Mkts plunge on global headwinds

Sensex at 3-wk low on geo-political, rate-hike worries and monthly derivatives expiry session; Investors’ wealth fell by Rs6.97 lakh crore in 4 days

image for illustrative purpose

Renewed Rate Hike Fears

- 29 of Sensex-30 stocks declined

- 47 of Nifty-50 constituents in the red

- Investors in wait n watch mode

- All eyes on US Fed outcome, RBI minutes

Investors lose Rs3.87 lakh cr

Investors became poorer by Rs3.87 lakh crore on Wednesday amid a sell-off in the equity market that saw benchmark Sensex tumbling 928 points. The market capitalization (mcap) on BSE fell Rs6,97,102.05 crore in four days of decline as the mcap was down to Rs2,61,33,883.55 crore.

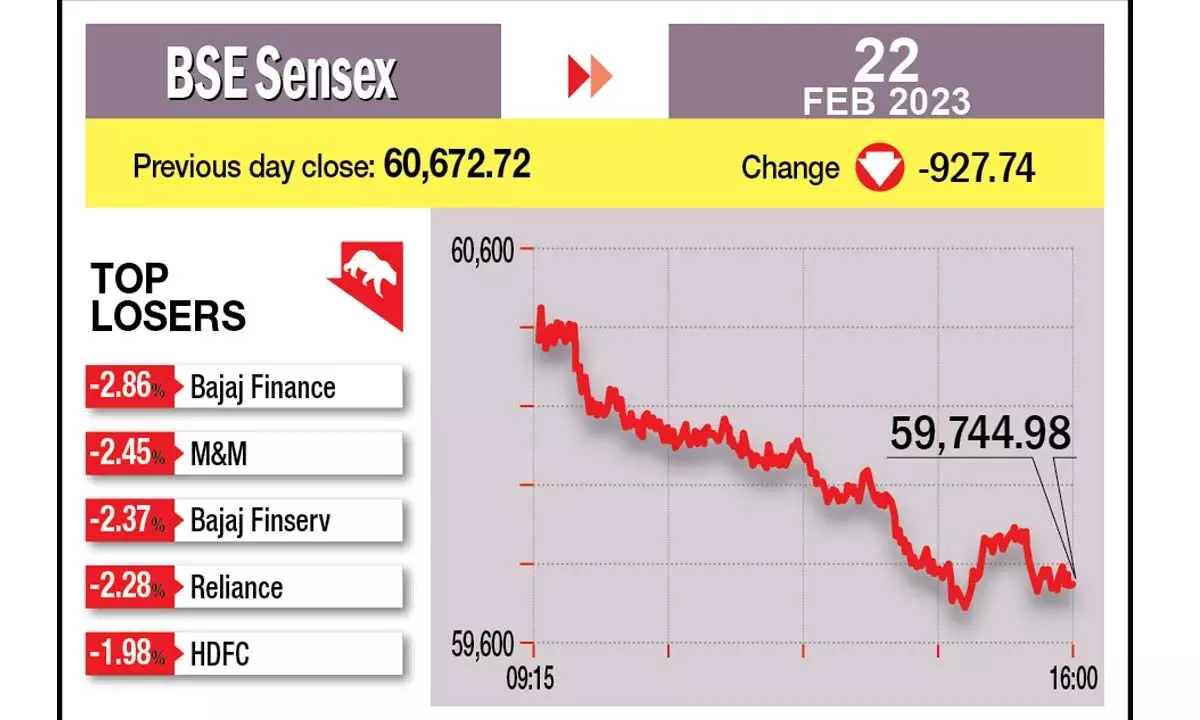

Mumbai: Benchmark Sensex tanked 927 points, while the broader Nifty settled at a four-month low on Wednesday due to an intense selling in heavyweight stocks triggered by geo-political and inflation concerns.

Losses in global equities and across-the-board selling ahead of the monthly expiry of derivatives also hit the investor sentiment, dragging down the key indices for a fourth straight day. The BSE Sensex tumbled 927.74 points or 1.53 per cent to settle at 59,744.98, the lowest closing level since February 1.

As many as 29 of the Sensex stocks declined. During the day, it tanked 991.17 points or 1.63 per cent to 59,681.55. The 50-issue NSE Nifty declined 272.40 points or 1.53 per cent to end at a four-month low of 17,554.30 with 47 of its constituents ending in the red. In the broader market, the BSE midcap gauge declined by 1.16 per cent and smallcap index fell by 1.09 per cent. As many as 266 stocks hit their 52-week low levels on BSE. Investors' wealth eroded by Rs 6.97 lakh crore (Rs 6,97,102.05 crore) in four days of decline. The total market valuation stands at Rs 2,61,33,883.55 crore.

“Resurgence of the cold war between US & Russia has brought apprehension in the market. Although it should be a short-term effect, the fear of sanctions against Russia and its degree of implication on the economy, especially on food and oil exports, is adding to the anxiety. The market is just recovering from the pandemic, and high interest & inflation are the headwinds in the background. It is presumed that this war will be fought on an economic front, limiting its effect on strong economies like the US & India. Awaiting the release of Fed and RBI minutes are the other major elements that kept investors on the sidelines,” said Vinod Nair, head (research) at Geojit Financial Services.

“Following negative global markets, Indian equities opened lower on the day before monthly expiry and were under pressure for the whole day. Traders seem to be cautious ahead of the FOMC minutes due tonight as well as the RBI monetary policy meeting minutes, also due later today,” said Om Mehra, equity research analyst, Choice Broking.

Foreign Portfolio Investors (FPIs) bought shares worth Rs525.80 crore on Tuesday, according to exchange data.