Investment position sizing through Kelly Criterion

It is the process of determining how much capital to allocate to a single investment

Investment position sizing through Kelly Criterion

There are numerous ways to make money in the markets, and no single method is the only way. Most investors spend enormous time trying to answer one question: what should I buy? But very few spend enough time on a more critical question: How much should I buy?

The Kelly Criterion addresses this neglected but decisive part of investing - position sizing. Originally developed for gambling and information theory, Kelly has quietly become one of the most powerful frameworks for long-term capital compounding, especially relevant in volatile and structurally imperfect markets like India.

The importance of position sizing is well established and illustrated in the book, “The lost billionaires.” In an experiment conducted across 61 youngsters (college students of economics and some young professional financiers) were given $25 and asked to bet on a rigged coin at even odds. Each flip, they were told had a 60 per cent chance of coming up heads.

They’d time for about 300 tosses, could choose each bet’s size and would keep their winning up to a cap of $250. This was an exceptionally good deal: simply betting 10 per cent of the remaining pot on each toss had a 94 per cent chance of yielding the maximum pot on each toss had a 94 per cent players’ average payout was just $91, only a fifth of them hit the cap and 28 per cent managed to lose everything.

Position sizing—the process of determining how much capital to allocate to a single investment—is a critical yet often overlooked aspect of portfolio management. A well-structured portfolio not only identifies high-potential stocks but also ensures that winning positions have a meaningful impact on overall returns.

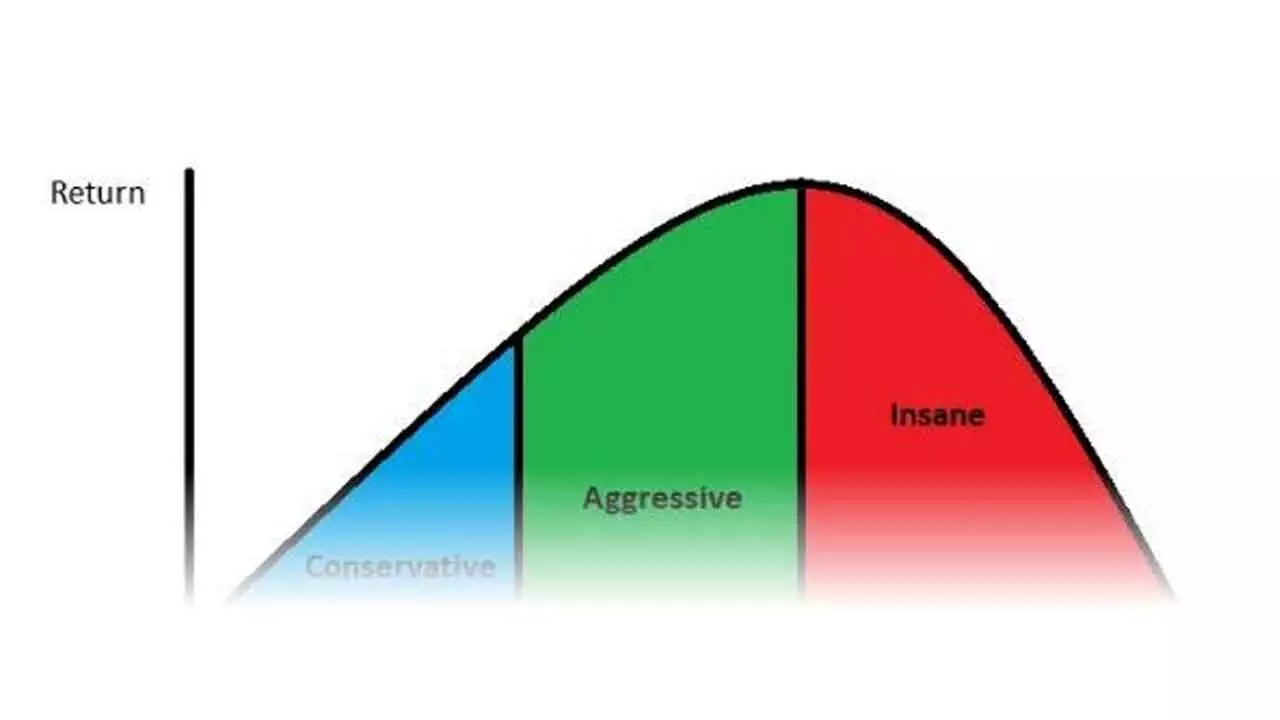

Many think bigger bets equal bigger profits, but that’s not true when you’re playing repeatedly. If one bets too little, we don’t grow the wealth quickly. If one bet too much, they risk losing big and possibly going broke. The Kelly Criterion finds the sweet spot — the best percentage of your bankroll to bet every time to grow your money the fastest over many repeated bets or investments.

The Kelly Criterion is a rule that tells you what fraction of your capital to allocate to a bet or investment, based on your expected edge (probability of success), the payoff if the decision is right and the loss if the decision is wrong.

Its objective is not to maximise short-term returns, but to maximise long-term compounded (geometric) growth, while avoiding ruin. In simple terms: Even if you are right most of the time, betting too much can still destroy you. Kelly formalizes how to avoid that outcome.

It is a mathematical rule that tells you how much of your money you should risk on a bet or investment to make the most money over the long run — without risking going broke. It’s all about finding the balance between growth and safety. If you have an advantage — you think a bet or investment has a better than even chance of winning — the Kelly Criterion helps you figure out how large a percentage of your total money to bet.

It introduces gamblers’ ruin — the idea that you can still go bankrupt over time if you bet too much, even if each individual bet has a good chance to win. Having a good forecast (edge) isn’t enough, you must also size the bet appropriately or could go broke even with a good edge. Kelly doesn’t tell you which bet to take. It tells you how much to bet so that even if you’re wrong sometimes, you’ll win in the end.

This method is about long-term growth, not short-term wins: caters over many bets or cycles, not a guaranteed winning shortcut on a single bet.

Even if you expect to win money, if you bet too much you might go broke before you ever get there. Kelly finds the balance that maximizes growth without risking ruin. People use this idea in sports betting, stock/investment position sizing and any repeated decisions with known probabilities.

However, this is not a magic formula to address all perils. Remember, you need good estimates of your probabilities and payouts — if your odds are wrong, the formula won’t help. Theoretically, Kelly gives an exact optimal fraction.

Practically, markets suffer from estimated errors, non-repeatable outcomes, correlated risks and regime shifts. So, most professionals use “fractional Kelly” i.e., betting less than the full Kelly (half or quarter) suggestion to reduce risk and volatility. Perhaps Kelly’s biggest benefit is psychological. By capping position size investors avoid panic-selling, drawdowns remain reliable and decision-making improves under stress.

(The author is a partner with “Wealocity Analytics”, a SEBI registered Research Analyst and could be reached at [email protected])