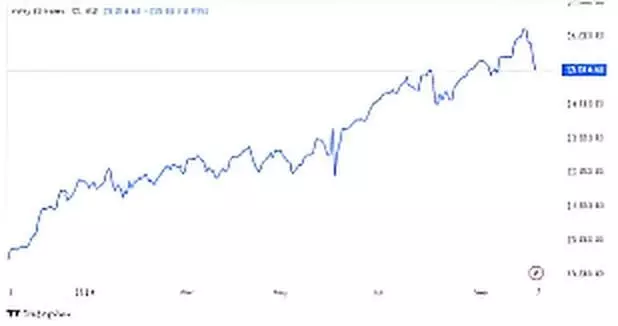

Nifty Crosses Key Level on October 6, Next Resistance Around 25,119: Trade Setup for Oct 7

Nifty starts the week strong, crossing the 50% retracement level. Analysts eye the next resistance at 25,119 ahead of Tuesday’s weekly expiry. Check trade setup for October 7.

Trade Setup for October 7: Nifty Surpasses Key Level, Next Resistance 40 Points Away

The Nifty opened the week on a strong note, showing a trending move rather than just a minor 40–50 point gain. Monday’s session saw the index cross an important hurdle—the 50% retracement of the September 18–September 30 decline—closing comfortably above 25,017.

Despite broader markets underperforming benchmarks, with 1,392 NSE stocks ending in losses versus 1,228 gainers, the Nifty bulls managed to assert dominance. Technology and banking sectors led the way, driving gains across the board.

Key Movers: Nifty IT and Nifty Bank

The Nifty IT index showed a strong recovery, building on Friday’s gains ahead of TCS results on Thursday. All constituents of the IT index closed higher, with Coforge leading the rally and TCS gaining 3%.

Meanwhile, the Nifty Bank continued its winning streak, marking five consecutive days of gains. The index not only retraced its recent losses but also reached a new swing high of 56,161 on Monday, adding nearly 1,800 points over the last five sessions. The next resistance levels for the Nifty Bank are 56,350–56,500, while support is seen around 55,700–55,600, according to Om Mehra of SAMCO Securities.

Next Key Levels for Nifty

Analysts say the next critical level for Nifty is the 61.8% retracement of its recent fall, around 25,119, roughly 40 points above Monday’s close. Weekly expiry on Tuesday could bring further volatility as investors react to business updates. Stocks like Trent and Bank of India are expected to see movements based on their announcements.

HDFC Securities’ Nagraj Shetti highlighted the formation of a long bull candle on the Nifty daily chart, signaling a strong breakout above the 24,900 resistance zone. He expects the upside target to range between 25,300 and 25,400.

SBI Securities’ Sudeep Shah noted, “The 25,130–25,180 zone represents the 61.8% Fibonacci retracement of the prior decline (25,449–24,587) and will act as a crucial hurdle. A sustained move above 25,180 could trigger a sharp rally to 25,300, while the 20-day EMA zone of 24,950–24,920 will act as key support on the downside.”

Bottom Line:

Monday’s session set a positive tone for the week, led by Nifty IT and Bank, while traders now eye the next resistance around 25,119–25,180. Market reactions to business updates and the weekly expiry are likely to shape Tuesday’s trading action.