MACD Shows Increase In Bearish Momentum

Stay neutral but avoid highly leveraged positions for now. After the expiry, the index may find the way for near future

MACD Shows Increase In Bearish Momentum

The consolidation will continue for a few more days. The nearest support is at 24626. In any case, if it closes below 24800, it will test 24626. Below this, the key support is at 24460. The index may trade in the defined range with increased volatility

The equities failed to continue the bullish momentum. The Nifty declined by 174.95 points or 0.70 per cent and closed at 24826.20. The Nifty India Defence index is the top gainer with 1.06 per cent. The PSU Bank, Realty, and Midcap indices closed positively with 0.25 per cent. The FMCG, Commodities, IT, Auto, Services, FinNifty, and Infra indices declined by over 0.60 per cent. The India VIX is up by 2.86 per cent. The market breadth is neutral as 1462 declines and 1412 advances. About 42 stocks hit a 52-week high, and 101 stocks traded in the upper circuit. Indigo, Eternal, HDFC Bank, ICICI Bank, and Mazdock were the top trading counters in terms of value.

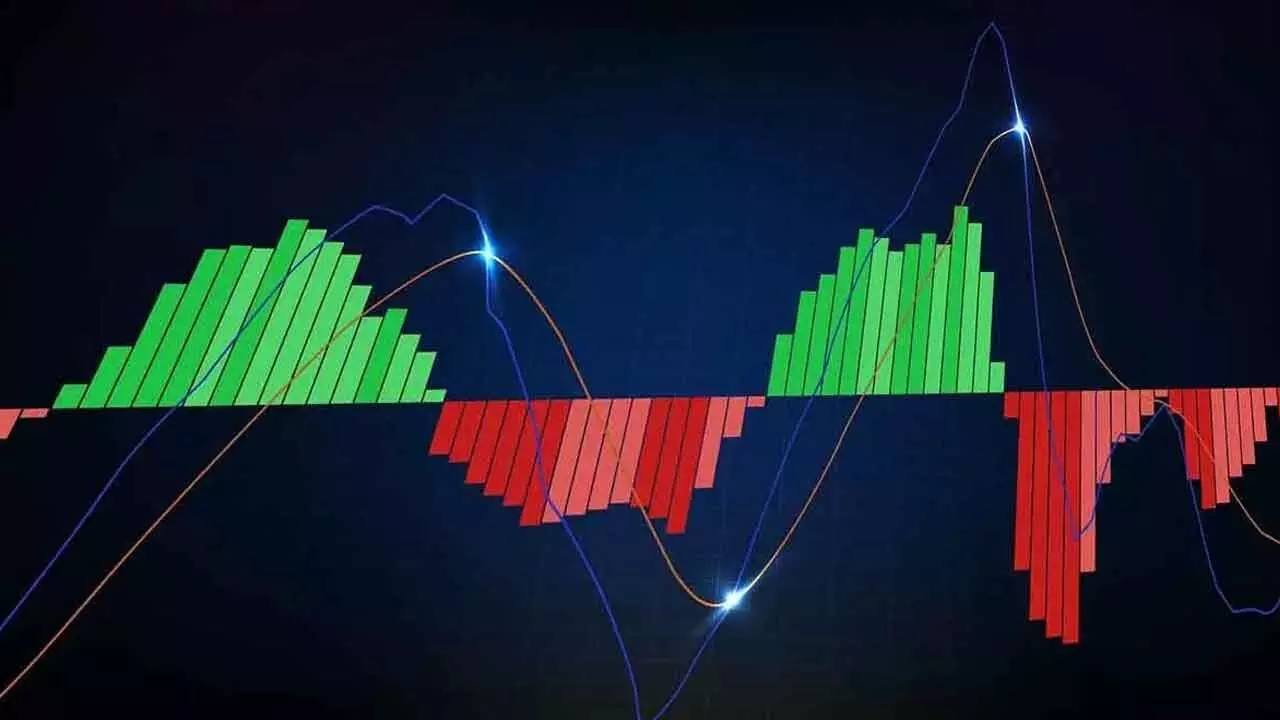

On a volatile session, the index closed below the previous day. The Nifty registered a distribution day as it recorded a massive volume on a 0.70 per cent decline day. Interestingly, it recorded the highest volume after 7th April. Before the monthly expiry, the volatility has increased. The India VIX again reached 18.53. Though broader market breadth is positive, the trend is not showing strong momentum. As we stated earlier, the consolidation will continue for a few more days. The nearest support is at 20 DMA of 24626. It is able to close above the 8 EMA. The RSI is back into the neutral zone. The MACD histogram shows an increase in the bearish momentum. In any case, if it closes below 24800, it will test 24626. Below this, the key support is at 24460. The index may trade in the defined range with increased volatility. Expiry trades may hurt the trades on both sides. Stay neutral but avoid highly leveraged positions for now. After the expiry, the index may find the way for near future.

(The author is partner, Wealocity Analytics, Sebi-registered research analyst, chief mentor, Indus School of Technical Analysis, financial journalist, technical analyst and trainer)