73,400 would act as support zone

As long as the index is trading above73,400, the positive momentum is likely to continue

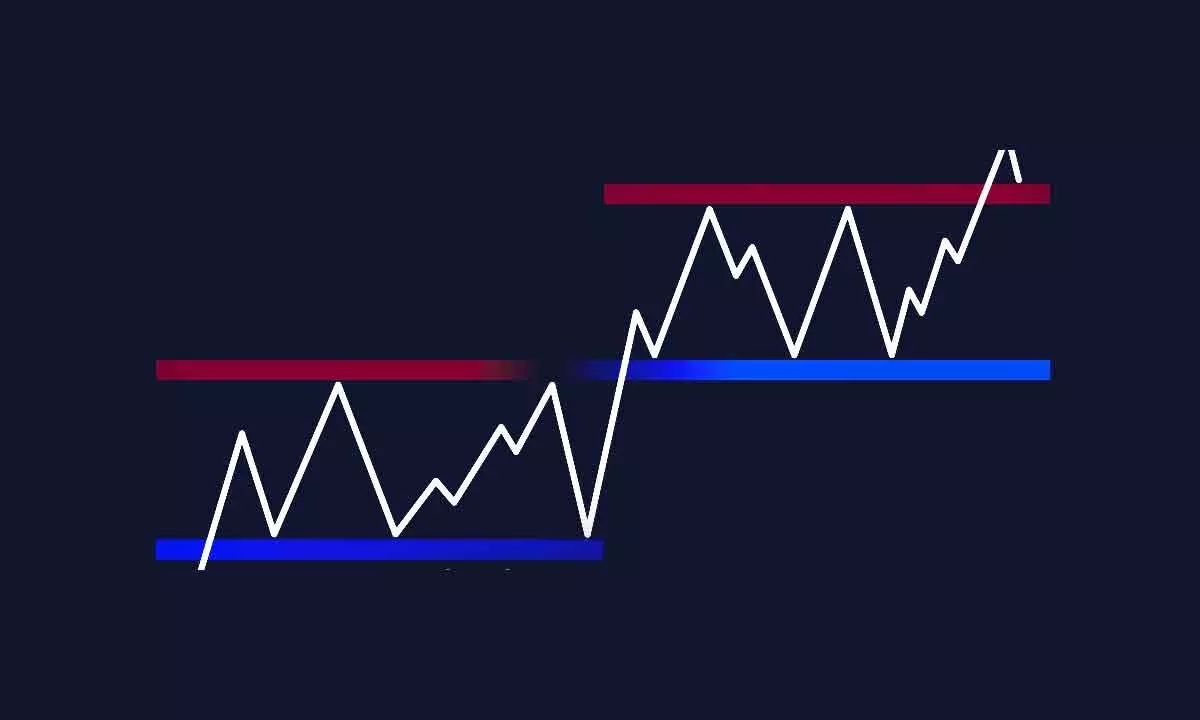

image for illustrative purpose

Mumbai: On Tuesday, the benchmark indices witnessed a range-bound activity as BSE Sensex was down by 195 points. Among sectors, PSU Bank index outperformed, rallied over 2.5 per cent whereas IT index corrected sharply, shed over 1.5 per cent.

Technically, after early morning intraday correction, the index took the support near 73,400 and bounced back sharply.

On daily charts, the index has formed small Doji kind of candlestick formation, which indicating indecisiveness between the bulls and bears.

“For the traders now, the 73,400 would act as a sacrosanct support zone. As long as the index is trading above the same, the positive momentum is likely to continue,” says Shrikant Chouhan, head (equity research), Kotak Securities.

Above the same, the market could move up till 74,000-74,200. On the flip side, below 73,400 the uptrend would be vulnerable.

Prashanth Tapse, senior V-P (research), Mehta Equities, says: “Combination of weak global cues and persistent upsurge in past four trading sessions resulted in profit-taking as markets languished in negative territory for major part of trading session. Buying in auto and banking stocks pared losses in a weak market.”

Stock Picks

Canara Bank (Buy)

CMP: 602.45 | SL: 590.00 | Target: 625 and 650

The stock has given a good breakout above its recent swing high of 598.80, signaling a good sign of momentum and strength. The overall chart structure looks positive, and owing to a sharp rise in volumes, we expect good strength in the stock going forward. With the current market price being at 602.45, a strict stop loss of 590 should be kept for a potential target of 625 and 650.

PNB (Buy)

CMP: 129.70 | SL: 125.00 | Target: 132 and 135

The stock has given a good breakout above its downtrend line with a significant rise in volumes. At the current market price of 129.70, the stock is showing good signs of momentum and strength. On any pullback towards 127-128, the stock would be a good buy for potential targets of 132 and 135.

(Source_Riyank Arora Technical Analyst at Mehta Equities)