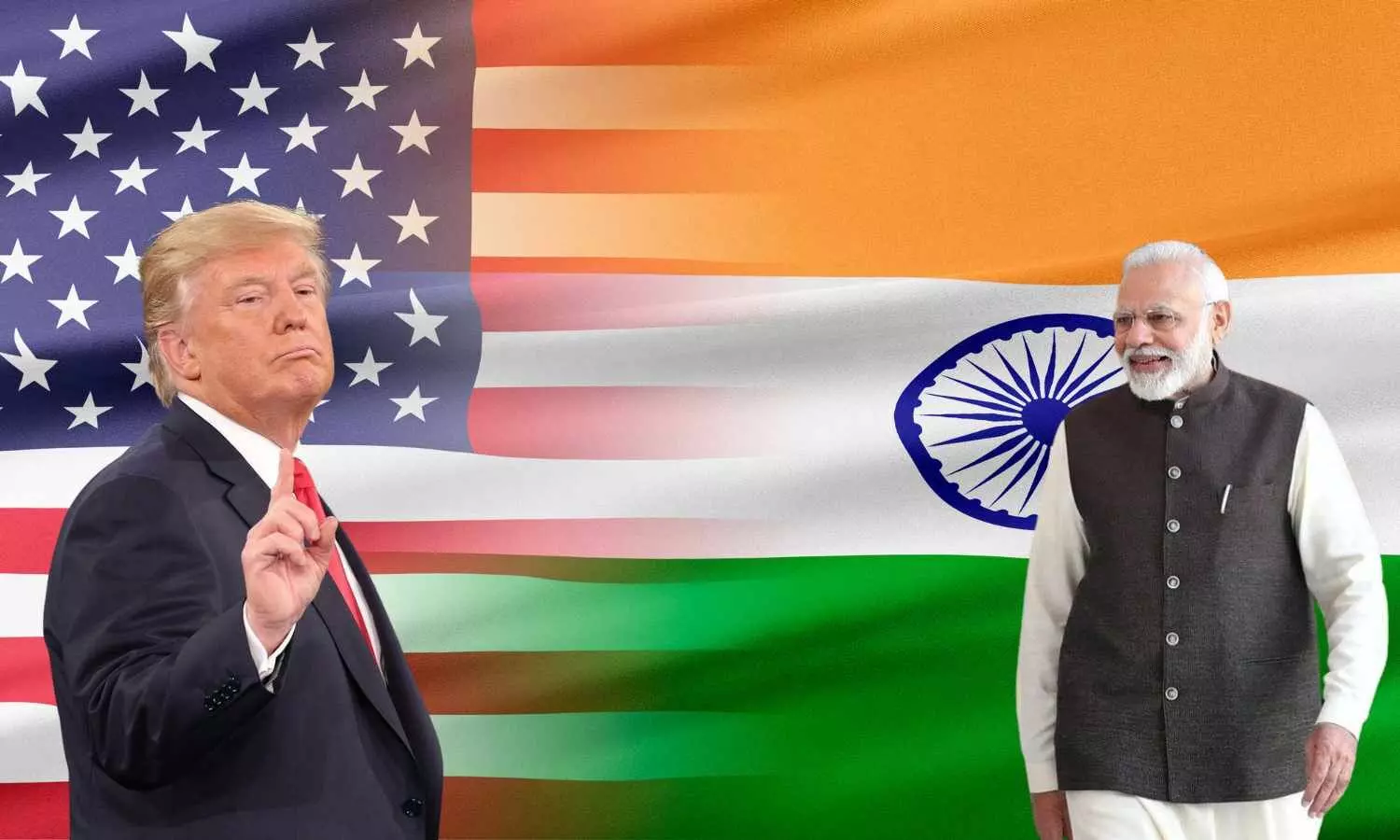

When tough tariffs impact India, can tough India get going

As tough tariffs impact India, the key question arises—can tough India get going? Analyze challenges, trade resilience, and strategies for economic growth.

