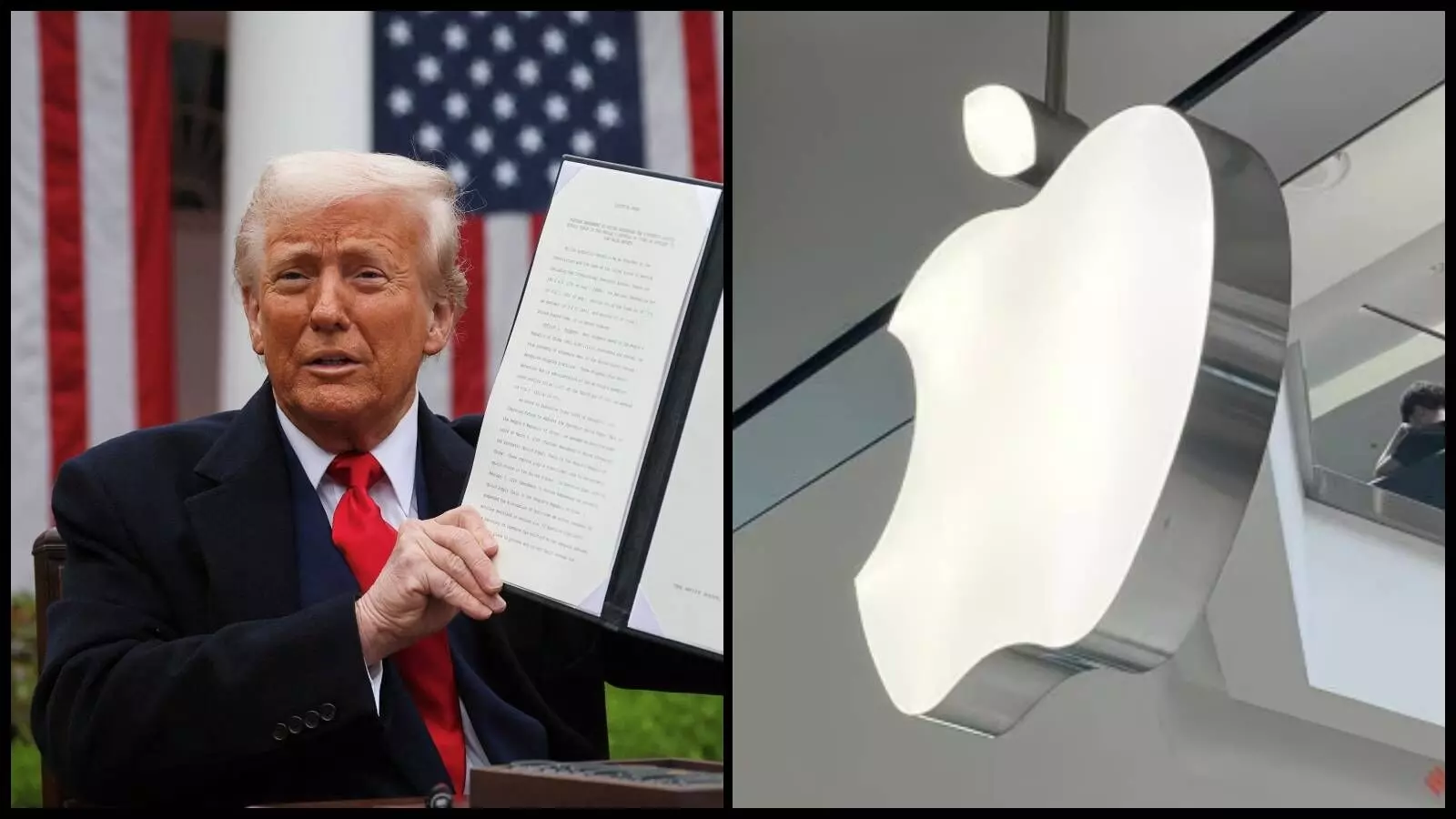

Why Trump’s Tariffs May Have Little Effect on Apple’s India Ambitions

Despite the possibility of tariffs, Apple is increasing iPhone manufacturing in India because of the less labor-intensive costs when compared to the U.S. despite a 25% import duty, assembling in India continues to be significantly more cost-effective.

Why Trump’s Tariffs May Have Little Effect on Apple’s India Ambitions

Foxconn's major investment in India which is backed by incentives from the government, strengthens India's status as a major manufacturing center for Apple and could even surpass China.

As geopolitical tensions increase and trade-related threats are soaring across borderlines, Apple is quietly altering its manufacturing map around the world, with India in the middle. India continues to transform its manufacturing sector despite Donald Trump's warnings paired with threats to enact 25% tariffs on iPhones made in India to persuade Apple CEO Tim Cook. Apple maintains its stance while increasing its dedication to setting up manufacturing operations in India.

Why? because the economics are just too important to not take into consideration. The statistics remain favorable for India as well as Apple regardless of the tariff situation.

Even if tariffs on imports are imposed, making iPhones in India is still much cheaper than moving production to United States. Take into account Prime Minister Modi policy of incentives for the government and a growing supply chain, that has which has already invested massively in new facilities, and the picture gets much clearer.

India isn't just an affordable substitute for China. It's Apple's newest production base. Here's a breakdown of the numbers that will explain the question of.

Let's get the math done.

Based on a news report by the Global Trade Research Initiative (GTRI), the value of 1,000 dollars. Apple is the most popular, due to its branding, design and software, take the largest share, which is around $450.

Taiwan contributes $150 to the manufacturing of chips. The production of OLED screens and memory components in South Korea adds $90 worth of value to the product. Japan contributes cameras for $85. US chipmakers such as Qualcomm and Broadcom contribute an additional $80. Germany combined with Vietnam and Malaysia make up a $45 contribution towards manufacturing.