FPIs hit slow lane as crude oil becomes pricey

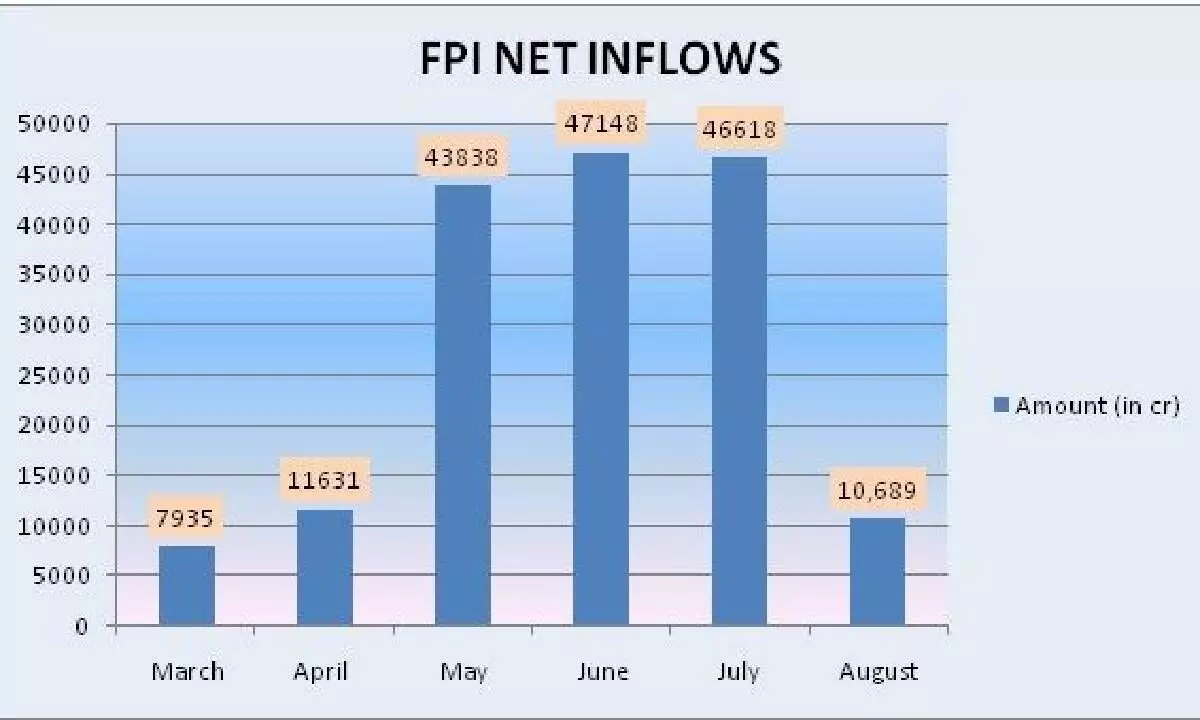

The pace of inflows from foreign investors ebbed in Aug with a net investment of Rs10,689 cr

image for illustrative purpose

New Delhi After infusing a staggering amount in Indian equities in the past three months, the pace of inflow from foreign investors ebbed in August with a net investment of Rs10,689 crore on higher crude oil prices and resurfacing of inflation risks.

Further, markets could remain volatile in the coming week due to macroeconomic uncertainty and rising US bond yields. This has been prompting FPIs to flee emerging market equities, including India, and park funds in haven US securities, said Shrikant Chouhan, Head of Research (Retail), Kotak Securities Ltd. Also, the poor monsoon in August and its skewed spatial distribution may keep inflation elevated, and this is becoming an area of concern impacting sentiments in the market. This might impact FPI investment too, V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said. According to the data with the depositories, Foreign Portfolio Investors (FPIs) invested a net amount of Rs10,689 crore in Indian equities this month (till August 26). This figure includes investment through the primary market and bulk deals, which have been gathering momentum recently. Before this investment, FPIs invested over Rs40,000 crore each in the past three months in Indian equities. The net inflow was at Rs46,618 crore in July, Rs47,148 crore in June, and Rs43,838 crore in May.