Covid, sluggish market hit seafood exports hard

Covid testing on seafood consignments caused market uncertainties

image for illustrative purpose

Visakhapatnam IN what is considered a double whammy, the Covid-19 pandemic and sluggish overseas markets have dealt a body blow to India's seafood exports.

Andhra Pradesh, considered aqua capital of India is also hit hard in exporting white-leg shrimp, which is being cultured by a large number of farmers in Bhimavaram and other areas. Visakhapatnam is the largest fish landing centre and exports hub for frozen shrimp and other types of fish in AP. The several spells of lockdown have also prevented the fishermen from venturing into the sea.

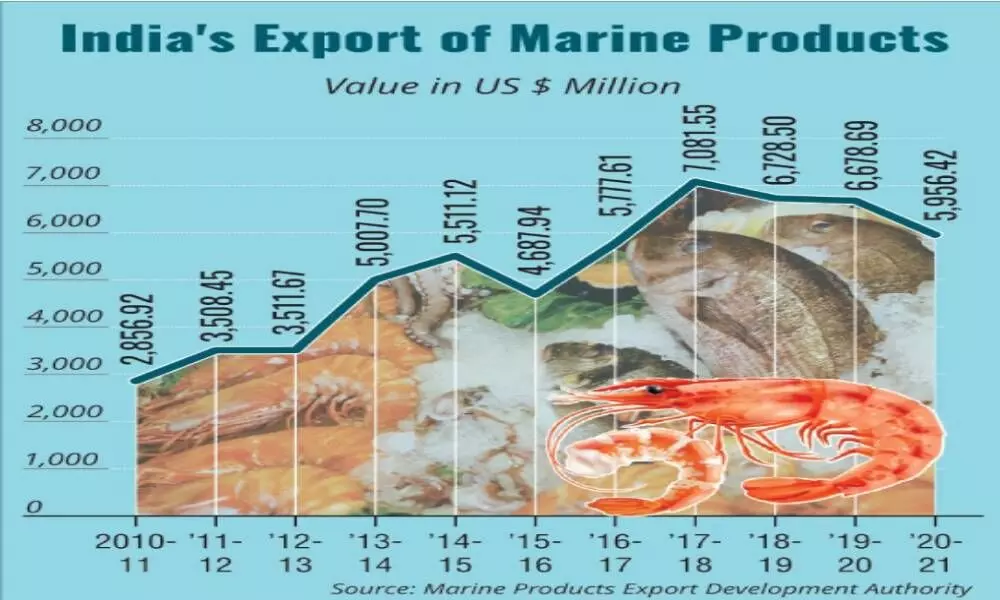

The Covid pandemic and sluggish overseas markets cast their shadow over India's resurgent seafood sector as the country exported 11,49,341 MT of marine products worth Rs 43,717.26 crore ($ 5.96 billion) during FY 2020-21, registering a contraction of 10.88 per cent in volume as compared to a year earlier, according to figures available with Marine Products Export Development Authority (Mpeda).

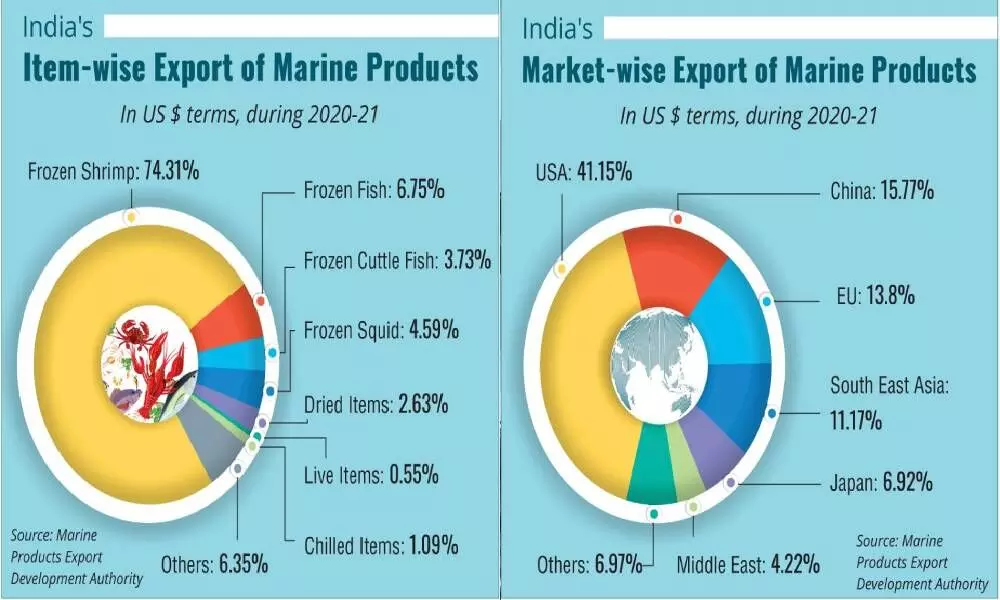

USA, China and the European Union (EU) are the leading importers, while frozen shrimp retained its position as the major export item followed by frozen fish. In 2019-20, India exported 12,89,651 MT of seafood worth Rs 46,662.85 crore ($ 6.68 billion), marking a decline of 6.31 per cent in rupee terms and 10.81 per cent in dollar value in 2020-21.

"The pandemic drastically affected seafood exports during the first half of the year, but it revived well in the last quarter of 2020-21. Also, the aquaculture sector performed better during this fiscal by contributing 67.99 per cent of exported items in dollar terms and 46.45 per cent in quantity, which is 4.41 per cent and 2.48 per cent higher, respectively when compared to 2019-20," said KS Srinivas, Chairman of Mpeda.

Srinivas said in a media note that besides the pandemic impact, several other factors negatively impacted seafood exports during 2020-21. On the production side, there were reduced fish landings due to less number of fishing days, slow logistic movements and market uncertainties.

The situation in the overseas market was another dampener. In China, container shortage, increased freight charges, and Covid testing on seafood consignments caused market uncertainties. In the USA, scarcity of containers made it difficult for exporters to execute orders in time. Closure of HoReCa (hotel, restaurant and café) segment also affected the demand. In Japan and the EU, Covid-induced lockdowns made the retail, restaurant, supermarkets and hotel consumption sluggish.

Frozen shrimp contributed 51.36 per cent in quantity and 74.31 per cent of the total dollar earnings. USA remained its largest importer (2,72,041 MT), followed by China (1,01,846 MT), EU (70,133 MT), Japan (40,502 MT), South East Asia (38,389 MT), and the Middle East (29,108 MT).

USA, with imports of 2,91,948 MT, continued to be the major importer of Indian seafood with a share of 41.15 per cent in dollar terms.

China, with an import of 2,18,343 MT of seafood worth $939.17 million, remained the second largest market with a share of 15.77 per cent in dollar earnings and 19 per cent in quantity terms. The EU, the third largest destination with a share of 13.80 per cent in dollar value, imported frozen shrimp as the major item.

Exports to South East Asia had a share of 11.17 per cent in dollar value. However, it declined by 2.56 per cent in quantity and 5.73 per cent in dollar earnings.

The Middle East, the sixth largest destination with a share of 4.22 per cent in dollar value, declined by 15.30 per cent and 15.51 per cent in quantity and dollar terms, respectively. Frozen shrimp was the major item of exports, having a share of 72.23 per cent in dollar terms.