Commodity Watch: Copper futures back in red

image for illustrative purpose

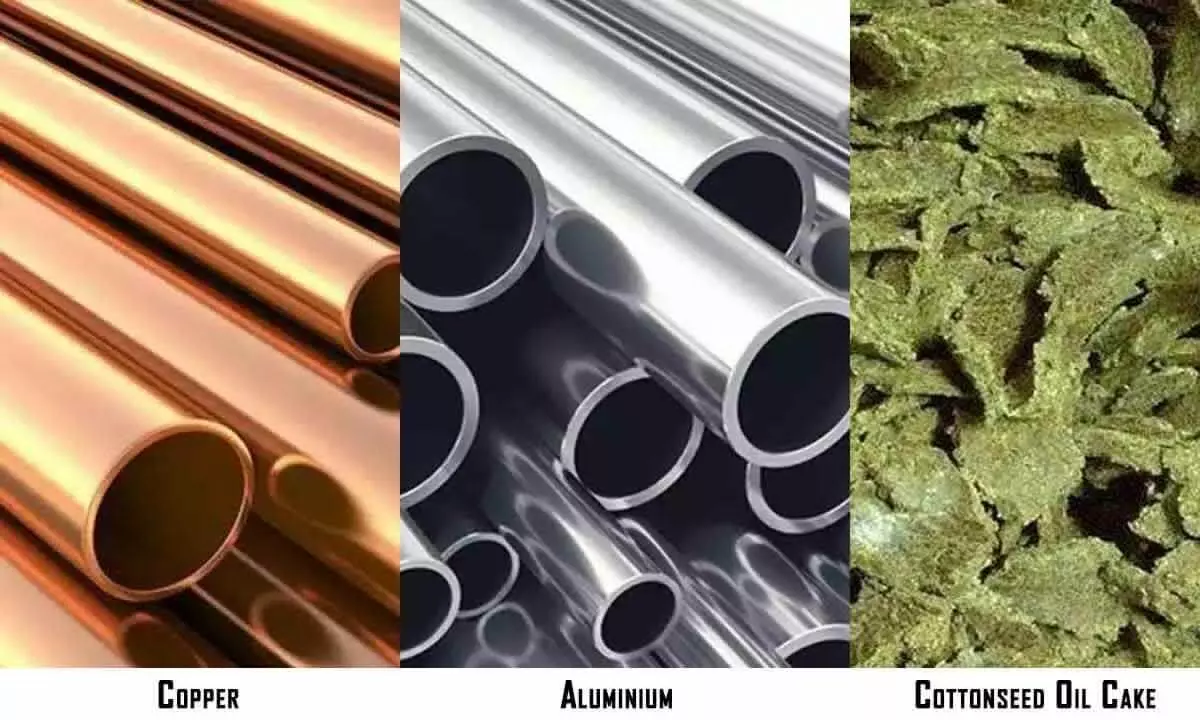

New Delhi: Copper futures on Thursday marginally fell Rs6.05 to Rs727.20 per kilogram as participants cut their positions amid a muted demand in the domestic market. On the Multi Commodity Exchange (MCX), copper contracts for February delivery eased by Rs6.05 or 0.83 per cent to Rs727.20 per kg in a business turnover of 4,548 lots. Analysts said trimming of positions by speculators amid a muted demand in the spot market mainly dragged down copper prices in the futures trade.

Aluminium futures fall

Aluminium prices marginally declined Rs1.65 to Rs203.25 per kilogram in the futures market as participants trimmed their positions on a weak trend in the spot market. On MCX, aluminium for delivery in February marginally fell by Rs1.65 or 0.81 per cent to Rs203.25 per kg in 3,826 lots. Analysts said cutting down of positions by participants on easing demand from consuming industries mainly kept aluminium prices lower.

Cottonseed oil futures decline

Cottonseed oil cake prices on Thursday decreased Rs11 to Rs2,475 per quintal in futures trade as participants reduced their bets following weak trends in spot markets. On the National Commodity and Derivatives Exchange (NCDEX), cottonseed oil cake for February delivery fell Rs11 or 0.44 per cent to Rs2,457 per quintal with an open interest of 49,280 lots. Analysts said a sell-off by participants at existing levels amid a subdued trend in the market mainly weighed on cottonseed oil cake prices.

Coriander futures rise

Coriander prices rose Rs8 to Rs7,724 per quintal in futures trade as speculators increased their holdings, tracking a firm trend in the spot market. On NCDEX, coriander contracts for April delivery traded higher by Rs8, or 0.10 per cent, at Rs7,724 per quintal with an Open Interest of 20,245 lots. A firm trend in the spot market and restricted supplies from producing regions pushed up coriander prices, market analysts said.