MACD Shows Strong Bearish Momentum

In any case if it closes below 24462-494, it will be a strong negative for the trend

MACD Shows Strong Bearish Momentum

The equities have given up the prior day’s bullish strength with a negative broader market breadth. The Nifty declined by 174.10 points or 0.70 per cent and closed at 2547.50. The Nifty Realty and India Defence indices were the top gainers with 1.20 per cent, and 1.11 per cent, respectively. The Media and Small-cap indices closed with moderate gains. The Private Bank, Energey, PSE and CPSE indices declined by over one per cent. The Infra, FinNifty, Services, Oil and Gases, Consumer Durables and IT indices declined by over half a per cent. The India VIX is down by 3.51 per cent to 16.55. The market breadth is negative as 1696 declines and 1224 advances. About 60 stocks hit a new 52-week high, and 103 stocks traded in the upper circuit. Yes Bank, Aptus, BSE, HDFC Bank, and Eternal were the top trading counters today, in terms of value.

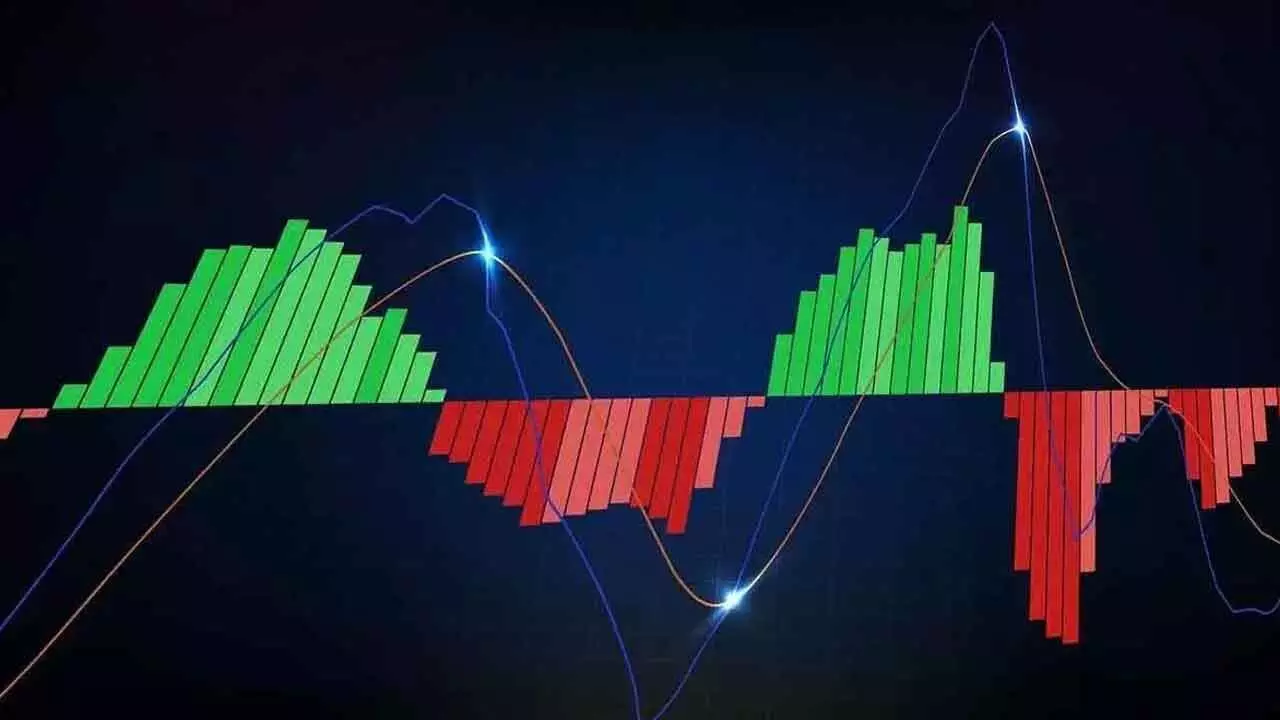

The Nifty closed at the support zone with increased selling pressure. The Index has registered another distribution day as it declined by 0.72 per cent with a higher volume than the previous day. The Nifty also formed a bearish engulfing candle and closed decisively below the 20DMA. The 8EMA entered into the downtrend. Now, the 24462-494 zone has become crucial for the trend. As the 20DMA is flattened and the upper Bollinger band begins to decline, expect the index to fall more. The Elder’s impulse system and the Heiken-Ashi have formed a strong bearish bars. The price pattern is like a double top. It has also formed a series of lower high bars. The RSI closed on the 50, and the MACD histogram shows a strong bearish momentum. In any case, the Nifty closed below the support zone 24462-494, which will be a strong negative for the trend. The nearest support is at 24320, and the 50 DMA is at 24038. Below these supports, the index will enter into a confirmed downtrend. Only a close above the prior day’s high and sustained above the 20 DMA will be positive and continue to consolidate in the range. To resume the uptrend, it must close above 25116 decisively with an increased volume support. For now, stay neutral to negative.

(The author is partner, Wealocity Analytics, Sebi-registered research analyst, chief mentor, Indus School of Technical Analysis, financial journalist, technical analyst and trainer)