Bold Move Will Boost Credit Access: India Inc

Pause to assess the full transmission of these cuts, before easing of interest rates

Bold Move Will Boost Credit Access: India Inc

New Delhi: The RBI's decision to slash the benchmark rate by a "bold" 50 basis points will lead to lower interest rates and improved credit access for borrowers, India Inc said on Friday, asserting that the move will support economic growth amid global headwinds.

However, they opined that by reverting its stance to neutral from accommodative, the central bank has signalled that it may now pause to assess the full transmission of these cuts, before considering further easing of interest rates. The Reserve Bank of India (RBI) on Friday cut interest rates by 50 basis points (bps), the third consecutive reduction, to 5.5 per cent. The central bank has also unexpectedly reduced the cash reserve ratio (CRR) for banks by a steep 100 basis points, which will unlock Rs2.5 lakh crore liquidity to the banking system for lending to productive sectors of the economy.

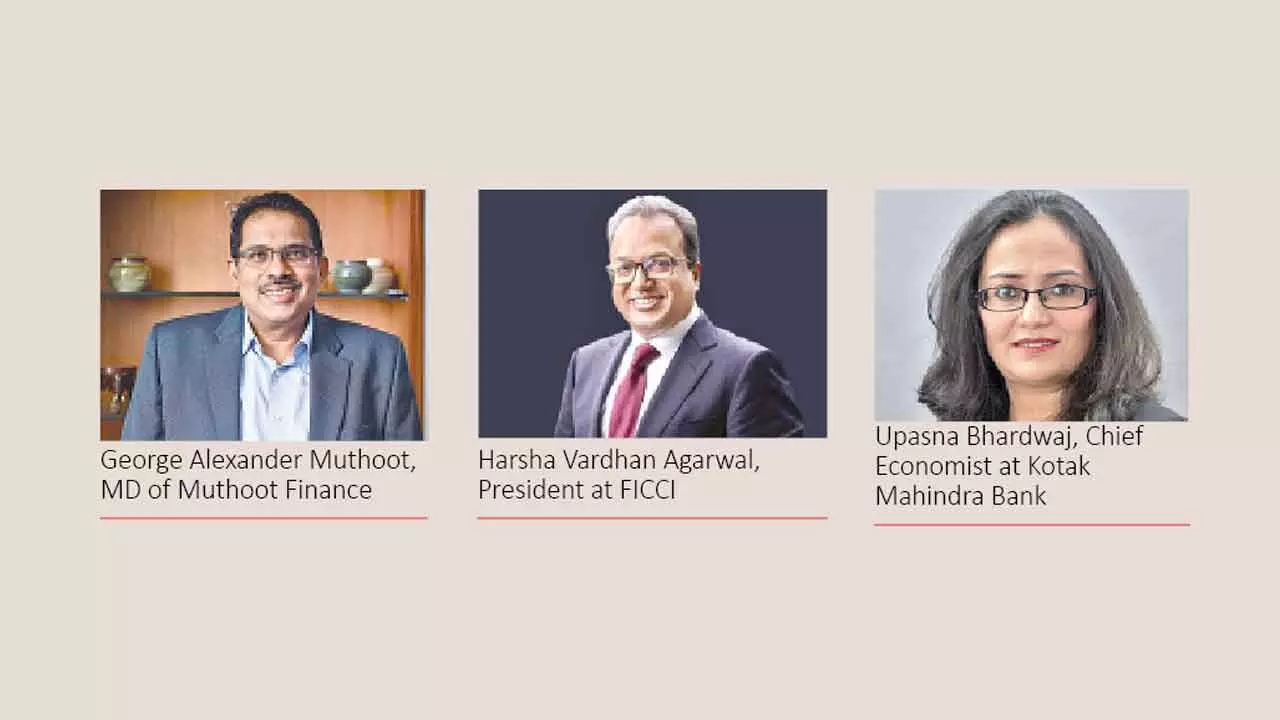

Harsha Vardhan Agarwal, President at FICCI, said, "FICCI welcomes RBI's bold and proactive move to slash the repo rate. "This front-loaded rate cut sends a strong signal of the RBI's commitment to supporting growth, especially at a time when the Indian economy is navigating multiple headwinds -- from trade uncertainties and geopolitical tensions to financial market volatility," Agarwal added. George Alexander Muthoot, MD of Muthoot Finance, said, "For NBFCs, this is an encouraging move as it creates a favourable environment by lowering borrowing costs and extending affordable credit to under-served communities.” “The move, coupled with a lowered inflation outlook, is likely to support domestic consumption and stimulate credit demand in the coming quarters. Overall, we view this as a timely and positive intervention that can support a stronger credit cycle in FY26," Muthoot added.

Upasna Bhardwaj, Chief Economist at Kotak Mahindra Bank, said, "The higher-than-expected repo rate cut comes along with a shift in the stance back to neutral. This clearly points towards future decisions being more data-dependent, given the significant global uncertainties.” Gaura Sengupta - Chief Economist at IDFC FIRST Bank, said, "The front-loading of the rate cut action plus CRR cut indicates focus is on enhancing the transmission of monetary policy. The neutral stance indicates that the bar for further rate cut is higher but isn't completely off the table.