The Art Of Allocating Capital In Your Portfolio!

Position sizing is often overlooked, but it can be key difference between a modest return and a portfolio that truly outperforms

The Art Of Allocating Capital In Your Portfolio!

In the world of investing, strategy isn't just about picking the right stocks- it's about deciding how much to bet on each one. It highlights the importance of position sizing, using real-life examples and practical tips to help investors ensure that their winners truly make a difference in their portfolios

Investing involves many permutations and combinations. No one strategy always proves right and each works fine for them. While most discussions tend to concentrate on what to buy or sell, the most important decision, however, should be 'how much'. Position sizing in portfolio building is an important exercise. Though there will be times when a particular stock does extremely well, a multi-bagger, the overall allocation to the portfolio might be so low that its impact would be minimal or insignificant.

This is well established and illustrated in the book, "The Lost Billionaires". In an experiment conducted 61 youngsters (college students of economics and some young professional financiers) were given $25 and asked to bet on a rigged coin at even odds. Each flip, they were told had a 60 per cent chance of coming up heads. They'd time for about 300 tosses, could choose each bet's size, and would keep their winning up to a cap of $250. This was an excellent deal: simply betting 10 per cent of the remaining pot on each toss had a 94 per cent chance of yielding the maximum pot on each toss had a 94 per cent players' average payout was just $91, and only a fifth of them hit the cap and 28 per cent managed to lose everything.

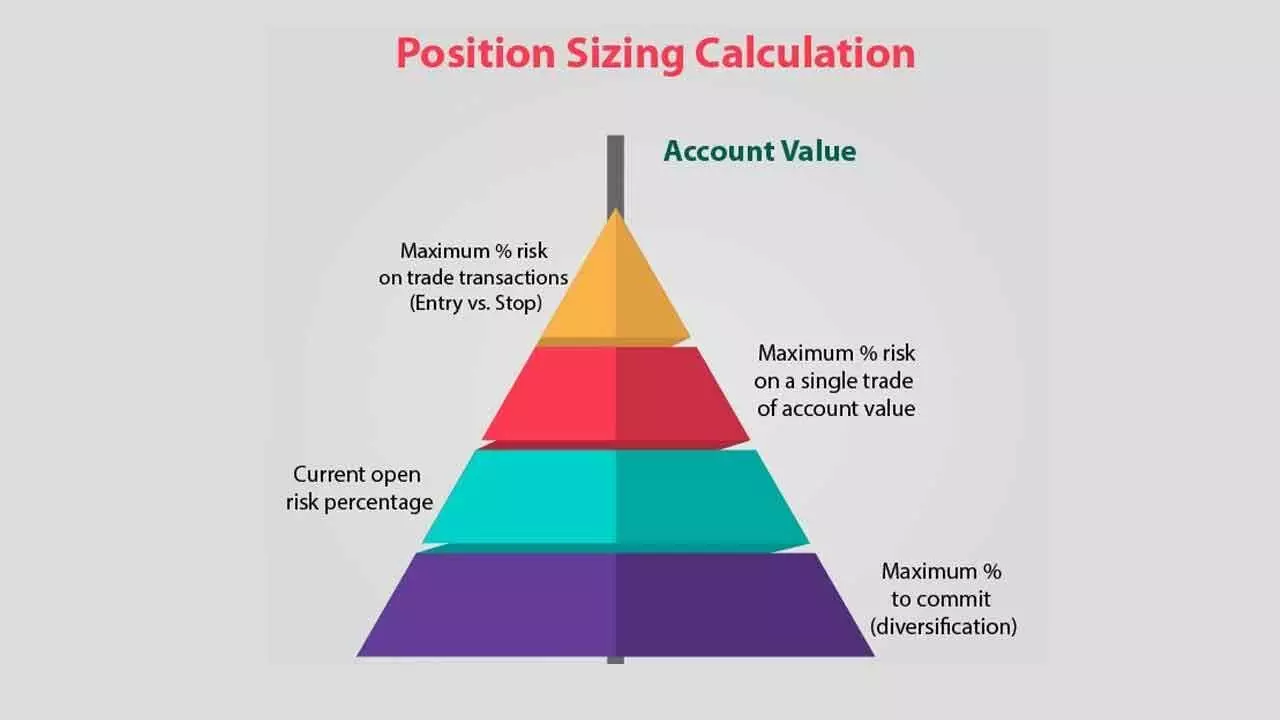

Position sizing- the process of determining how much capital to allocate to a single investment- is a critical yet often overlooked aspect of portfolio management. A well-structured portfolio not only identifies high-potential stocks but also ensures that winning positions have a meaningful impact on overall returns.

One of the biggest regrets investors face is discovering a multi-bagger (a stock that grows several times in value) but realising that its allocation was too small to make a significant difference. This article explores why position sizing matters, how under-allocation can limit portfolio performance, and strategies to optimise allocation for maximum impact.

For instance, imagine an investor with a portfolio investment value of 10L, allocates 10,000 to a small cap stock which becomes a 10 bagger (grows ten times to 1L) but the rest of the portfolio grows by say 10 per cent i.e., 9.9L by 10 per cent to 10.89L. Now, the total portfolio value is 11.89L where the absolute gain from multi-bagger is 90K. The overall portfolio growth is approx- 19 per cent (1.89L). Though the small-cap stock has delivered a 1000 per cent return, its smaller allocation has only meant 9 per cent to the total portfolio.

Investors usually have certain inhibitions that make them under-allocate to potential winners. Over-diversification i.e., holding too many stocks dilutes the impact of any single winner. Fear of concentration risk i.e., investors avoid larger bets even on high-conviction ideas. Misjudging potential i.e., underestimating how much a stock can grow. Anchoring or recency bias/past performance i.e., avoiding stocks that have already risen, missing further upside.

The better way to approach this is by optimal position sizing through balanced risk and conviction. Ideally, stocks with durable moats, strong growth, great management, and reasonable valuations could form a high-conviction pick with about a third of the portfolio. The other way is to increase the allocation as you grow the conviction over quarters or even years, averaging the stock upwards.

Then there's a minimal impact rule i.e. 5-25 rule. For a stock to meaningfully impact portfolio returns, it should be at least 5 per cent of the portfolio if it doubles, or 10-15 per cent if it becomes a multi-bagger. A 1 per cent position needs a 100x (100 times) return to double the portfolio, a near-impossible feat. Dynamic rebalancing is another way one could achieve this. Let the winners run if the fundamentals remain strong while trim positions when they bloat too large.

Merton share is a simple thumb rule for determining asset allocation which says that allocations should rise in proportion to expected returns, fall in proportion to the investor's risk aversion and fall a lot in proportion to volatility (it's square).

While finding multi-baggers are hard ensuring they have a meaningful allocation is even harder. A disciplined position-sizing strategy ensures that when you do pick a winner, it moves the needle.

(The author is a partner at "Wealocity Analytics", a SEBI Registered Analyst, and could be reached at [email protected])