Focus on stock-specific activity

Look for a close above 17,611 points on 15 minutes chart for a fresh long position

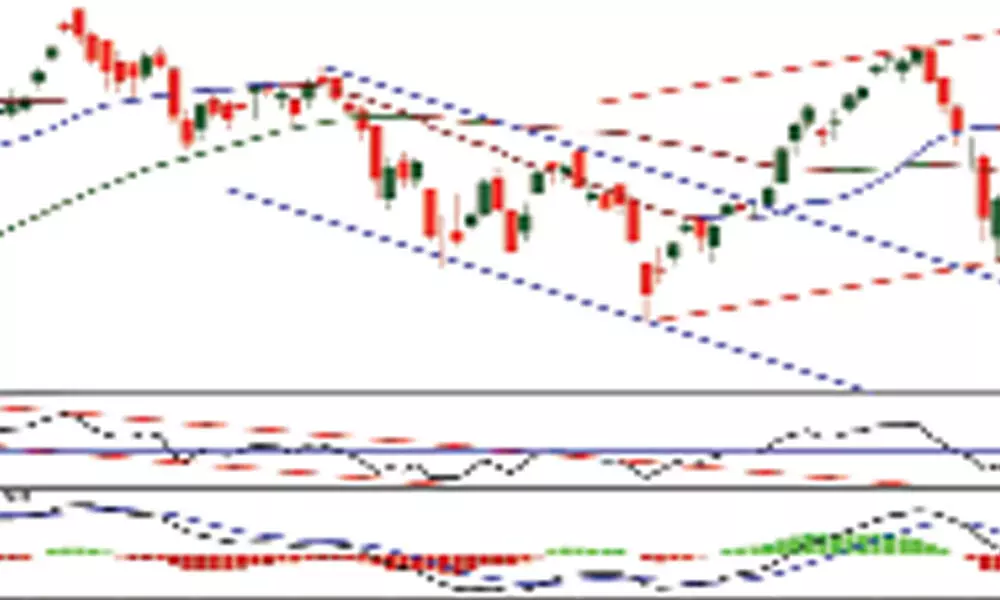

image for illustrative purpose

On a non-eventful monetary policy, the equities rallied for the third straight session. The NSE Nifty gained by 142.05 points or 0.81 per cent and closed at 17,605.85 points. After the RBI policy announcements, it sustained in the green territory after trading mostly in sideways.

The Media, Metal and IT indices are the top gainer with 1 - 1.5 per cent gains. Auto and PSU Bank indices closed flat to negative. The remaining indices closed with less than half a per cent gain.

The Market breadth is at 1:1 as 1,001 advances and 1,027 declines. About 52 stocks hit a new 52-week high and 131 stocks traded in the lower circuit. HDFC, Adani Power and Reliance are the top trading counters on Thursday.

The Nifty opened with a 90 point gap up and sustained the gains till the end. After the policy announcement, the Nifty traded in a range rest of the day. It faced resistance at 20DMA, as we expected yesterday. As the index is trading between 20 and 50 DMAs, the market is still in the neutral zone. The Nifty formed a series of Doji candles on the hourly chart, and the momentum significantly declined. On the weekend, the Nifty has to close above 17611 to continue the present positive bias. The prior swing high is at 17795. This zone of 17611-7695 will act as a crucial resistance. For the next 2-3 days. As stated earlier, there is a negative bias for now though it is trading in a neutral zone. Above the swing high, we can see more buying interest. As of now, the volume is below the average.

The daily MACD line is below the zero line and the signal line. The 14-period RSI moves above the 50 zone and near the prior swing high. It is not showing any divergences. The Strategy is simple. As long as the Nifty trades above 50DMA, be with a positive bias. Look for a close above 17611 on 15 minutes chart for a fresh long position. As the weekend approaches, trade with light position size. Stock-specific activity will continue, and metals will shine.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)