Equity MF inflows hit 3-mth high on NFO push

Surge in new fund offers (NFOs) and consistent SIP investments helped equity mutual funds attract Rs8,637 cr in June; Small-cap category continues to be the major driver with a record infusion of Rs5,472 crore: Amfi

image for illustrative purpose

New Delhi: Strong inflow in new fund offers (NFOs) and consistent SIP flow helped equity mutual funds attract Rs8,637 crore in June, which is the highest level in three months. Of these flows, the small-cap category continues to be the major driver with a record infusion of Rs5,472 crore in the month under review.

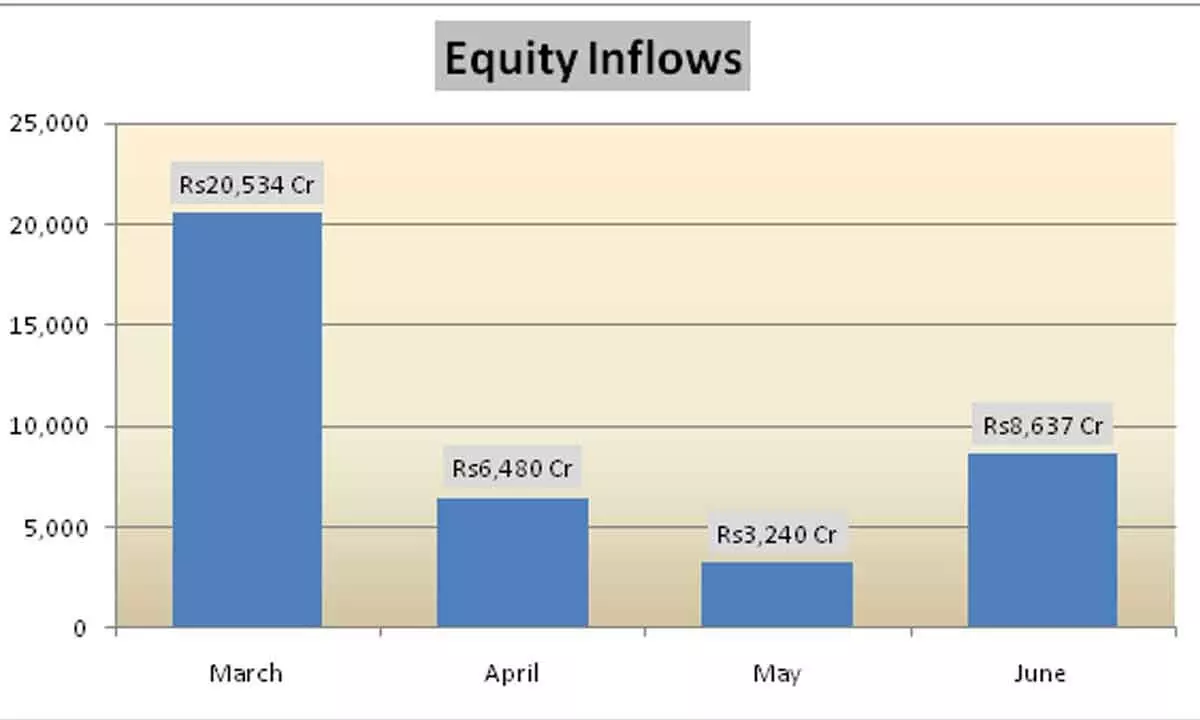

This could be primarily due to attractive valuations offered by these stocks following the price correction seen during 2022-23. In comparison, equity mutual funds logged an inflow of Rs3,240 crore in May and Rs6,480 crore in April. Before that, the number was Rs20,534 crore in March, data released by the Association of Mutual Funds in India (Amfi) showed on Monday. “A good amount of the net inflows seen in the equity asset class could be attributed to the six newly launched funds which mopped up around Rs3,038 crore during the month,” said Melvyn Santarita, Analyst - Manager Research, Morningstar India.

Overall, a total of 11 schemes were launched, all in the open ended category, raising a total of Rs3,228 crore in June. Manish Mehta, National Head and Sales, Marketing & Digital Business at Kotak Mahindra Asset Management Company, said that June net numbeRswere a tad higher than May. Some profit-booking at higher levels to maintain asset allocation is not ruled out but investoRscontinue to keep investing through SIPs (Systematic Investment Plans) and STPs (Systematic Transfer Plans). InvestoRscontinue to flock towards the SIP route for making investments as inflow through the category was at Rs14,734 crore last month as compared to Rs14,749 crore in May. Overall, the 43-player mutual fund industry saw a withdrawal of Rs2,022 crore, on contributions from debt-oriented schemes. This comes following a net investment of Rs57,420 crore in the preceding month. “This steep fall was on expected lines with June being the quarter-ending month, impacted by advance tax payments and other liquidity requirements by companies and individuals,” Kavalireddi said.

However, average assets under management of the industry rose to a record high of Rs44.8 lakh crore at June-end from Rs42.9 lakh crore at the end of May in line with the bullish trend witnessed in the Indian equity indices. This growth in the asset base could be attributed to buoyant stock market, which was boosted by a strong flow from Foreign Portfolio InvestoRs(FPIs) in June. Debt-oriented schemes witnessed net outflow in June after witnessing two consecutive months of net inflows. The segment saw a net outflow of Rs14,135 crore in June as compared to an inflow of Rs45,959 crore in the preceding month. In the debt schemes, the majority of outflows happened from the liquid and Ultra Short Duration categories. On the other hand, hybrid schemes saw inflow of Rs4,611 crore, with a large part of flow into arbitrage funds at Rs3,366 crore. Within equities, the small-cap category led the pack with record-breaking net inflows in June 2023 amounting to Rs5,472 crore.

This was followed by value category (Rs2,239 crore), midcap (Rs1,748 crore), and large and midcap category (Rs1,147 crore). On the other hand, large cap category (Rs2,049 crore) and focused category (Rs1,018 crore) were among the few categories which saw net outflows during the month under review. “With large-cap stocks underperforming in H1 CY2023 due to the notable valuation difference with the broader market-cap stocks, it was the right move by investors,” Gopal Kavalireddi, Vice President - Research at FYERS, said. NS Venkatesh, CEO, AMFI, stated that it is particularly encouraging to see money flowing into equity schemes.