Call OI bases shifting to higher bands

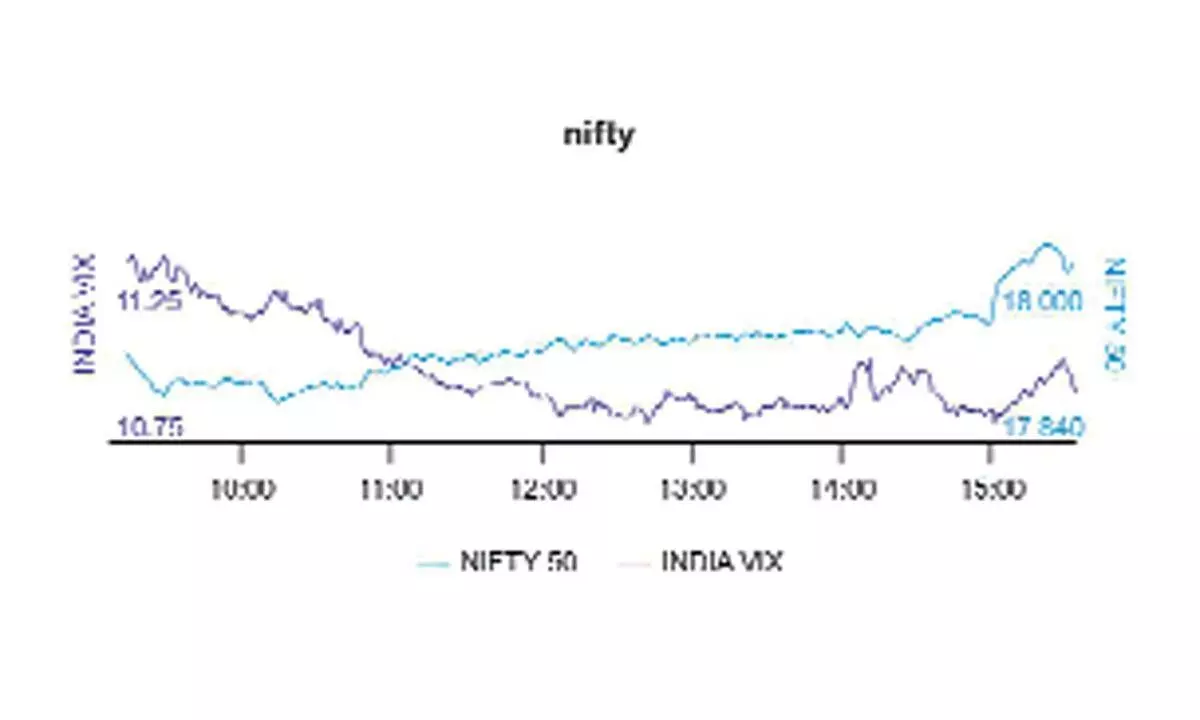

India VIX falls 0.85% to 10.78 level and it bodes well with ongoing positive bias; Put-Call Ratio o at 1.53 indicates a higher inclination towards Put writing over Calls

image for illustrative purpose

The resistance level, based on the latest options data on NSE after Friday’s session, moved up by 400points to 20,000CE and the support level marginally up by 100 points to 19,600PE. The options data is pointing to upward shifting of the OI bases.

The 20,000CE has highest Call OI followed by 20,200/ 19,900/ 19,800/ 20,100/ 20,500 strikes, while 20,200/ 20,400/ 20,500/ 19,900/ 19,850 strikes recorded reasonable addition of Call OI.

Coming to the Put side, maximum Put Oi is seen at 19,600PE followed by 19,700/19,550/ 19,200/ 19,000/19,800/ 19,300 strikes. Further, 19,800/19,700/ 19,750/19,300/19,000 strikes witnessed moderate build-up of Put OI. Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “In the analysis of derivatives data for Nifty, the highest Call writing was observed at the 20,000 and 19,900 strikes. Conversely, the highest Put Open Interest was found at the 19,600 and 19,700 strikes.”

“On the weekly chart, both the Nifty and Bank Nifty indices closed with gains of over one per cent. However, Bank Nifty showed weaker performance as compared to Nifty. The market saw notable outperformance in energy, infra, IT and media stocks. On the flip side, there was a trend of profit-taking in FMCG stocks,” added Bisht. BSE Sensex closed the week ended September 8, 2023, at 65,598.91 points, a further recovery of 211.75 points or 0.32 per cent, from the previous week’s (September 1) closing of 65,387.16 points. During the week, NSE Nifty too moved up by 384.65 points or 1.97 per cent to 19,819.95 points from 19,435.30 points a week ago.

Bisht forecasts: “Looking ahead to the upcoming week, it is anticipated that Nifty’s trading range will be between the psychological levels of 20,000 and 19,500 points. The prevailing viewpoint suggests adopting a buy on dips approach as long as Nifty remains above the 19,500 level.”

FIIs resorted to cover shorts in the F&O space and also took net longs marginally in the index futures segment. Due to this and closure during monthly settlement, the net short contracts of nearly 40,000 contracts have turned to net longs with nearly 3,000 contracts. Also, the aggressive shorts seen in the stock futures segment also declined marginally during the last week as short covering worth Rs2,000 crore seen in stock futures.

India VIX fell 0.85 per cent to 10.78 level, near the lowest level this month and it bodes well with the ongoing positive bias. Hence, one should turn cautious only if Nifty slips below 19,300 level once again. “Turning to Implied Volatility (IV), Call options for Nifty settled at 9.20 per cent, while Put options concluded at 10.35 per cent. The Nifty VIX, a measure of market volatility, ended the week at 10.87 per cent. The Put-Call Ratio of Open Interest, standing at 1.53 for the week, indicated a higher inclination towards Put writing over Calls,” observed Bisht.

“Traders are advised to closely monitor the India VIX, as it is trading near a support level. A rebound in India VIX could be expected in the coming weeks,” adds Bisht.

Bank Nifty

NSE’s banking index closed the week at 45,156.40 points, higher by 720.30 points or 1.62 per cent from the previous week’s closing of 44,436.10 points. “For Bank Nifty, the highest Call Open Interest was seen at the 46,000 strike, followed by the 45,500 strike. On the Put side, the highest Open Interest was noted at the 45,000 strike,” remarked Bisht.

According to ICICIdirect.com, the options concentration in Bank Nifty was at ATM 44,000 Put and 44,500 Call strikes. Considering the VWAP of the August series near 44,500 level, a fresh up move is likely beyond these levels. Also, looking at the relatively low open interest in Bank Nifty, we believe that fresh accumulation is likely to be seen if Bank Nifty sustains above these levels.