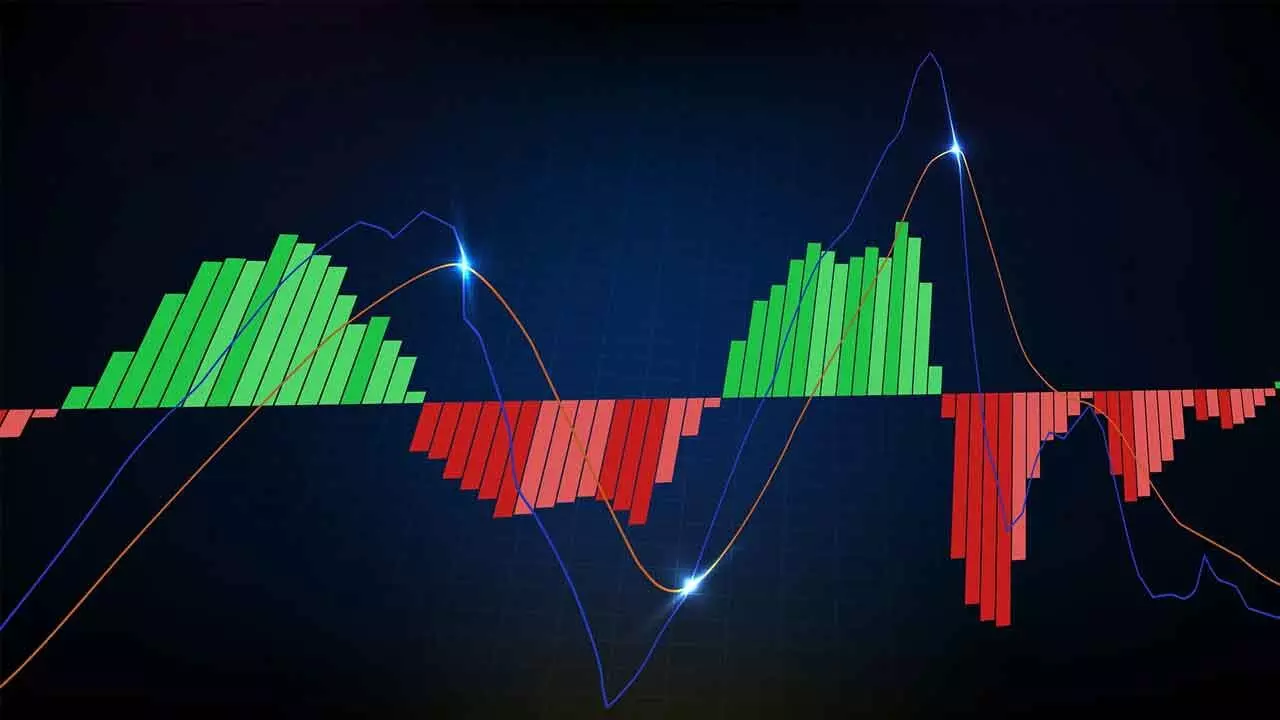

Hourly MACD Flags 1st Reversal Sign

If the index closes above the 8EMA after the first hour of trading today, expect it to test the 25,300 soon; On the downside, 50DMA is crucial support, fresh shorts can be opened below this support

Hourly MACD Flags 1st Reversal Sign

After 5 days of failed attempts, the Nifty closed above the 50DMA. The index breadth was positive, but the volumes were lower than the previous day and below the average. The overall volume trend is declining, which is a characteristic of a counter-trend consolidation

The equities rebounded above the key levels with the support of banks. NSE Nifty gained 163.70 points or 0.66 per cent and closed at 25,127.95 points. The Realty index was the top gainer with 1.61 per cent. The IT and Bank Nifty gained by 1.27 per cent each. FinNifty also gained 1.04 per cent. The media was the top loser with one per cent. The Metal and Oil and Gas index moderately declined. The India VIX was down by 1.70 per cent to 12.99. The market breadth was slightly positive as 1,432 advances and 1,380 declines. About 94 stocks hit a new 52-week high, and 136 stocks traded in the upper circuit. BSE, CDSL, DMart, and Reliance were the top trading counters in terms of value.

After five days of failed attempts, the Nifty closed above the 50DMA. The index breadth was positive, but the volumes were lower than the previous day and below the average. The overall volume trend is declining, which is a characteristic of a counter-trend consolidation. It formed a strong bull candle and closed above the three-day high. The Banks led the positive bias, particularly HDFC Bank, which contributed over 61 points to the gain. The index failed to close above the 8EMA resistance. The MACD histogram shows a decline in the bearish momentum. The RSI is now eight days high at 46.90, rising in the neutral zone. If it crosses 50, we may see strength in the upswing. The positive aspect of the day is that the Nifty closed above the hourly moving average ribbon along with the hourly MACD closed above the zero line. This shows the first reversal signs. The Index also closed above the 23.6 per cent retracement level of the prior fall. If the index closes above the 8EMA after the first hour of trading on Tuesday, expect that it will test the 25,300 soon. On the downside, the 50DMA is crucial support now. Only below this support fresh shorts can be opened. The Nifty closed above the 25,000-100 resistance is another positive for the day. The heavyweight stock earnings will dominate the market for the next four days. Stay vigilant.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)