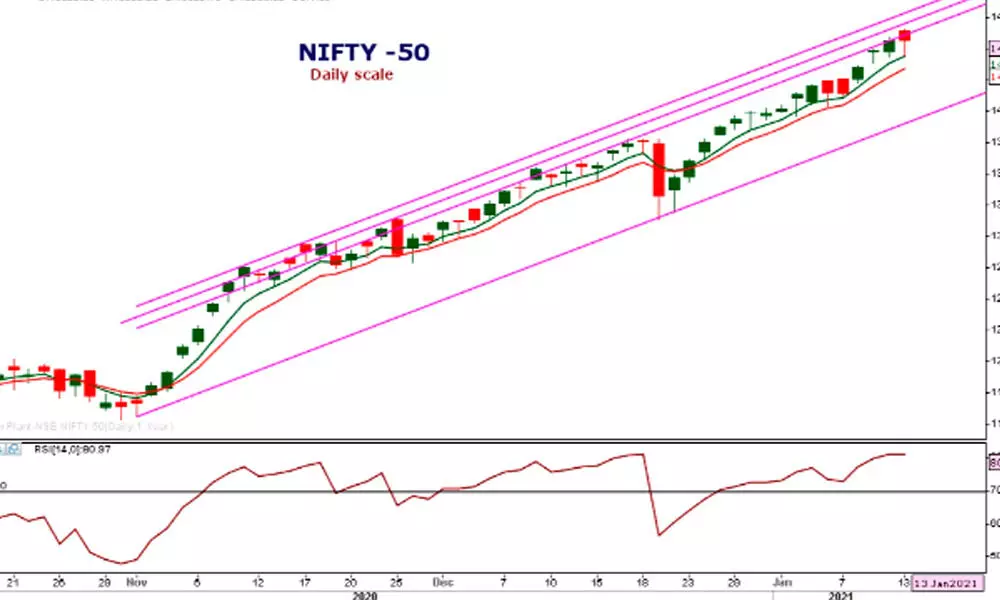

Nifty below 14,335 pts portends a bearish turn

The stock market’s rally looks tired.

image for illustrative purpose

THE stock market's rally looks tired. The benchmark indices closed flat as the sectoral participation is taking a pause. All the sectoral indices moved less than half per cent on either side. The Nifty closed flat with just 1.40 points gain. Even as the SBI stock went up 4.89 per cent only, the PSU bank index was up by 3.27 per cent. Pharma index fell the most - 0.92 per cent. As many as 1,260 stocks declined, 643 stocks advanced, and 323 closed unchanged. A total of 167 stocks hit new 52-week high today. The Put-Call Ratio (PCR) was at the highest level of 1.79. As the weekly derivatives expiry nears, the market may experience increased volatility.

Yet another bearish candle, and another intraday fall attracted buying. Over 200 points volatility. 5EMA support is on hold. The Nifty tested the prior day low. Many of the index stocks formed bearish shooting star candles. The volatility increased further. This is the day's happening in the market.

The Nifty closed absolute flat. It formed a bearish hanging man. The Banknifty formed a perfect doji. These evidences are definitely not bullish signs. We cannot go with an aggressive long. The new derivative index FinNifty is not attracting as much as expected volumes.

The volumes are decreasing for the past two months. But, today's volumes are higher since 22nd December. This shows that the traders are booking profits or distribution is happening. Though the major indicators are not showing any negative divergence, yet, unconventional indicators like ATR and the linear regression slope are showing the negative divergence.

The positive directional movement indicator +DMI has declined today. This is another factor to be cautious about long positions. The Nifty breadth 1:1, but the broader market breadth is negative and in favour of declines. In any case, the Nifty closes below the 14,335 will lead to a short term negative bias. The 5EMA support is at 14,440, and the 8EMA support is at 14,341. These levels work as the important support for the short term. Only above 14,650, the bullish strength will continue.

(The author is a financial journalist, technical analyst, trainer, family fund manager)