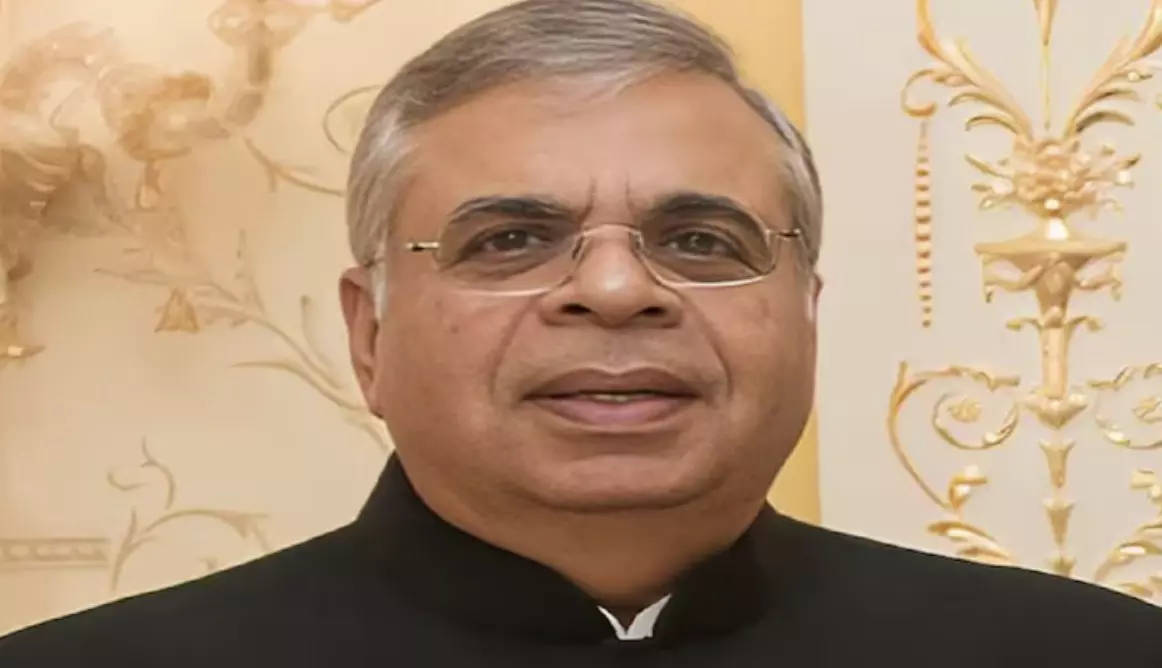

DPIIT approval secured, IIHL aims for Reliance Capital Acquisition completion by January 2025: Ashok Hinduja

DPIIT approval secured, IIHL aims for Reliance Capital Acquisition completion by January 2025: Ashok Hinduja

IndusInd International Holdings (IIHL) has received approval from the Department for Promotion of Industry and Internal Trade (DPIIT) for its acquisition of Reliance Capital, with plans to finalize the Rs 9,861 crore transaction by the end of January 2025, according to Chairman Ashok Hinduja.

This acquisition marks a significant milestone in IIHL’s growing para-banking portfolio, which is targeting a $50 billion valuation by 2030. IIHL, the promoter of IndusInd Bank, had previously received approval from the National Company Law Tribunal (NCLT) for the takeover of Reliance Capital under the insolvency and bankruptcy code.

"The process now involves completing certain formalities with the administrator and the Committee of Creditors (COC), such as delisting of equity, creation of trust for excluded assets, capital reduction, and clearing charges on Reliance Capital’s assets. These steps should take about four to six weeks, so we expect the deal to close by January end," Hinduja stated during a media briefing in Mumbai.

How Will IIHL Fund the Deal?

Hinduja explained that IIHL has already made significant financial arrangements to fund the acquisition. "Rs 2,750 crore has been paid and is currently with the Committee of Creditors. An additional Rs 3,000 crore has been raised in debt and is kept in a separate account, pending the completion of some activities," he said.

He added, "The final Rs 4,300 crore will be disbursed once Reliance Capital’s shares are delisted. The lenders for these funds include 360 One and Barclays." In addition, an extra Rs 200 crore was paid to strengthen Reliance General Insurance’s solvency position.

Plans for Management and Strategic Direction

IIHL intends to retain the current management after the transaction is completed. Hinduja emphasized that the current leadership, led by the MD & CEO, has been performing well. "The companies have survived and been profitable over the past few years, so there’s no immediate need for changes," he said. The focus post-acquisition will be on securing bancassurance partnerships for life and general insurance segments and implementing digitization to enhance customer service by March 2025.

Hinduja also confirmed plans to divest 34 to 35 of Reliance Capital’s 39 subsidiaries, generating liquidity of around Rs 1,000 crore, which will be reinvested in new opportunities for Reliance Capital.

Future Prospects and Strategic Partners

Regarding potential strategic partnerships, Hinduja indicated openness to minority investors, whether at the holding company level or within individual subsidiaries, as long as they add value for IIHL’s shareholders.

Earlier this year, in April, IIHL entered the asset management sector with the acquisition of a majority stake in the India arm of US-based Invesco AMC.