When tough tariffs impact India, can tough India get going

US President Donald Trump-led administration has notified that 25% additional tariffs on India’s exports to the US will be effective August 27. This takes the total tariffs applicable on India to 50%, among the highest faced by major countries doing trade with the US.

The US Department of Homeland Security announced in its draft order that higher duties will be imposed on Indian goods that are "entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 am eastern daylight time on August 27, 2025".

The Indian government estimates the tariffs will impact $48.2 billion worth of exports. Officials have warned the new duties could make shipments to the US commercially unviable, triggering job losses and slower economic growth.

India–US trade relations have expanded in recent years but remain vulnerable to disputes over market access and domestic political pressures. India is one of the fastest-growing among major global economies and it may face a slowdown as a result.

The tariffs threaten India’s $434 billion export engine, with $87 billion directed to the US, equivalent to 2.5% of India’s GDP. Industry estimates suggest a $4–5 billion drop in engineering exports alone, while overall GDP growth could decline by 0.2–0.5%, with forecasts revised from 6.5% to as low as 6%.

The sectors like Small and medium enterprises (MSMEs), which dominate textiles and leather, face reduced competitiveness against rivals in Vietnam and Bangladesh, where tariffs are lower.

The Indian rupee has weakened in offshore markets, raising concerns about imported inflation and increased borrowing costs for foreign debt-laden companies.

According to CRISIL, “The imposition of higher tariffs by the US will significantly impact micro, small and medium enterprises (MSMEs), which account for as much as ~45% of India's total exports.”

“Of the five sectors expected to see meaningful impact, gems and jewellery has the highest exposure to the US at ~$10 billion. While we expect export volumes to contract, the impact may not be fully reflected in revenue terms because of a likely runup in gold prices and sustained domestic demand,” it says.

The removal of trade preferences under GSP will significantly impact sectors constituting approximately 25% of India's US exports, particularly textiles, gems and jewellery, and seafood industries.

Small and medium enterprises, which dominate these sectors with over 70% share, will experience substantial difficulties. The chemical sector, where SMEs hold 40% market share, is also expected to face significant challenges.

In Surat's gems and jewellery industry, which controls over 80% of diamond exports, MSMEs will experience adverse effects from the tariff implementation, says CRISIL. The US, being a significant consumer of Indian diamonds, receives approximately one-third of exports, whilst diamonds constitute more than half of the nation's gems and jewellery exports.

Certain industries remain protected at present. For example, pharmaceutical products, constituting 12% of US-bound exports, are presently free from tariff impositions.

The US tariff implementation will impact $19 billion worth of exports across textiles, chemicals, seafood and auto components sectors, with a portion facing potential risks. Nevertheless, the anticipated $10 billion growth in the domestic market for these sectors is likely to partially offset the negative effects, says CRISIL.

The natural temptation for India would be retaliation; yet, any escalation can spiral out of control, and so a more pragmatic response will be through its domestic resilience. First, India must lean on its large domestic market to absorb part of the export surplus. Authorities are already considering cuts in the Goods and Services Tax on consumer goods to stimulate spending ahead of the festive season. Lower prices for clothing, appliances, and automobiles could encourage households to buy what American retailers are unwilling to. While the home market cannot fully substitute American demand, it can cushion the shock and keep factories running.

Indian exports to the US could fall from $86.5bn this year to about $50bn in 2026 as a result of today’s announcement.

On top of the $12bn income tax giveaway announced earlier this year, businesses could expect a “massive tax bonanza” soon. It’s also understood that Delhi is planning to lower and simplify the goods and services tax.

This, along with a boost to the salaries of nearly five million state employees and 6.8 million pensioners (which will kick in next year), could help India’s economy retain some growth momentum.

An Indian commerce ministry official said exporters hit by tariffs would receive financial assistance and other giveaways to diversify into markets like Latin America and the Middle East.